Answered step by step

Verified Expert Solution

Question

1 Approved Answer

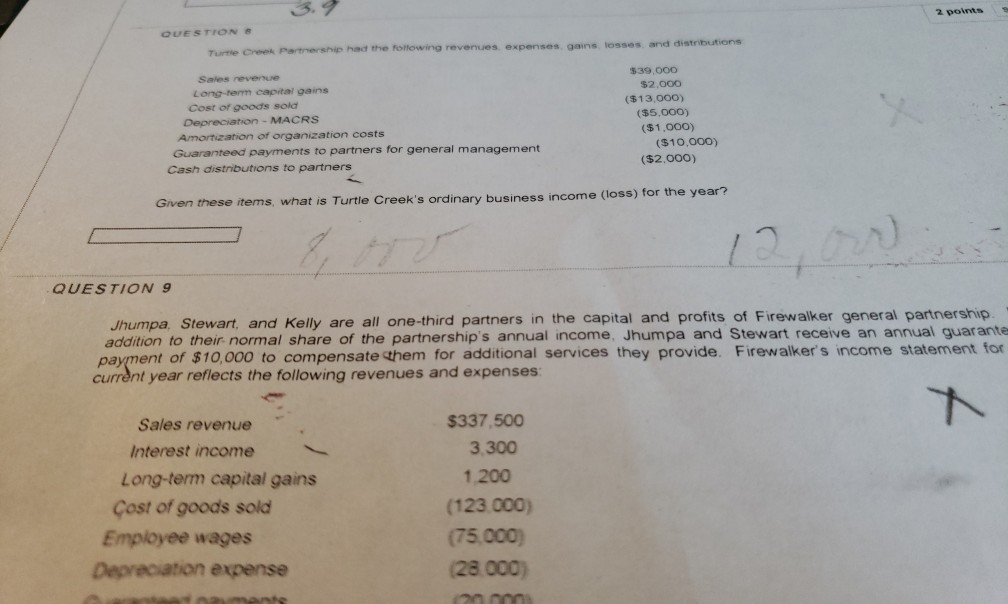

2 points QUESTIONe Turtle Creek $39,000 Long-term capital gains Cost of goods sold Depreciation MACRS $2,000 (313,000) (35,000) ($1,000) Amortization of organization costs Guaranteed payments

2 points QUESTIONe Turtle Creek $39,000 Long-term capital gains Cost of goods sold Depreciation MACRS $2,000 (313,000) (35,000) ($1,000) Amortization of organization costs Guaranteed payments to partners for general management ($10,000) ($2,000) Cash distributions to partners Given these items, what is Turtle Creek's ordinary business income (loss) for the yea r? QUESTION 9 Jhumpa. Stewart, and Kelly are all one-third partners in the capital and profits of Firewalker general partnership addition to their normal share of the partnership's annual income, Jhumpa and Stewart receive an annual guarante payment of $10,000 to compensate them for additional services they provide. Firewalker's income statement for t year reflects the following revenues and expenses: Sales revenue Interest income $337,500 3,300 1.200 (123 000) (75.000) (28 000) Long-term capital gains ost of goods sold Employee wages Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started