Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#2 please Name Instructions: Complete the following in your selected groups (2-3 students). document per group and be sure to include the names of all

#2 please

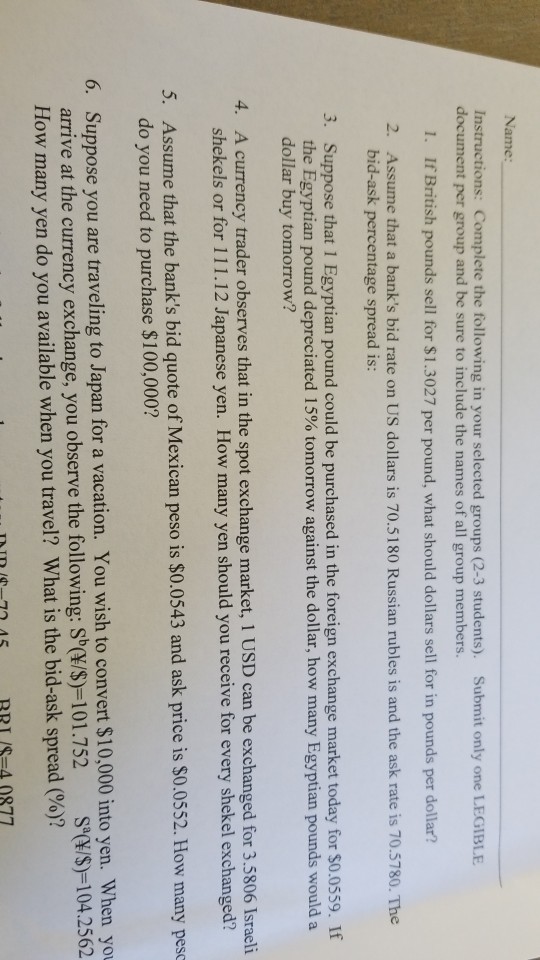

Name Instructions: Complete the following in your selected groups (2-3 students). document per group and be sure to include the names of all group members. Submit only one LEGIBLE 1. If British pounds sell for $1.3027 per pound, what should dollars sell for in pounds per dollar? 2. Assume that a bank's bid rate on US dollars is 70.5180 Russian rubles is and the ask rate is 70.5780. The bid-ask percentage spread is: 3. Suppose that 1 Egyptian pound could be purchased in the foreign exchange market today for $0.0559. If the Egyptian pound depreciated 1 590 tomorrow against the dollar, how many Egyptian pounds would a dollar buy tomorrow? 4. A currency trader observes that in the spot exchange market, 1 USD can be exchanged for 3.5806 Israeli shekels or for 111.12 Japanese yen. How many yen should you receive for every shekel exchanged? 5. Assume that the bank's bid quote of Mexican peso is s0.0543 and ask price is S0.0552. How many pesc do you need to purchase $100,000? Suppose you are traveling to Japan for a vacation. You wish to convert $10,000 into yen. When yo arrive at the currency exchange, you observe the following: S(/s)-101.752 S)-104.2562 6. How many yen do you available when you travel? What is the bid-ask spread (%)? BRI /S 40877Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started