Question

2. Nike Inc. currently has an AA- rated (Standard & Poor's) corporate bond outstanding, with a coupon rate of 3.875%, paid semi-annually, due to

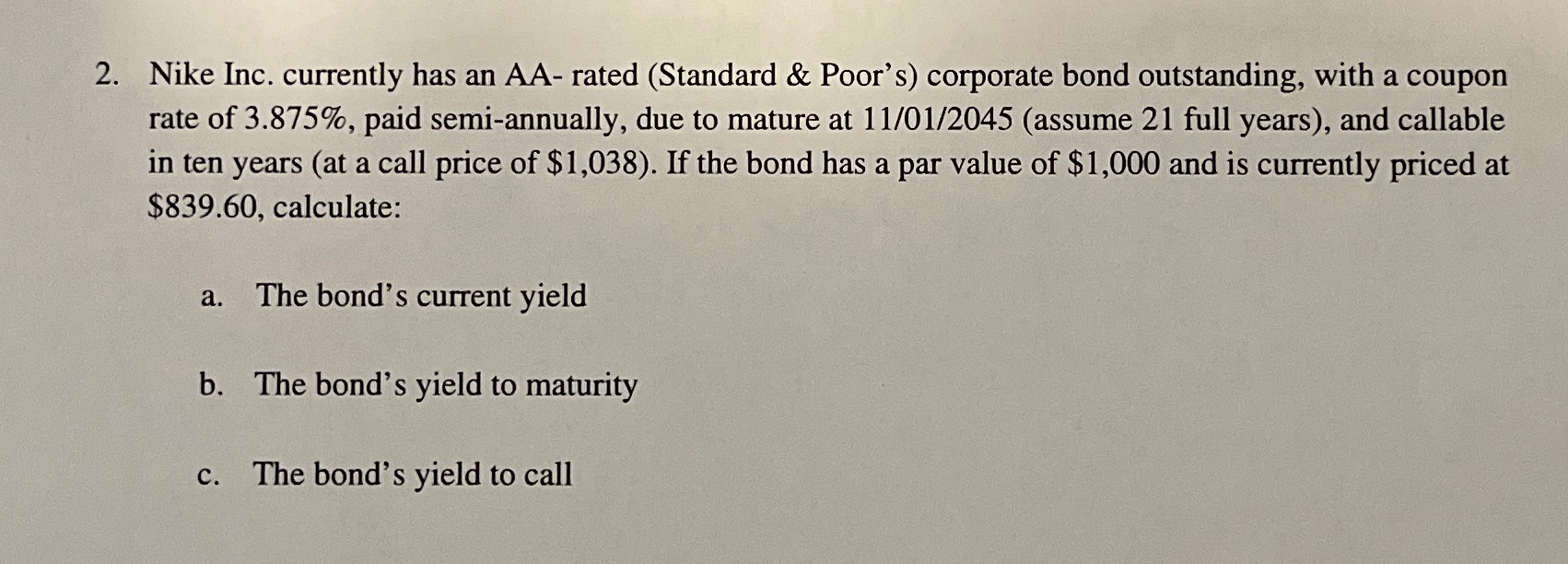

2. Nike Inc. currently has an AA- rated (Standard & Poor's) corporate bond outstanding, with a coupon rate of 3.875%, paid semi-annually, due to mature at 11/01/2045 (assume 21 full years), and callable in ten years (at a call price of $1,038). If the bond has a par value of $1,000 and is currently priced at $839.60, calculate: a. The bond's current yield b. The bond's yield to maturity C. The bond's yield to call

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Nike Bond Calculations a Current Yield The current yield is a simple calculation of the annual inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fixed Income Analysis

Authors: Barbara S. Petitt

5th Edition

1119850541, 978-1119850540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App