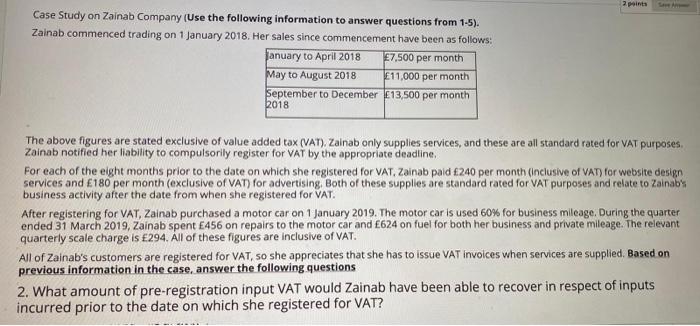

2 points Case Study on Zainab Company (Use the following information to answer questions from 1-5). Zainab commenced trading on 1 January 2018. Her sales since commencement have been as follows: january to April 2018 7,500 per month May to August 2018 E11,000 per month September to December 13,500 per month 2018 The above figures are stated exclusive of value added tax (VAT). Zainab only supplies services, and these are all standard rated for VAT purposes Zainab notified her liability to compulsorily register for VAT by the appropriate deadline, For each of the eight months prior to the date on which she registered for VAT, Zainab paid 240 per month (inclusive of VAT) for website design services and 180 per month (exclusive of VAT) for advertising Both of these supplies are standard rated for VAT purposes and relate to Zainab business activity after the date from when she registered for VAT. After registering for VAT, Zainab purchased a motor car on 1 January 2019. The motor car is used 60% for business mileage. During the quarter ended 31 March 2019, Zainab spent E456 on repairs to the motor car and 624 on fuel for both her business and private mileage. The relevant quarterly scale charge is 294. All of these figures are inclusive of VAT. All of Zainab's customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied. Based on previous information in the case, answer the following questions 2. What amount of pre-registration input VAT would Zainab have been able to recover in respect of inputs incurred prior to the date on which she registered for VAT? 2 points Case Study on Zainab Company (Use the following information to answer questions from 1-5). Zainab commenced trading on 1 January 2018. Her sales since commencement have been as follows: january to April 2018 7,500 per month May to August 2018 E11,000 per month September to December 13,500 per month 2018 The above figures are stated exclusive of value added tax (VAT). Zainab only supplies services, and these are all standard rated for VAT purposes Zainab notified her liability to compulsorily register for VAT by the appropriate deadline, For each of the eight months prior to the date on which she registered for VAT, Zainab paid 240 per month (inclusive of VAT) for website design services and 180 per month (exclusive of VAT) for advertising Both of these supplies are standard rated for VAT purposes and relate to Zainab business activity after the date from when she registered for VAT. After registering for VAT, Zainab purchased a motor car on 1 January 2019. The motor car is used 60% for business mileage. During the quarter ended 31 March 2019, Zainab spent E456 on repairs to the motor car and 624 on fuel for both her business and private mileage. The relevant quarterly scale charge is 294. All of these figures are inclusive of VAT. All of Zainab's customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied. Based on previous information in the case, answer the following questions 2. What amount of pre-registration input VAT would Zainab have been able to recover in respect of inputs incurred prior to the date on which she registered for VAT