Answered step by step

Verified Expert Solution

Question

1 Approved Answer

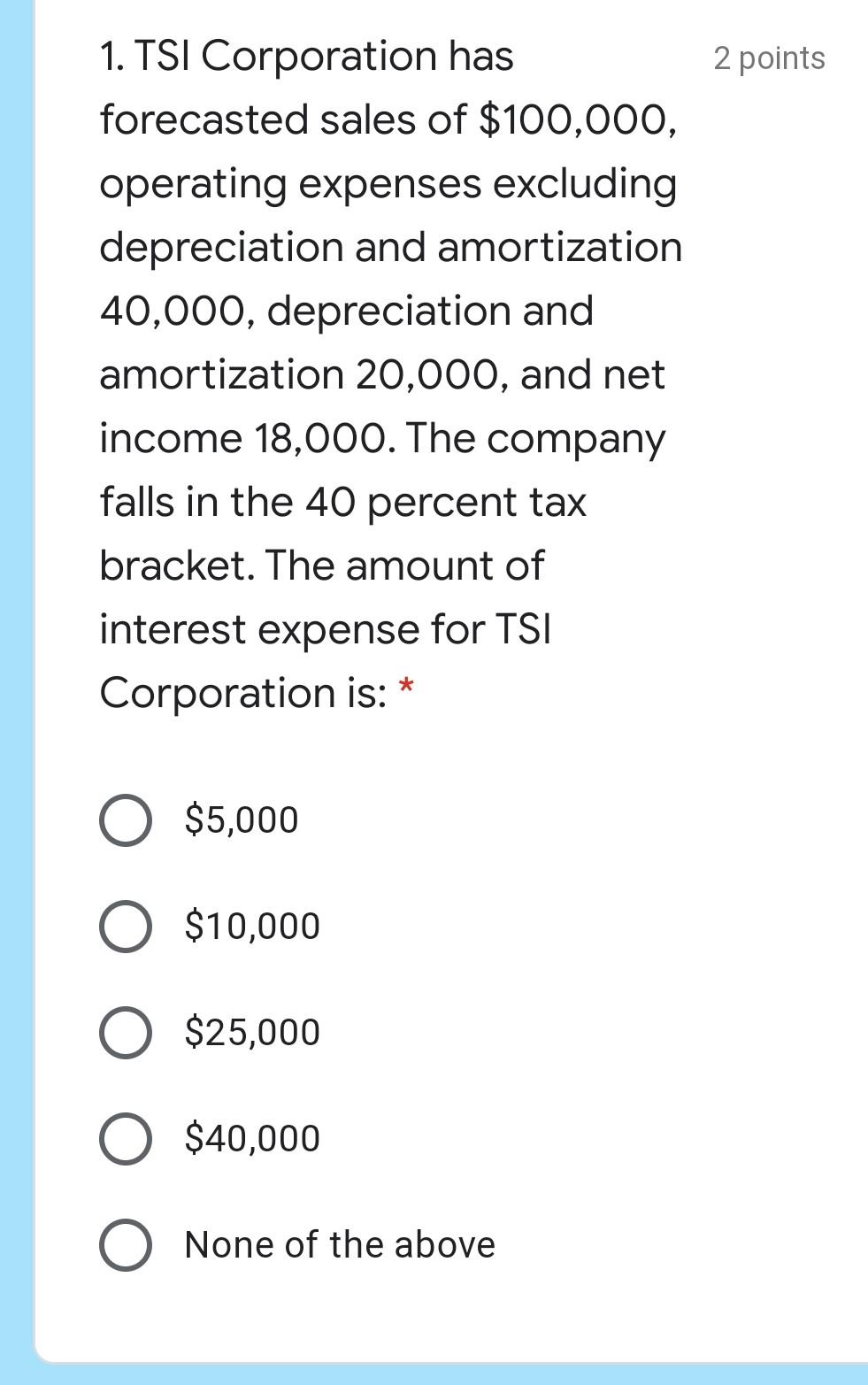

2 points 1. TSI Corporation has forecasted sales of $100,000, operating expenses excluding depreciation and amortization 40,000, depreciation and amortization 20,000, and net income 18,000.

