Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. On Jan, 1 2014, Peter Corp. (a U.S. based company) formed a new subsidiary in Saudi Arabia, Saeed Inc., with an initial investment

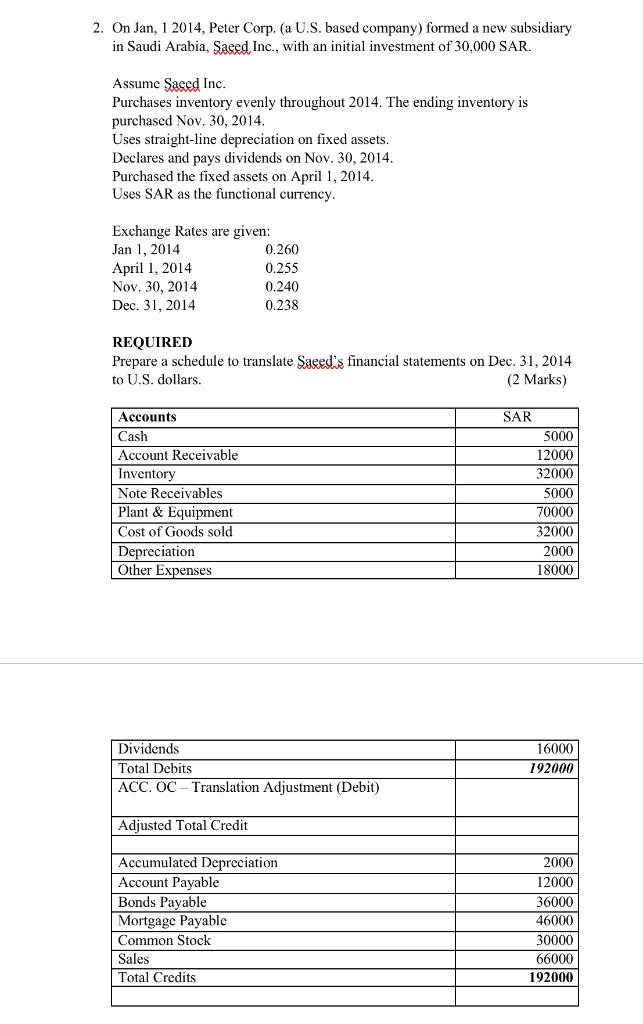

2. On Jan, 1 2014, Peter Corp. (a U.S. based company) formed a new subsidiary in Saudi Arabia, Saeed Inc., with an initial investment of 30.000 SAR. Assume Saced Inc. Purchases inventory evenly throughout 2014. The ending inventory is purchased Nov. 30, 2014. Uses straight-line depreciation on fixed assets. Declares and pays dividends on Nov. 30, 2014. Purchased the fixed assets on April 1, 2014. Uses SAR as the functional currency. Exchange Rates are given: Jan 1, 2014 April 1, 2014 Nov, 30, 2014 0.260 0.255 0.240 Dec. 31, 2014 0.238 REQUIRED Prepare a schedule to translate Saeed's financial statements on Dec. 31, 2014 to U.S. dollars. (2 Marks) Accounts SAR Cash 5000 Account Receivable Inventory Note Receivables Plant& Equipment Cost of Goods sold Depreciation Other Expenses 12000 32000 5000 70000 32000 2000 18000 Dividends 16000 Total Debits ACC. OC - Translation Adjustment (Debit) 192000 Adjusted Total Credit Accumulated Depreciation 2000 Account Payable Bonds Payable Mortgage Payable 12000 36000 46000 Common Stock 30000 Sales Total Credits 66000 192000

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution incursted thtough Hade that is simple avesage of year end 1ade opeing Expense incusted t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started