Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 of 7 (0 complete) his T-shirt design business will help her other company, Wonder Wilderness Company, w - X More Info Each of the

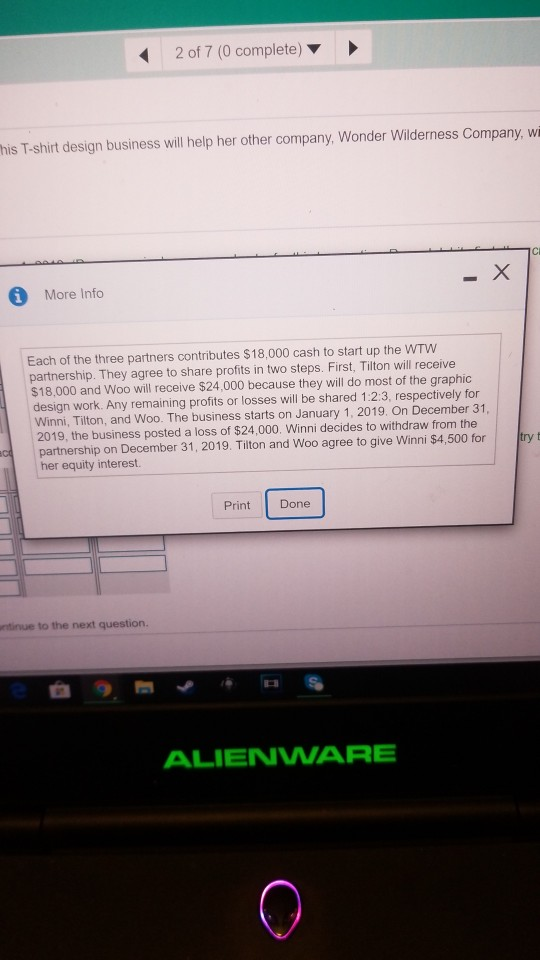

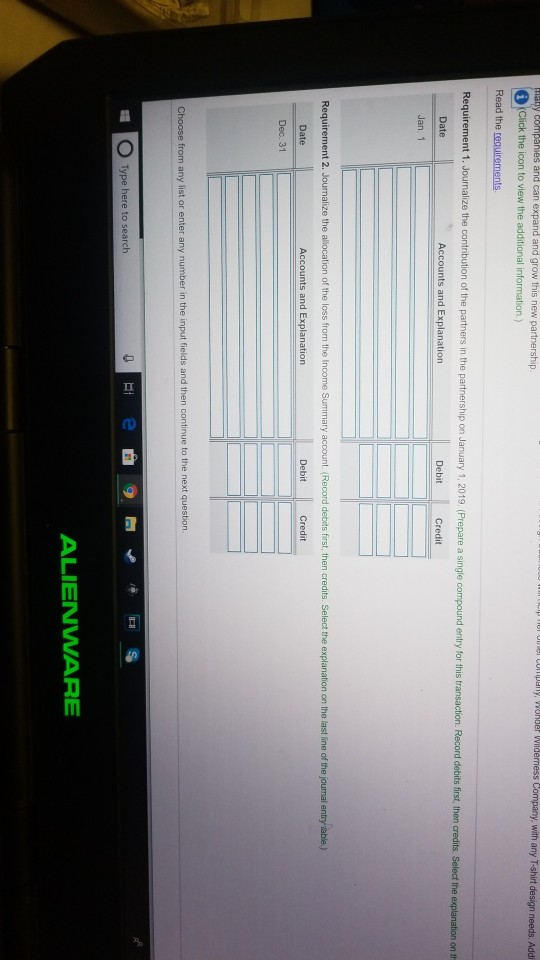

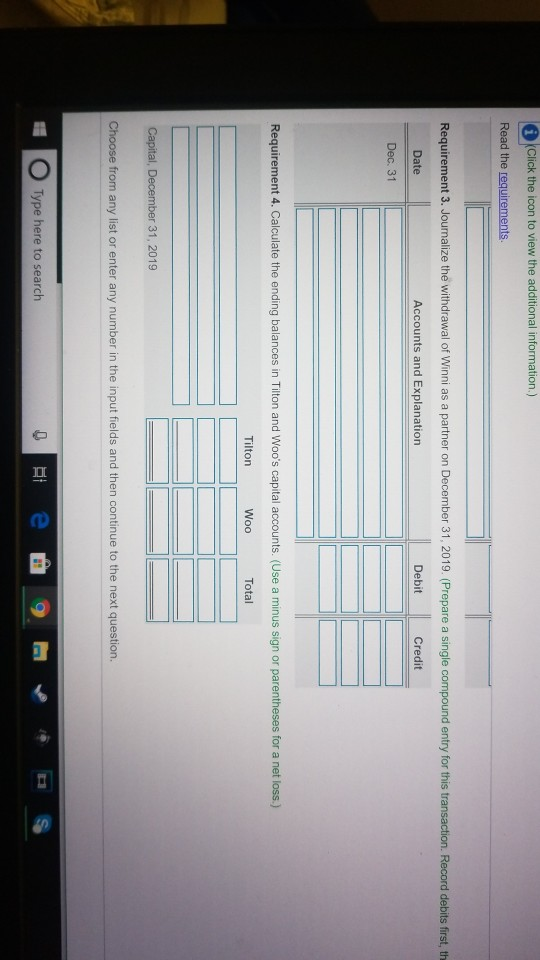

2 of 7 (0 complete) his T-shirt design business will help her other company, Wonder Wilderness Company, w - X More Info Each of the three partners contributes $18,000 cash to start up the WTW partnership. They agree to share profits in two steps. First, Tilton will receive $18,000 and Woo will receive $24,000 because they will do most of the graphic design work. Any remaining profits or losses will be shared 1:2:3, respectively for Winni, Tilton, and Woo. The business starts on January 1, 2019. On December 31, 2019, the business posted a loss of $24,000. Winni decides to withdraw from the partnership on December 31, 2019. Tilton and Woo agree to give Winni $4,500 for her equity interest. try t Done Print untinue to the next question. ALIENWNARE l 0el Cumpny, Worder Willderness Company, with any T-shirt design needs. Addi elp any companis and can expand and grow this new partnership Click the icon to view the additional information.) Read the requirements Requirement 1. Journalize the contribution of the partners in the partnership on January 1, 2019. (Prepare a single compound entry for this transaction. Record debits first, then credits. Select the explanation on th Date Accounts and Explanation Debit Credit Jan. 1 Requirement 2. Journalize the allocation of the loss from the Income Summary account. (Record debits first, then credits. Select the explanation on the last line of the journal entry able.) Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question Type here to search ALIENWARE Click the icon to view the additional information.) Read the requirements. Requirement 3. Journalize the withdrawal of Winni as a partner on December 31, 2019. (Prepare a single compound entry for this transaction. Record debits first, th Date Accounts and Explanation Debit Credit Dec. 31 Requirement 4. Calculate the ending balances in Tilton and Woo's capital accounts. (Use a minus sign or parentheses for a net loss.) Tilton Woo Total Capital, December 