Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. On January 1,2020 , SuperQuick Stores Co. signed a contract to lease a number of stores for 10 years from ProMana Property Management Co.

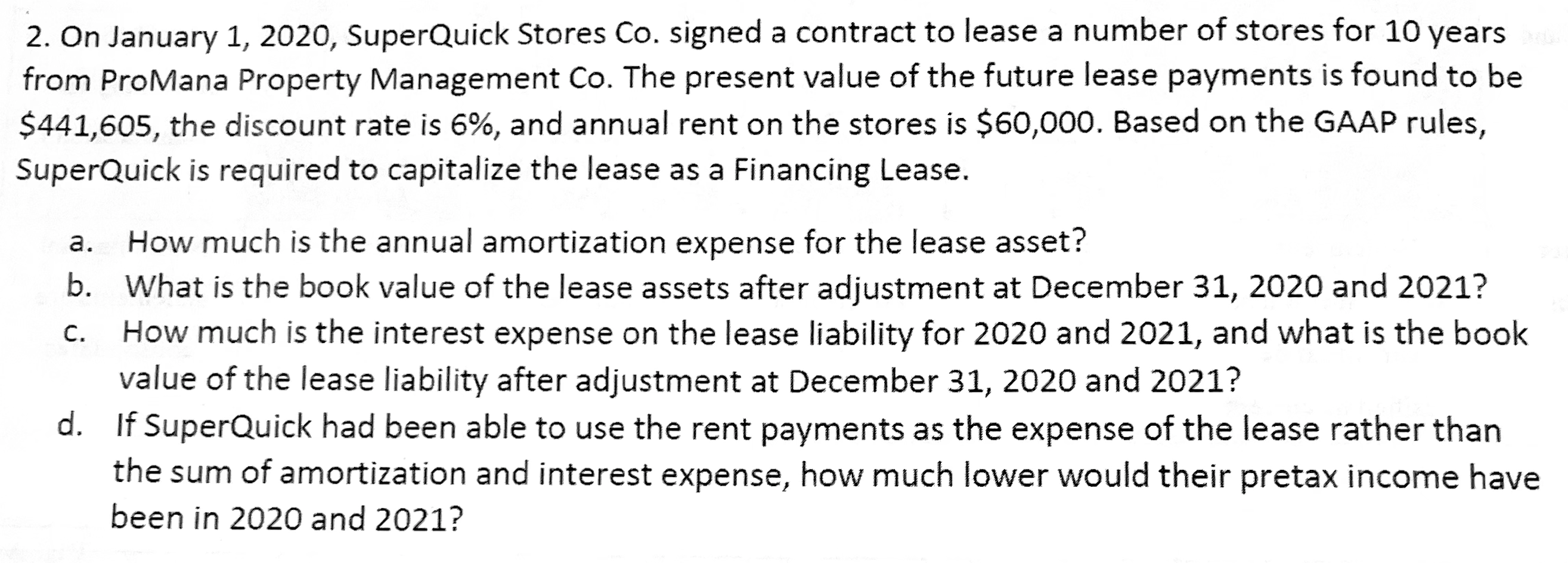

2. On January 1,2020 , SuperQuick Stores Co. signed a contract to lease a number of stores for 10 years from ProMana Property Management Co. The present value of the future lease payments is found to be $441,605, the discount rate is 6%, and annual rent on the stores is $60,000. Based on the GAAP rules, SuperQuick is required to capitalize the lease as a Financing Lease. a. How much is the annual amortization expense for the lease asset? b. What is the book value of the lease assets after adjustment at December 31,2020 and 2021 ? c. How much is the interest expense on the lease liability for 2020 and 2021, and what is the book value of the lease liability after adjustment at December 31, 2020 and 2021? d. If SuperQuick had been able to use the rent payments as the expense of the lease rather than the sum of amortization and interest expense, how much lower would their pretax income have been in 2020 and 2021

2. On January 1,2020 , SuperQuick Stores Co. signed a contract to lease a number of stores for 10 years from ProMana Property Management Co. The present value of the future lease payments is found to be $441,605, the discount rate is 6%, and annual rent on the stores is $60,000. Based on the GAAP rules, SuperQuick is required to capitalize the lease as a Financing Lease. a. How much is the annual amortization expense for the lease asset? b. What is the book value of the lease assets after adjustment at December 31,2020 and 2021 ? c. How much is the interest expense on the lease liability for 2020 and 2021, and what is the book value of the lease liability after adjustment at December 31, 2020 and 2021? d. If SuperQuick had been able to use the rent payments as the expense of the lease rather than the sum of amortization and interest expense, how much lower would their pretax income have been in 2020 and 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started