Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Ms. Melody decided to invest 800 dollars per month in her pension fund at the beginning of each month (6% annual rate), for

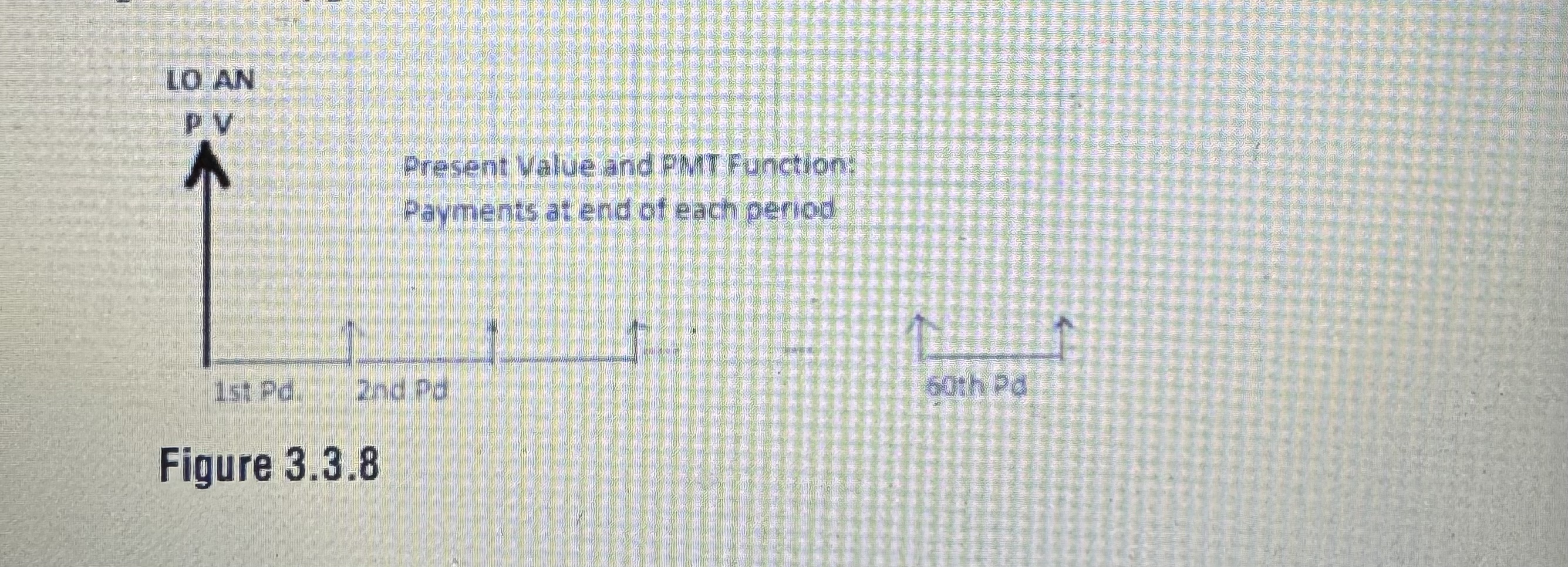

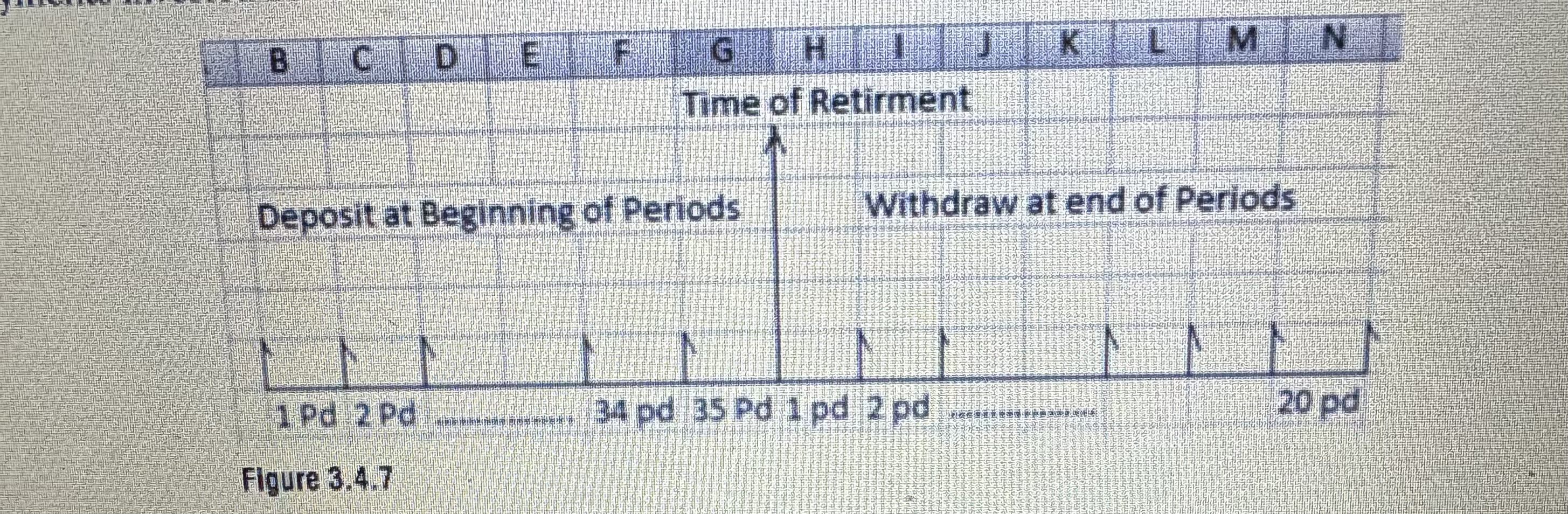

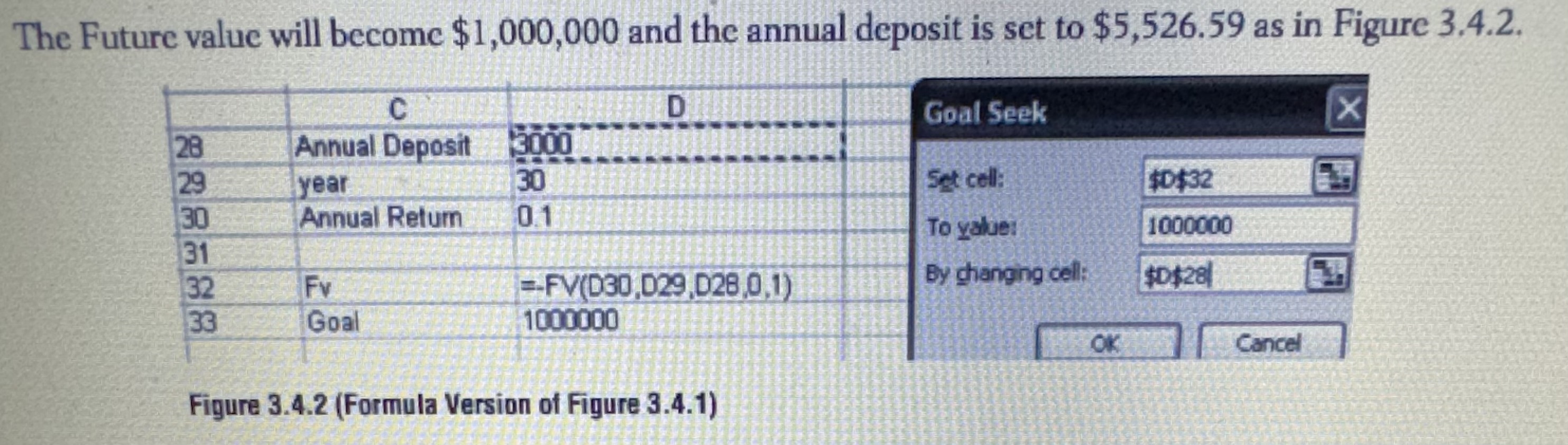

2. Ms. Melody decided to invest 800 dollars per month in her pension fund at the beginning of each month (6% annual rate), for thirty years, before her retirement. Ms. Melody also decided that, at time of retirement, she will not take out all of the accumulated money at once. Instead, she will take her money out in 240 equal monthly installments, beginning one month after the date of retirement (refer to Figure 3.4.7 for timing of payments.) How much will Ms. Melody be receiving each month after retirement? 3. In Section 3.4 (Figure 3.4.2) our goal has been to accumulate 1,000,000 dollars by chang- ing your annual investment amount. An alternative way to accumulate 1,000,000 dollars is to change the number of years of investment. At a 10% fixed annual rate, and at an annual invest- ment of 3,000 dollars, how many years will be needed to reach the goal? 4. Suppose that you wish to receive 5,000 dollars, once a month, for 20 years after retirement. You also plan to invest once a month