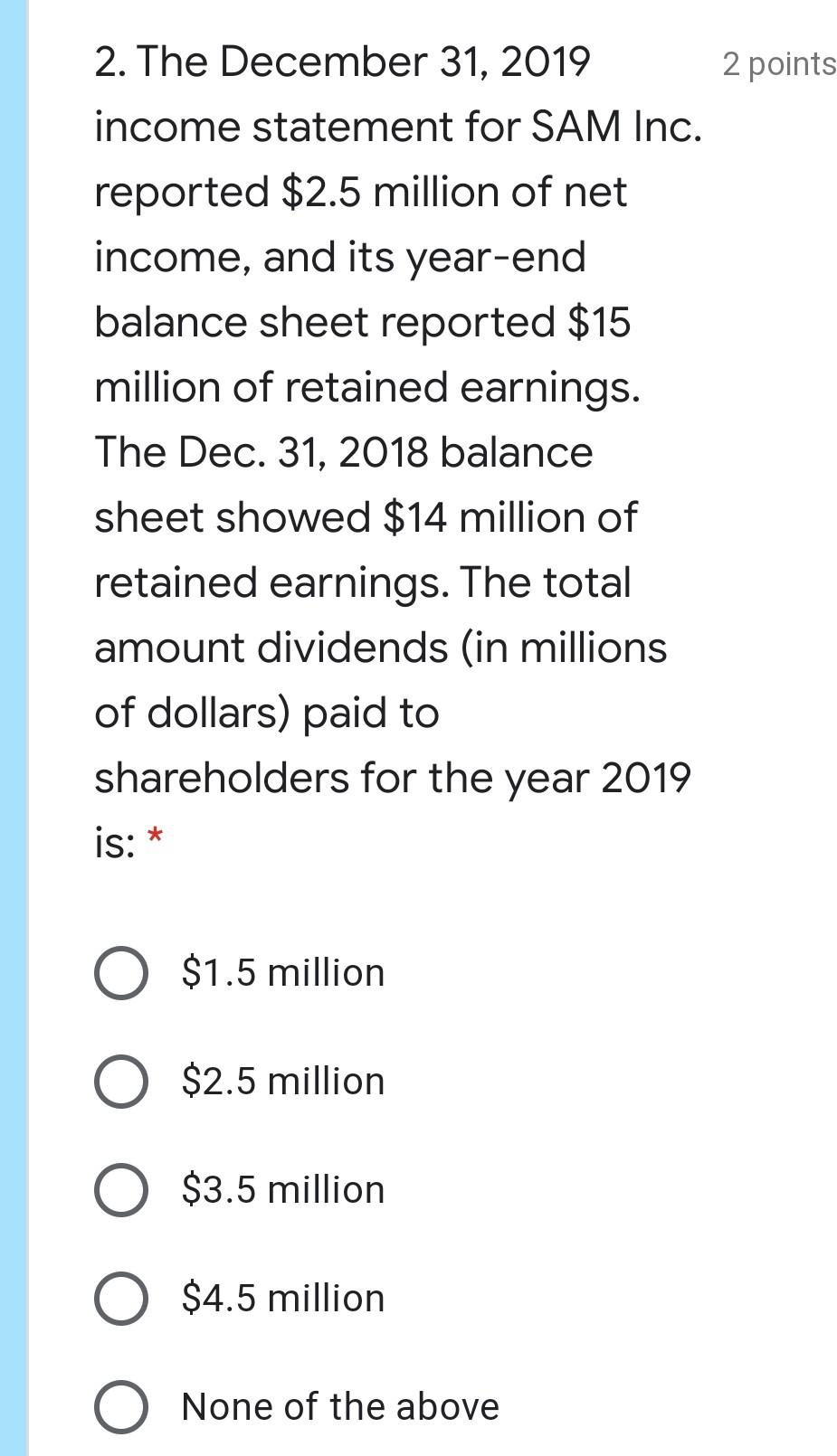

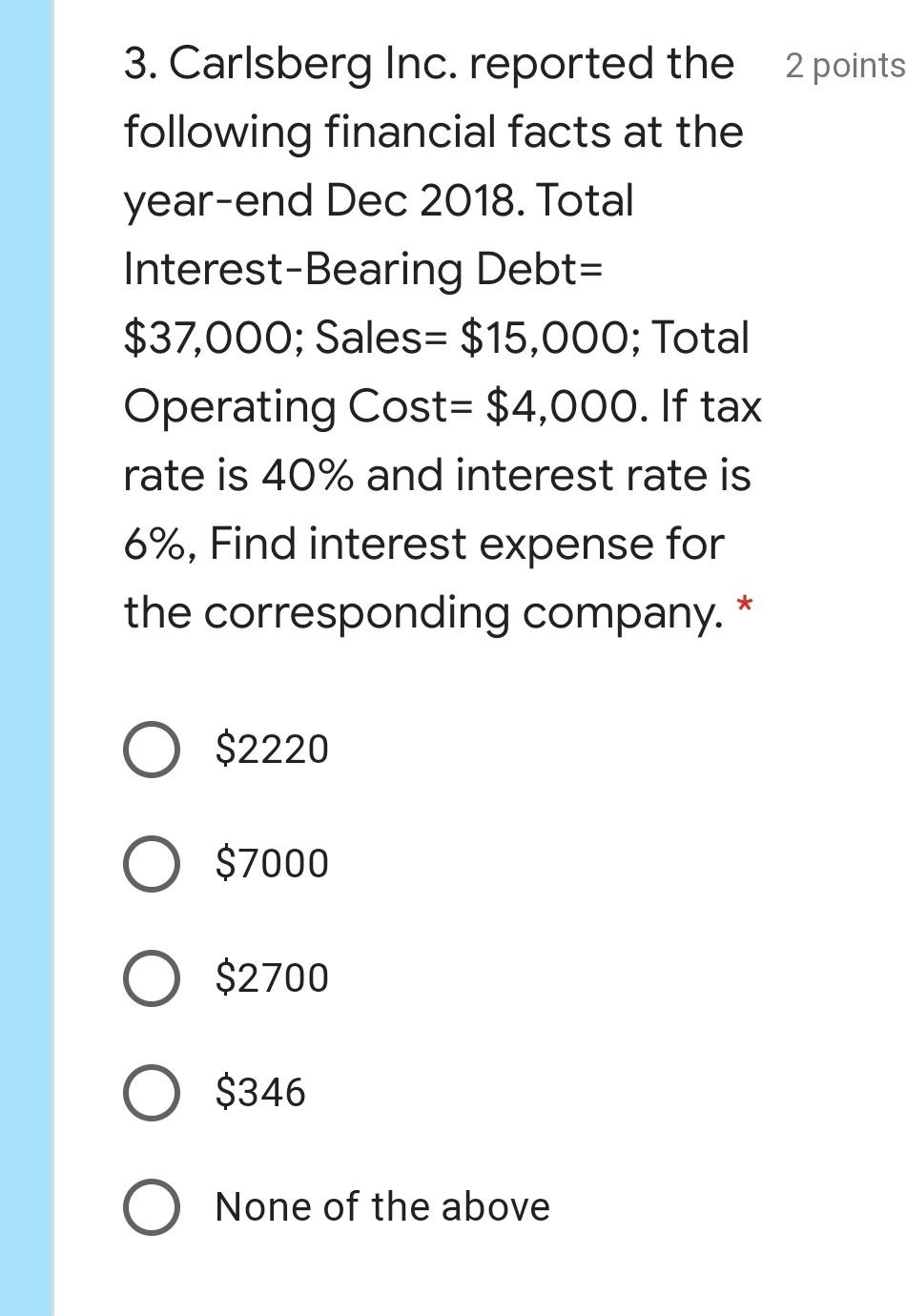

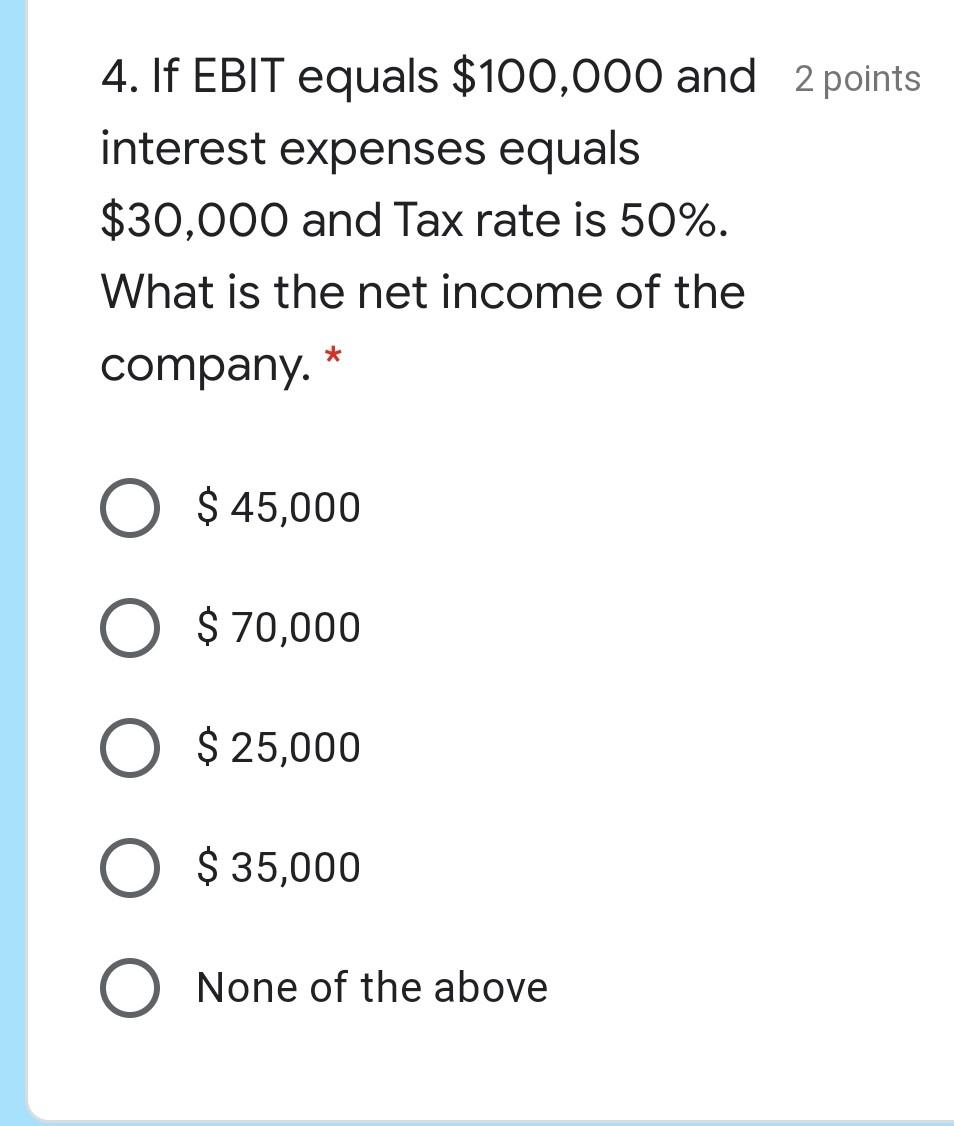

2 points 1. TSI Corporation has forecasted sales of $100,000, operating expenses excluding depreciation and amortization 40,000, depreciation and amortization 20,000, and net income 18,000. The company falls in the 40 percent tax bracket. The amount of interest expense for TSI Corporation is: * O $5,000 O $10,000 $25,000 O $40,000 O None of the above 2 points 2. The December 31, 2019 income statement for SAM Inc. reported $2.5 million of net income, and its year-end balance sheet reported $15 million of retained earnings. The Dec. 31, 2018 balance sheet showed $14 million of retained earnings. The total amount dividends (in millions of dollars) paid to shareholders for the year 2019 is: O $1.5 million O $2.5 million $3.5 million $4.5 million None of the above 2 points 3. Carlsberg Inc. reported the following financial facts at the year-end Dec 2018. Total Interest-Bearing Debt= $37,000; Sales= $15,000; Total Operating Cost= $4,000. If tax rate is 40% and interest rate is 6%, Find interest expense for the corresponding company. O $2220 O $7000 O $2700 O $346 None of the above 4. If EBIT equals $100,000 and 2 points interest expenses equals $30,000 and Tax rate is 50%. What is the net income of the * company. O $ 45,000 $ 70,000 O $ 25,000 $ 35,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started