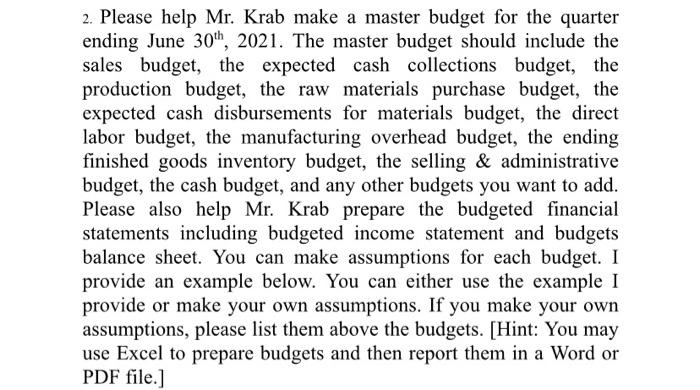

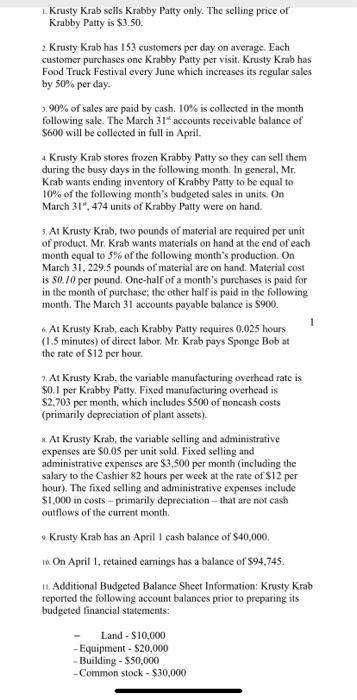

2. Please help Mr. Krab make a master budget for the quarter ending June 30th, 2021. The master budget should include the sales budget, the expected cash collections budget, the production budget, the raw materials purchase budget, the expected cash disbursements for materials budget, the direct labor budget, the manufacturing overhead budget, the ending finished goods inventory budget, the selling & administrative budget, the cash budget, and any other budgets you want to add. Please also help Mr. Krab prepare the budgeted financial statements including budgeted income statement and budgets balance sheet. You can make assumptions for each budget. I provide an example below. You can either use the example I provide or make your own assumptions. If you make your own assumptions, please list them above the budgets. (Hint: You may use Excel to prepare budgets and then report them in a Word or PDF file.) Krusty Krab sells Krabby Patty only. The selling price of Krabby Patty is $3.50 2 Krusty Krab has 153 customers per day on average. Each customer purchases one Krabby Patty per visit. Krusty Krab has Food Truck Festival every June which increases its regular sales by 50% per day. 1.90% of sales are paid by cash. 10% is collected in the month following sale. The March 31" accounts receivable balance of $600 will be collected in full in April. Krusty Krab stores frozen Krabby Patty so they can sell them during the busy days in the following month. In general, Mr. Krab wants ending inventory of Krabby Patty to be equal to 10% of the following month's budgeted sales in units. On March 31", 474 units of Krabby Patty were on hand. 5. At Krusty Krab, two pounds of material are required per unit of product. Mr. Krab wants materials on hand at the end of each month equal to 5% of the following month's production. On March 31, 229.5 pounds of material are on hand. Material cost is 50.10 per pound. Onc-half of a month's purchases is paid for in the month of purchase the other half is paid in the following month. The March 31 accounts payable balance is $900. 6 At Krusty Krab, cach Krabby Patty requires 0.025 hours (1.5 minutes) of direct labor. Mr. Krab pays Sponge Bob at the rate of S12 per hour At Krusty Krab, the variable manufacturing overhead rate is $0.1 per Krabby Patty. Fixed manufacturing overhead is $2,703 per month, which includes $500 of noncash costs (primarily depreciation of plant assets). 1. At Krusty Krab, the variable selling and administrative expenses are $0.05 per unit sold. Fixed selling and administrative expenses are $3,500 per month (including the salary to the Cashier 82 hours per week at the rate of $12 per hour). The fixed selling and administrative expenses include $1,000 in costs - primarily depreciation that are not eash outflows of the current month. Krusty Krab has an April 1 cash balance of $40,000. 10. On April 1, retained earnings has a balance of 894,745. I. Additional Budgeted Balance Sheet Information: Krusty Krab reported the following account balances prior to preparing its budgeted financial statements: Land - $10,000 -Equipment - $20,000 - Building - $50,000 -Common stock - $30,000 2. Please help Mr. Krab make a master budget for the quarter ending June 30th, 2021. The master budget should include the sales budget, the expected cash collections budget, the production budget, the raw materials purchase budget, the expected cash disbursements for materials budget, the direct labor budget, the manufacturing overhead budget, the ending finished goods inventory budget, the selling & administrative budget, the cash budget, and any other budgets you want to add. Please also help Mr. Krab prepare the budgeted financial statements including budgeted income statement and budgets balance sheet. You can make assumptions for each budget. I provide an example below. You can either use the example I provide or make your own assumptions. If you make your own assumptions, please list them above the budgets. (Hint: You may use Excel to prepare budgets and then report them in a Word or PDF file.) Krusty Krab sells Krabby Patty only. The selling price of Krabby Patty is $3.50 2 Krusty Krab has 153 customers per day on average. Each customer purchases one Krabby Patty per visit. Krusty Krab has Food Truck Festival every June which increases its regular sales by 50% per day. 1.90% of sales are paid by cash. 10% is collected in the month following sale. The March 31" accounts receivable balance of $600 will be collected in full in April. Krusty Krab stores frozen Krabby Patty so they can sell them during the busy days in the following month. In general, Mr. Krab wants ending inventory of Krabby Patty to be equal to 10% of the following month's budgeted sales in units. On March 31", 474 units of Krabby Patty were on hand. 5. At Krusty Krab, two pounds of material are required per unit of product. Mr. Krab wants materials on hand at the end of each month equal to 5% of the following month's production. On March 31, 229.5 pounds of material are on hand. Material cost is 50.10 per pound. Onc-half of a month's purchases is paid for in the month of purchase the other half is paid in the following month. The March 31 accounts payable balance is $900. 6 At Krusty Krab, cach Krabby Patty requires 0.025 hours (1.5 minutes) of direct labor. Mr. Krab pays Sponge Bob at the rate of S12 per hour At Krusty Krab, the variable manufacturing overhead rate is $0.1 per Krabby Patty. Fixed manufacturing overhead is $2,703 per month, which includes $500 of noncash costs (primarily depreciation of plant assets). 1. At Krusty Krab, the variable selling and administrative expenses are $0.05 per unit sold. Fixed selling and administrative expenses are $3,500 per month (including the salary to the Cashier 82 hours per week at the rate of $12 per hour). The fixed selling and administrative expenses include $1,000 in costs - primarily depreciation that are not eash outflows of the current month. Krusty Krab has an April 1 cash balance of $40,000. 10. On April 1, retained earnings has a balance of 894,745. I. Additional Budgeted Balance Sheet Information: Krusty Krab reported the following account balances prior to preparing its budgeted financial statements: Land - $10,000 -Equipment - $20,000 - Building - $50,000 -Common stock - $30,000