Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) On December 31, 2022, Big Red Paper Company had sales of $945,000 for the year. Refunds in 2023 are expected to be 2.25%

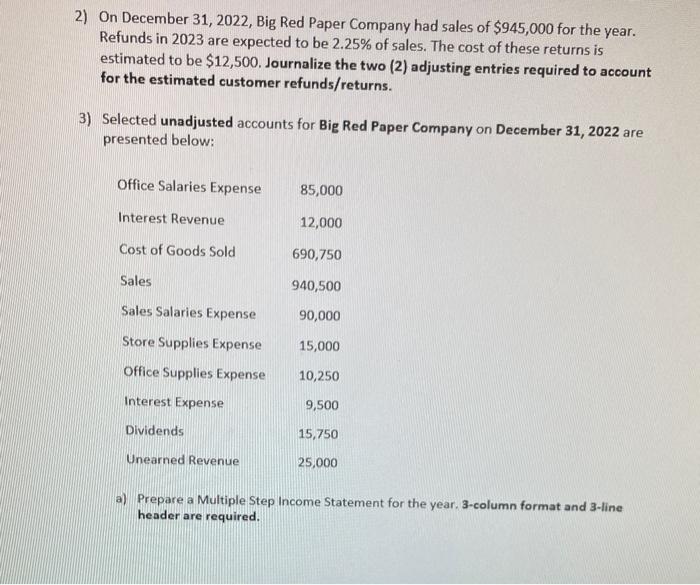

2) On December 31, 2022, Big Red Paper Company had sales of $945,000 for the year. Refunds in 2023 are expected to be 2.25% of sales. The cost of these returns is estimated to be $12,500. Journalize the two (2) adjusting entries required to account for the estimated customer refunds/returns. 3) Selected unadjusted accounts for Big Red Paper Company on December 31, 2022 are presented below: Office Salaries Expense Interest Revenue Cost of Goods Sold Sales Sales Salaries Expense Store Supplies Expense Office Supplies Expense Interest Expense Dividends Unearned Revenue 85,000 12,000 690,750 940,500 90,000 15,000 10,250 9,500 15,750 25,000 a) Prepare a Multiple Step Income Statement for the year. 3-column format and 3-line header are required. b) Using the data above, close the adjusted temporary accounts in journal entry format.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2 Journalize the two 2 adjusting entries required to account for the estimated customer refund...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started