Answered step by step

Verified Expert Solution

Question

1 Approved Answer

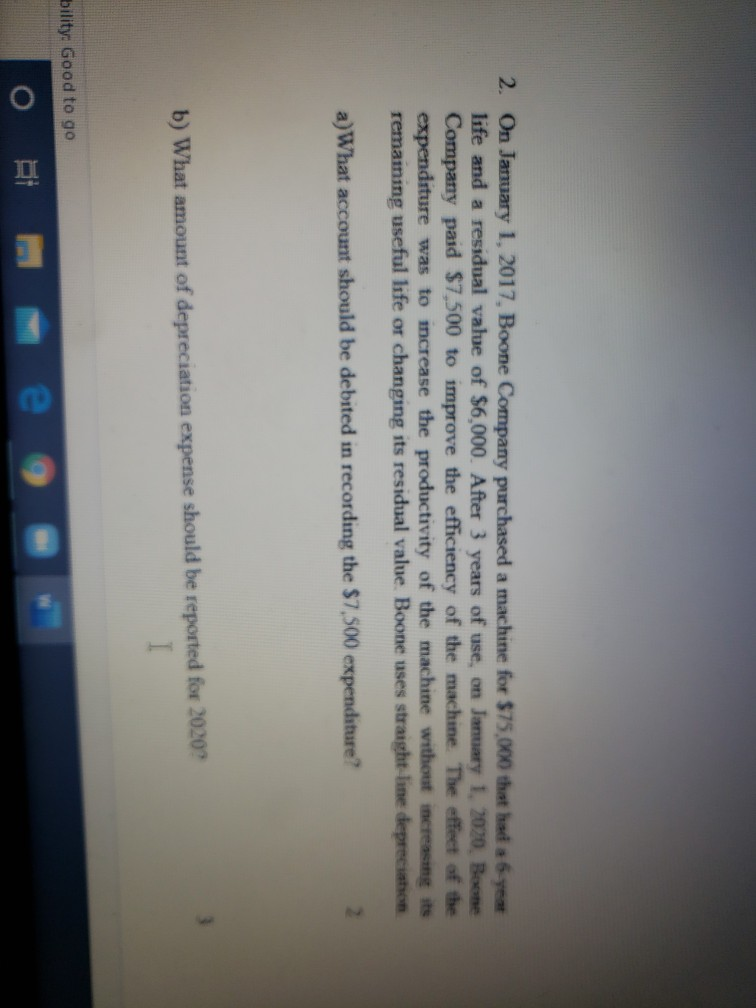

2. On January 1, 2017, Boone Company purchased a machine for $75.000 that had a 6-yeat life and a residual value of $6,000. After 3

2. On January 1, 2017, Boone Company purchased a machine for $75.000 that had a 6-yeat life and a residual value of $6,000. After 3 years of use, on January 1, 2020. Boone Company paid $7,500 to improve the efficiency of the machine. The effect of the expenditure was to increase the productivity of the machine without increasing its remaining useful life or changing its residual value Boone uses straight line depreciation a)What account should be debited in recording the $7,500 expenditure? b) What amount of depreciation expense should be reported for 2020? I bility: Good to go I o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started