Answered step by step

Verified Expert Solution

Question

1 Approved Answer

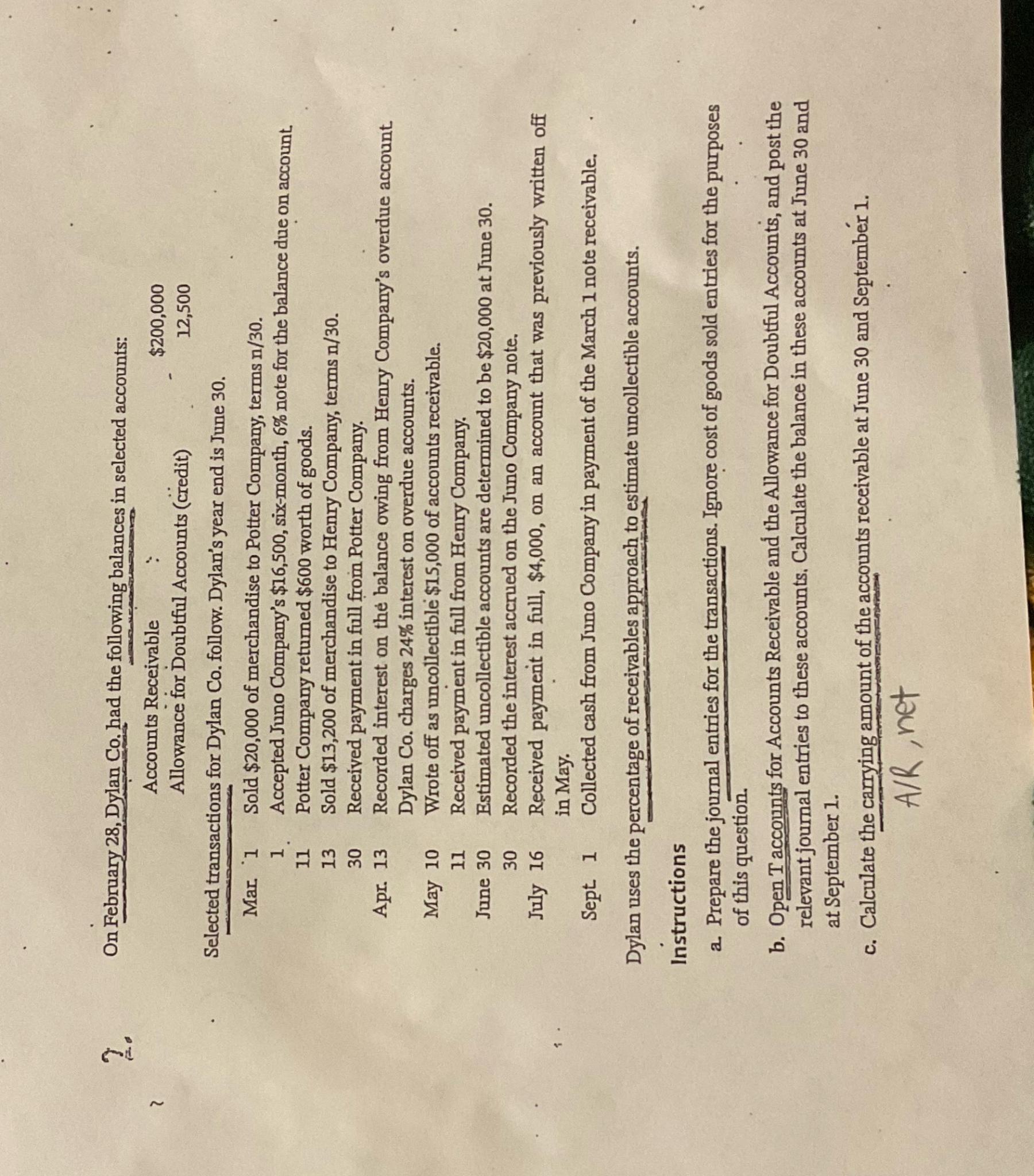

2. On February 28, Dylan Co. had the following balances in selected accounts: Accounts Receivable Allowance for Doubtful Accounts (credit) Selected transactions for Dylan

2. On February 28, Dylan Co. had the following balances in selected accounts: Accounts Receivable Allowance for Doubtful Accounts (credit) Selected transactions for Dylan Co. follow. Dylan's year end is June 30. $200,000 12,500 Sold $20,000 of merchandise to Potter Company, terms n/30. Accepted Juno Company's $16,500, six-month, 6% note for the balance due on account. Potter Company returned $600 worth of goods. Sold $13,200 of merchandise to Henry Company, terms n/30. Received payment in full from Potter Company. Mar 1 1 11 13 30 Apr. 13 May 10 Wrote off as uncollectible $15,000 of accounts receivable. 11 Received payment in full from Henry Company. June 30 30 Recorded interest on the balance owing from Henry Company's overdue account. Dylan Co. charges 24% interest on overdue accounts. July 16 Sept. 1 Estimated uncollectible accounts are determined to be $20,000 at June 30. Recorded the interest accrued on the Juno Company note. Received payment in full, $4,000, on an account that was previously written off in May. Collected cash from Juno Company in payment of the March 1 note receivable. Dylan uses the percentage of receivables approach to estimate uncollectible accounts. Instructions a. Prepare the journal entries for the transactions. Ignore cost of goods sold entries for the purposes of this question. b. Open T accounts for Accounts Receivable and the Allowance for Doubtful Accounts, and post the relevant journal entries to these accounts. Calculate the balance in these accounts at June 30 and at September 1. c. Calculate the carrying amount of the accounts receivable at June 30 and September 1. A/R, net

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started