into your pension fund for 35 year before retirement. Your investment will start 35 years before the date of retirement, and will end one month before the date of retirement. The date of first payment to you will be one month after the date of retire- ment. Assuming that a fixed annual rate of 6% before and after retirement is guaranteed by your pension company, what amount do you need to deposit each month? (Refer to Figure 3.4.7 for timing of payments.) LO AN PV Present Value and PMT Function: Payments at end of each period 1st Pd. 2nd Pd Figure 3.3.8 60th Pd B C D E F G H K MN Time of Retirment Deposit at Beginning of Periods Withdraw at end of Periods 1 Pd 2 Pd 34 pd 35 Pd 1 pd 2 pd PLACE OF LIFE 20 pd Figure 3.4.7 The Future value will become $1,000,000 and the annual deposit is set to $5,526.59 as in Figure 3.4.2. C Annual Deposit 3000 D 228588 Goal Seek Set cell: $D$32 To value: 1000000 FV(D30,029,028,0,1) By changing cell: $D$28 1000000 OK Cancel year 30 Annual Retur 0.1 Fv Goal Figure 3.4.2 (Formula Version of Figure 3.4.1)

Step by Step Solution

★★★★★

3.29 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

2 Using the formula for annuity payments PMT P r 1 1 rn PMT Monthly payment after retirement P Month...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started