31, 2019 Choose from any list or enter any number in the input fields and then continue to the next question. Type here to search 2 of 7 (0 complete) his T-shirt design business will help her other company, Wonder Wilderness Company, w - X More Info Each of the three partners contributes $18,000 cash to start up the WTW partnership. They agree to share profits in two steps. First, Tilton will receive $18,000 and Woo will receive $24,000 because they will do most of the graphic design work. Any remaining profits or losses will be shared 1:2:3, respectively for Winni, Tilton, and Woo. The business starts on January 1, 2019. On December 31, 2019, the business posted a loss of $24,000. Winni decides to withdraw from the partnership on December 31, 2019. Tilton and Woo agree to give Winni $4,500 for her equity interest. try t Done Print untinue to the next question. ALIENWNARE l 0el Cumpny, Worder Willderness Company, with any T-shirt design needs. Addi elp any companis and can expand and grow this new partnership Click the icon to view the additional information.) Read the requirements Requirement 1. Journalize the contribution of the partners in the partnership on January 1, 2019. (Prepare a single compound entry for this transaction. Record debits first, then credits. Select the explanation on th Date Accounts and Explanation Debit Credit Jan. 1 Requirement 2. Journalize the allocation of the loss from the Income Summary account. (Record debits first, then credits. Select the explanation on the last line of the journal entry able.) Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question Type here to search ALIENWARE Click the icon to view the additional information.) Read the requirements. Requirement 3. Journalize the withdrawal of Winni as a partner on December 31, 2019. (Prepare a single compound entry for this transaction. Record debits first, th Date Accounts and Explanation Debit Credit Dec. 31 Requirement 4. Calculate the ending balances in Tilton and Woo's capital accounts. (Use a minus sign or parentheses for a net loss.) Tilton Woo Total Capital, December 31, 2019 Choose from any list or enter any number in the input fields and then continue to the next question. Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started