Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#2 Pam Corporation holds 70 percent ownership of Spray Enterprises. On December 31,206,5 pray poid Pam $31,000 for a truck thot Pom had purchosed for

#2

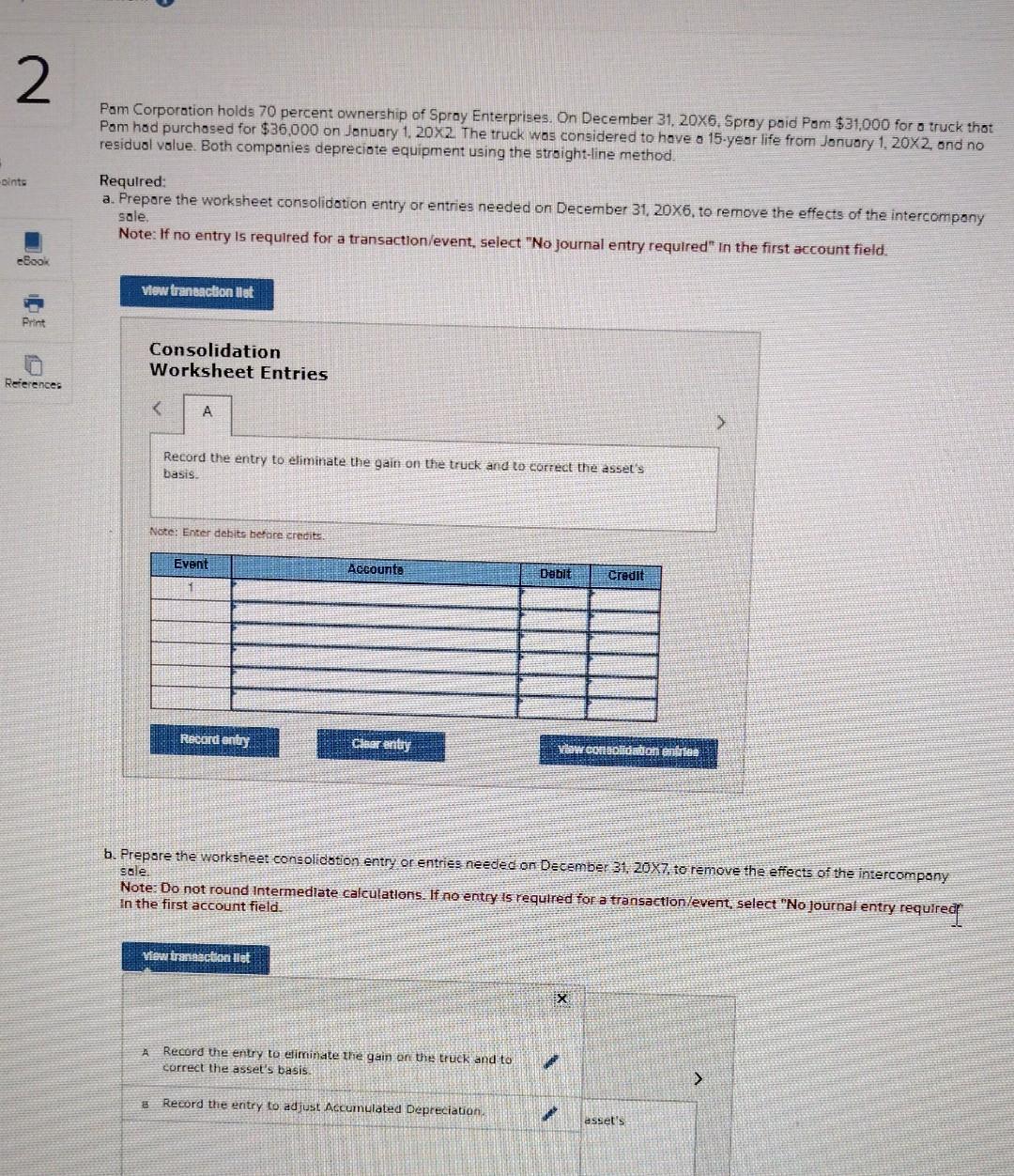

Pam Corporation holds 70 percent ownership of Spray Enterprises. On December 31,206,5 pray poid Pam $31,000 for a truck thot Pom had purchosed for $36,000 on Jonuary 1,202. The truck was considered to have a 15 -yeor life from Jonuary 1,202, and no residuol value. Both companies depreciote equipment using the stroight-line method. Required: a. Prepore the worksheet consolidotion entry or entries needed on December 31,206, to remove the effects of the intercompony sale. Note: If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Consolidation Worksheet Entries Record the entry to eliminate the gain on the truck and to correct the asset's basis. Note: Enter debits berare aresite: b. Prepare the worksheet consolidotion entry or entriee needed on December 31,207, to remove the effects of the intercompony sole. Note: Do not round Intemediate calculatlons. If no entry is requlred for a transactlonlevent, select "No journal entry required In the first account field: A Record the entry to etimindte the gain on the truck and to correct the asset's basis. B Record the entry to adjust Accumulated DepreciationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started