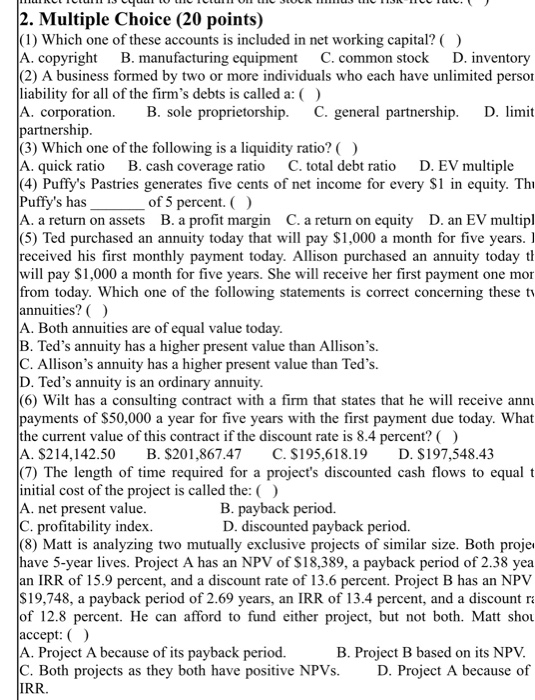

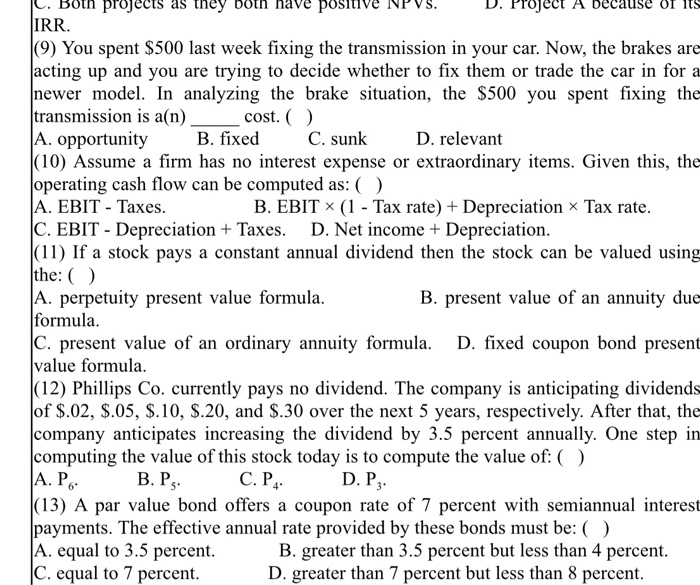

2. Multiple Choice (20 points) (1) Which one of these accounts is included in net working capital? ( ) A. copyright B. manufacturing equipment C. common stock D. inventory (2) A business formed by two or more individuals who each have unlimited person liability for all of the firm's debts is called a: ( ) A. corporation. B. sole proprietorship. C. general partnership. D. limit partnership (3) Which one of the following is a liquidity ratio? ( ) A. quick ratio B. cash coverage ratio C. total debt ratio D. EV multiple (4) Puffy's Pastries generates five cents of net income for every $1 in equity. Thi Puffy's has of 5 percent. () A. a return on assets B. a profit margin C. a return on equity D. an EV multipl (5) Ted purchased an annuity today that will pay $1,000 a month for five years. received his first monthly payment today. Allison purchased an annuity today th will pay $1,000 a month for five years. She will receive her first payment one mor from today. Which one of the following statements is correct concerning these ty annuities? ( ) A. Both annuities are of equal value today. B. Ted's annuity has a higher present value than Allison's. C. Allison's annuity has a higher present value than Ted's. D. Ted's annuity is an ordinary annuity. Wilt has a consulting contract with a firm that states that he will receive anni payments of $50,000 a year for five years with the first payment due today. What the current value of this contract if the discount rate is 8.4 percent? ( ) JA. $214,142.50 B. $201.867.47 C. $195,618.19 D. $197,548.43 (7) The length of time required for a project's discounted cash flows to equal t initial cost of the project is called the:( A. net present value. B. payback period. C. profitability index. D. discounted payback period. (8) Matt is analyzing two mutually exclusive projects of similar size. Both proje have 5-year lives. Project A has an NPV of $18,389, a payback period of 2.38 yea an IRR of 15.9 percent, and a discount rate of 13.6 percent. Project B has an NPV $19,748, a payback period of 2.69 years, an IRR of 13.4 percent, and a discount ra of 12.8 percent. He can afford to fund either project, but not both. Matt shou accept: () A. Project A because of its payback period. B. Project B based on its NPV. C. Both projects as they both have positive NPVs. D. Project A because of IRR. use of its projects as they positive Project A IRR. (9) You spent $500 last week fixing the transmission in your car. Now, the brakes are acting up and you are trying to decide whether to fix them or trade the car in for a newer model. In analyzing the brake situation, the $500 you spent fixing the transmission is a(n) cost. ( ) A. opportunity B. fixed C. sunk D. relevant (10) Assume a firm has no interest expense or extraordinary items. Given this, the operating cash flow can be computed as: ( ) A. EBIT - Taxes. B. EBIT * (1 - Tax rate) + Depreciation Tax rate. C. EBIT - Depreciation + Taxes. D. Net income + Depreciation. (11) If a stock pays a constant annual dividend then the stock can be valued using the: A. perpetuity present value formula. B. present value of an annuity due formula. C. present value of an ordinary annuity formula. D. fixed coupon bond present value formula. (12) Phillips Co. currently pays no dividend. The company is anticipating dividends of $.02, $.05, $.10, $.20, and $.30 over the next 5 years, respectively. After that, the company anticipates increasing the dividend by 3.5 percent annually. One step in computing the value of this stock today is to compute the value of: ( ) A.P. B. PS C.P4 (13) A par value bond offers a coupon rate of 7 percent with semiannual interest payments. The effective annual rate provided by these bonds must be: ( ) A. equal to 3.5 percent. B. greater than 3.5 percent but less than 4 percent. C. equal to 7 percent. D. greater than 7 percent but less than 8 percent. D. P3