Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. please answer questions completely using multiple choice. Operating and financial leverage may exist for firms. Which of the following statements is accurate concerning leverage?

2.

please answer questions completely using multiple choice.

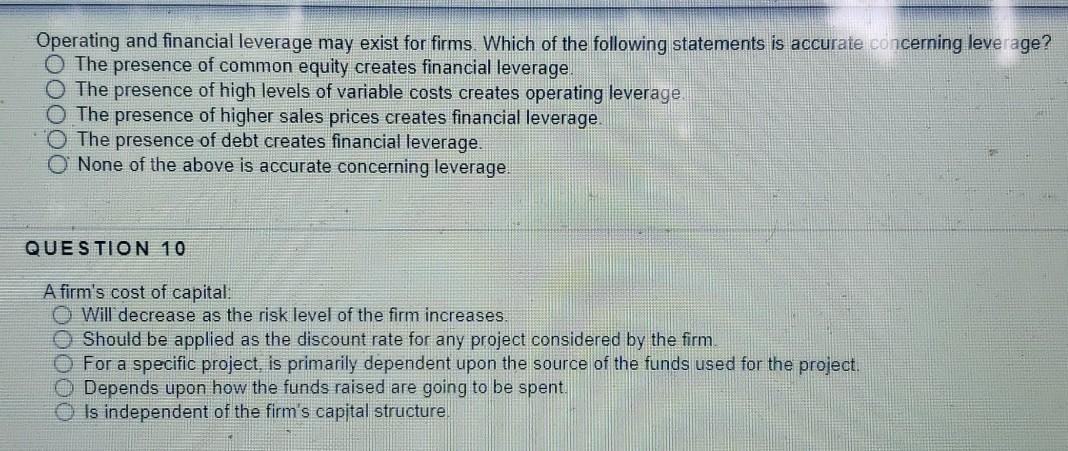

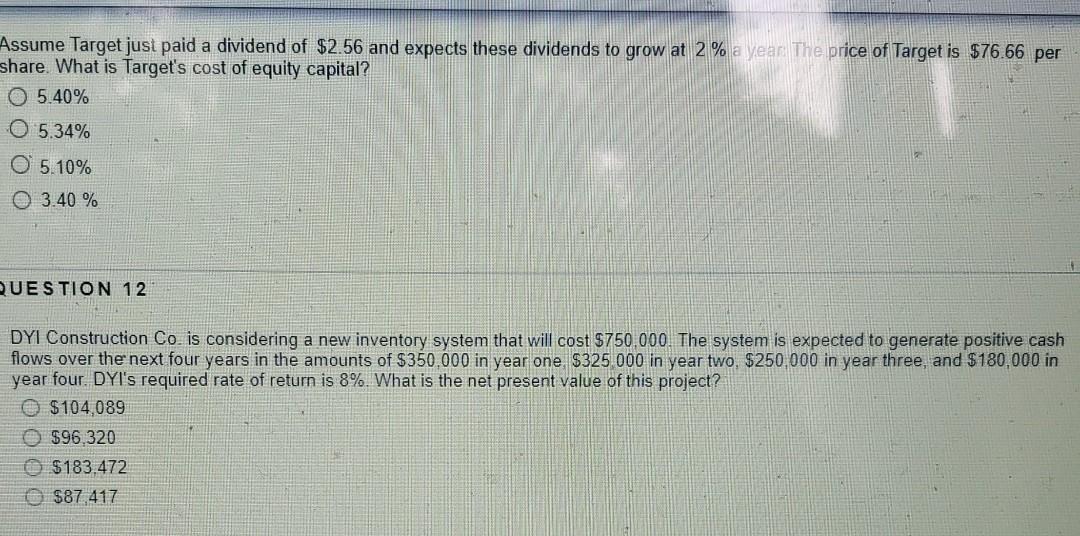

Operating and financial leverage may exist for firms. Which of the following statements is accurate concerning leverage? O The presence of common equity creates financial leverage. The presence of high levels of variable costs creates operating leverage The presence of higher sales prices creates financial leverage The presence of debt creates financial leverage. O None of the above is accurate concerning leverage. 000 QUESTION 10 A firm's cost of capital: Will decrease as the risk level of the firm increases. Should be applied as the discount rate for any project considered by the firm For a specific project, is primarily dependent upon the source of the funds used for the project. Depends upon how the funds raised are going to be spent. Is independent of the firm's capital structure. Assume Target just paid a dividend of $2.56 and expects these dividends to grow at 2 % a year. The price of Target is $76.66 per share. What is Target's cost of equity capital? O 5.40% O 5.34% 05.10% 0 3.40 % QUESTION 12 DYI Construction Co is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one, $325 000 in year two, $250,000 in year three, and $180,000 in year four. DYI's required rate of return is 8%. What is the nei present value of this project? $104,089 $96.320 $183,472 $87 417Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started