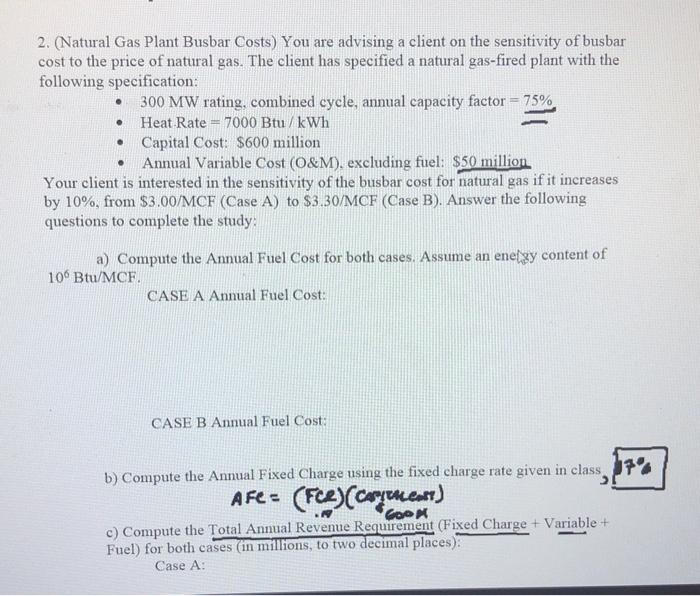

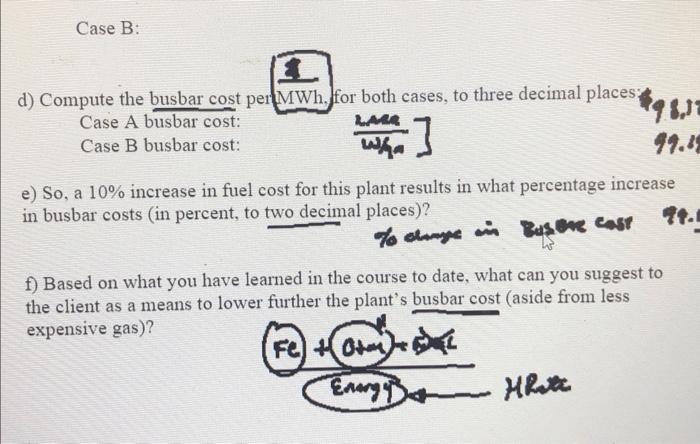

2. (Natural Gas Plant Busbar Costs) You are advising a client on the sensitivity of busbar cost to the price of natural gas. The client has specified a natural gas-fired plant with the following specification: 300 MW rating, combined cycle, annual capacity factor = 75% Heat Rate = 7000 Btu/kWh Capital Cost: $600 million Annual Variable Cost (O&M). excluding fuel: $50 million Your client is interested in the sensitivity of the busbar cost for natural gas if it increases by 10%, from $3.00/MCF (Case A) to $3.30/MCF (Case B). Answer the following questions to complete the study: . a) Compute the Annual Fuel Cost for both cases. Assume an energy content of 106 Btu/MCF. CASE A Annual Fuel Cost: CASE B Annual Fuel Cost: b) Compute the Annual Fixed Charge using the fixed charge rate given in classr Afe= (FCE) (corynent) GOO c) Compute the Total Annual Revenue Requirement (Fixed Charge + Variable + Fuel) for both cases (in millions, to two decimal places) Case A: Case B: EL d) Compute the busbar cost per MWh. for both cases, to three decimal places Case A busbar cost: Case B busbar cost: tqwa within] e) So, a 10% increase in fuel cost for this plant results in what percentage increase in busbar costs (in percent, to two decimal places)? to stay in Busine Case f) Based on what you have learned in the course to date, what can you suggest to the client as a means to lower further the plants busbar cost (aside from less expensive gas)? (Fe) tom) Hrite Energ 2. (Natural Gas Plant Busbar Costs) You are advising a client on the sensitivity of busbar cost to the price of natural gas. The client has specified a natural gas-fired plant with the following specification: 300 MW rating, combined cycle, annual capacity factor = 75% Heat Rate = 7000 Btu/kWh Capital Cost: $600 million Annual Variable Cost (O&M). excluding fuel: $50 million Your client is interested in the sensitivity of the busbar cost for natural gas if it increases by 10%, from $3.00/MCF (Case A) to $3.30/MCF (Case B). Answer the following questions to complete the study: . a) Compute the Annual Fuel Cost for both cases. Assume an energy content of 106 Btu/MCF. CASE A Annual Fuel Cost: CASE B Annual Fuel Cost: b) Compute the Annual Fixed Charge using the fixed charge rate given in classr Afe= (FCE) (corynent) GOO c) Compute the Total Annual Revenue Requirement (Fixed Charge + Variable + Fuel) for both cases (in millions, to two decimal places) Case A: Case B: EL d) Compute the busbar cost per MWh. for both cases, to three decimal places Case A busbar cost: Case B busbar cost: tqwa within] e) So, a 10% increase in fuel cost for this plant results in what percentage increase in busbar costs (in percent, to two decimal places)? to stay in Busine Case f) Based on what you have learned in the course to date, what can you suggest to the client as a means to lower further the plants busbar cost (aside from less expensive gas)? (Fe) tom) Hrite Energ