2

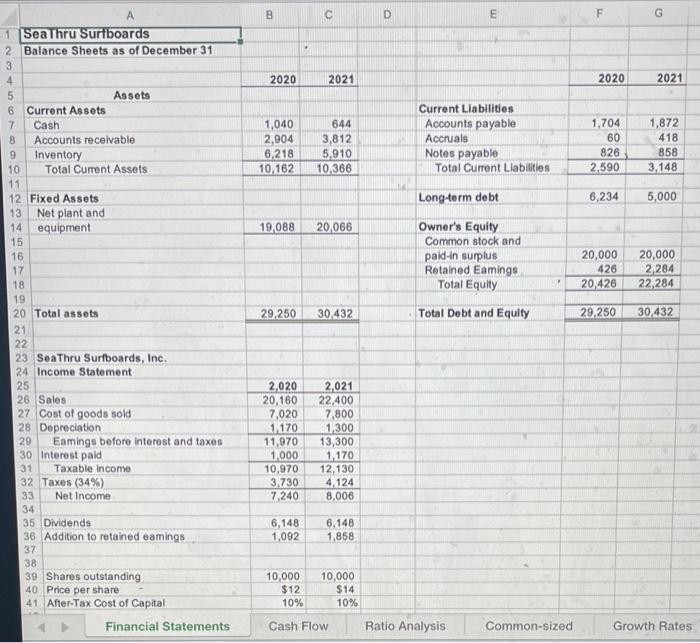

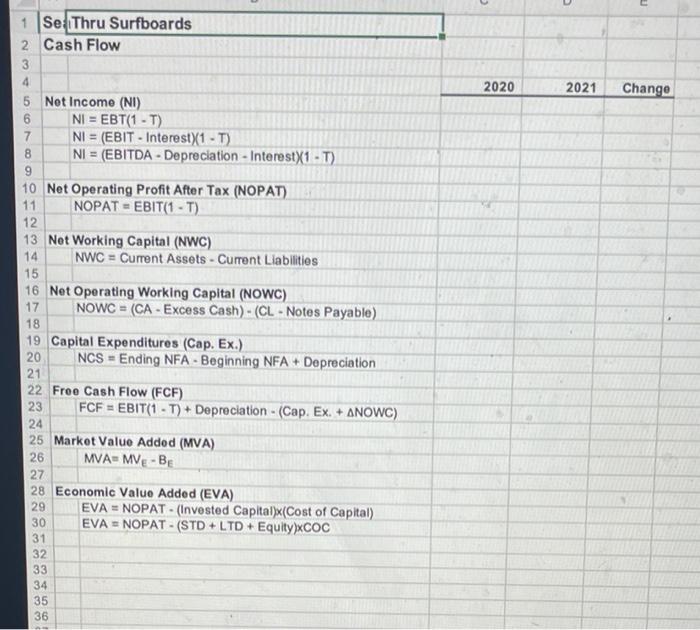

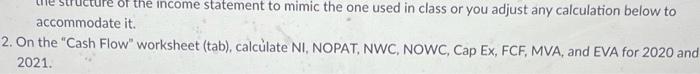

of the income statement to mimic the one used in class or you adjust any calculation below to accommodate it. 2. On the "Cash Flow" worksheet (tab), calculate NI, NOPAT, NWC, NOWC, Cap Ex, FCF, MVA, and EVA for 2020 and 2021. B 02 D E F 2020 2021 2020 2021 1,040 2,904 6,218 10.162 644 3,812 5,910 10.366 Current Liabilities Accounts payable Accruals Notes payable Total Current Liabilities 1,704 60 826 2.590 1,872 418 858 3,148 Long-term debt 6,234 5,000 19,088 20,066 Owner's Equity Common stock and paid in surplus Retained Eamings Total Equity 20,000 426 20,426 20,000 2284 22,284 1 Sea Thru Surfboards 2 Balance Sheets as of December 31 3 4 5 Assets 6 Current Assets 7 Cash Accounts receivable 9 Inventory 10 Total Current Assets 11 12 Fixed Assets 13 Net plant and 14 equipment 15 16 17 18 19 20 Total assets 21 22 23 Sea Thru Surfboards, Inc. 24 Income Statement 25 26 Sales 27 Cost of goods sold 28 Depreciation 29 Eamings before interest and taxes 30 Interest pald 31 Taxable income 32 Taxes (34%) 33 Net Income 34 35 Dividends 36 Addition to retained eamings 37 38 39 Shares outstanding 40 Price per share 41 After-Tax Cost of Capital 29,250 30.432 Total Debt and Equity 29,250 30.432 2,020 20,160 7,020 1.170 11,970 1,000 10,970 3,730 7,240 2,021 22,400 7,800 1,300 13,300 1,170 12,130 4,124 8,006 6,148 1,092 6,148 1,858 10,000 $12 10% 10,000 $14 10% Financial Statements Cash Flow Ratio Analysis Common-sized Growth Rates - 2020 2021 Change 1 Se Thru Surfboards 2 Cash Flow 3 4 5 Not Income (NU) 6 NI = EBT(1-T) NI = (EBIT - Interest)(1-T) 8 NI = (EBITDA - Depreciation - Interest 1 - T) 9 10 Net Operating Profit After Tax (NOPAT) 11 NOPAT - EBIT(1 - T) 12. 13 Net Working Capital (NWC) 14 NWC = Current Assets - Current Liabilities 15 16 Net Operating Working Capital (NOWC) 17 NOWC = (CA - Excess Cash) - (CL - Notes Payable) 18 19 Capital Expenditures (Cap. Ex.) 20 NCS = Ending NFA - Beginning NFA + Depreciation 21 22 Free Cash Flow (FCF) 23 FCF = EBIT(1-T) + Depreciation - (Cap. Ex. + ANOWC) 24 25 Market Value Added (MVA) 26 MVA-MVE-BE 27 28 Economic Value Added (EVA) 29 EVA = NOPAT (Invested Capital)x(Cost of Capital) 30 EVA - NOPAT - (STD + LTD + Equity)XCOC 31 32 33 34 35