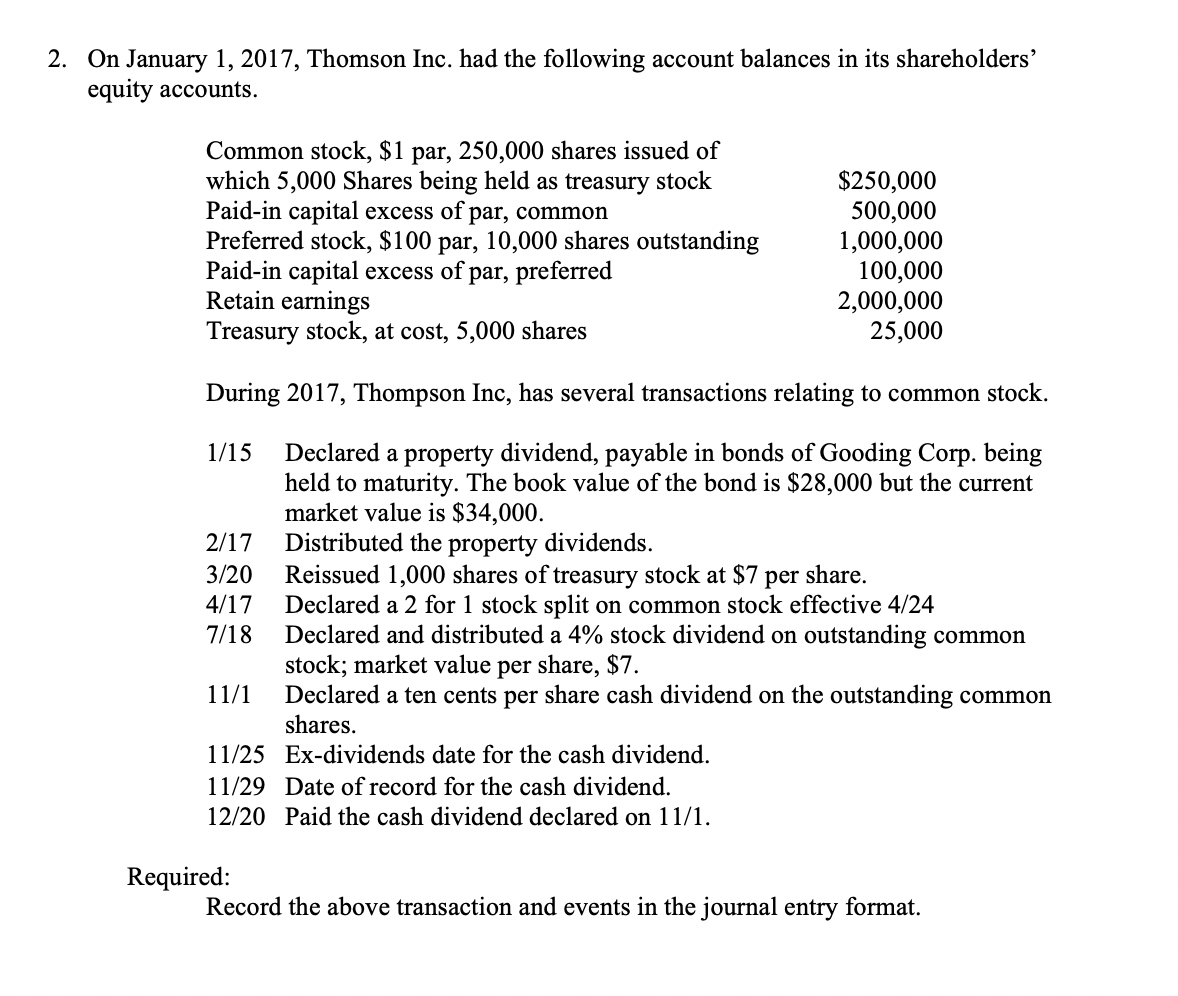

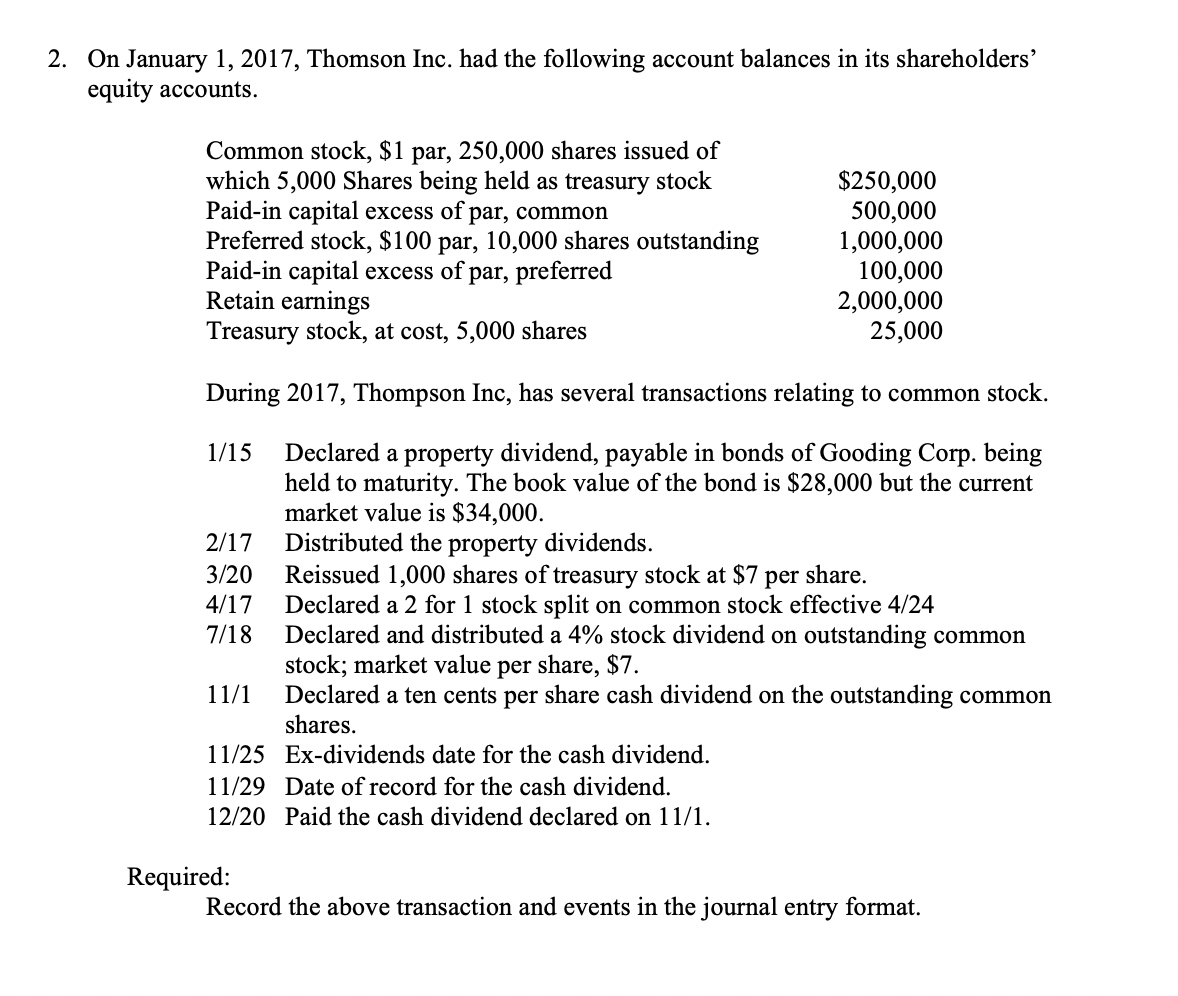

2. On January 1, 2017, Thomson Inc. had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 250,000 shares issued of which 5,000 Shares being held as treasury stock Paid-in capital excess of par, common Preferred stock, $100 par, 10,000 shares outstanding Paid-in capital excess of par, preferred Retain earnings Treasury stock, at cost, 5,000 shares $250,000 500,000 1,000,000 100,000 2,000,000 25,000 During 2017, Thompson Inc, has several transactions relating to common stock. 1/15 Declared a property dividend, payable in bonds of Gooding Corp. being held to maturity. The book value of the bond is $28,000 but the current market value is $34,000. 2/17 Distributed the property dividends. 3/20 Reissued 1,000 shares of treasury stock at $7 per share. 4/17 Declared a 2 for 1 stock split on common stock effective 4/24 7/18 Declared and distributed a 4% stock dividend on outstanding common stock; market value per share, $7. Declared a ten cents per share cash dividend on the outstanding common shares. 11/25 Ex-dividends date for the cash dividend. 11/29 Date of record for the cash dividend. 12/20 Paid the cash dividend declared on 11/1. Required: Record the above transaction and events in the journal entry format. 2. On January 1, 2017, Thomson Inc. had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 250,000 shares issued of which 5,000 Shares being held as treasury stock Paid-in capital excess of par, common Preferred stock, $100 par, 10,000 shares outstanding Paid-in capital excess of par, preferred Retain earnings Treasury stock, at cost, 5,000 shares $250,000 500,000 1,000,000 100,000 2,000,000 25,000 During 2017, Thompson Inc, has several transactions relating to common stock. 1/15 Declared a property dividend, payable in bonds of Gooding Corp. being held to maturity. The book value of the bond is $28,000 but the current market value is $34,000. 2/17 Distributed the property dividends. 3/20 Reissued 1,000 shares of treasury stock at $7 per share. 4/17 Declared a 2 for 1 stock split on common stock effective 4/24 7/18 Declared and distributed a 4% stock dividend on outstanding common stock; market value per share, $7. Declared a ten cents per share cash dividend on the outstanding common shares. 11/25 Ex-dividends date for the cash dividend. 11/29 Date of record for the cash dividend. 12/20 Paid the cash dividend declared on 11/1. Required: Record the above transaction and events in the journal entry format