Answered step by step

Verified Expert Solution

Question

1 Approved Answer

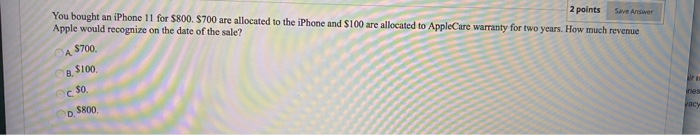

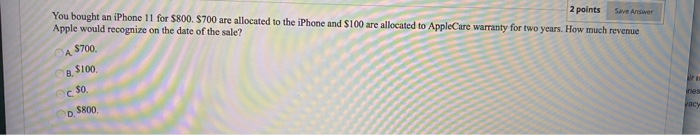

2 points You bought an iPhone 11 for $800. S700 are allocated to the iPhone and $100 are allocated to AppleCare warranty for two years.

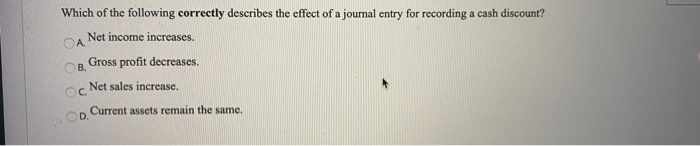

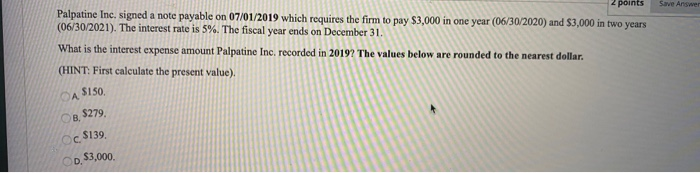

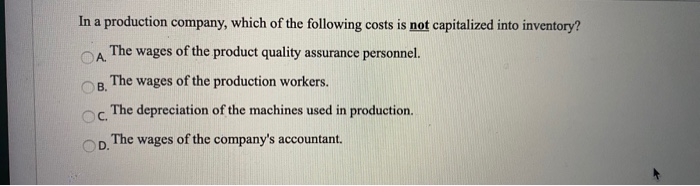

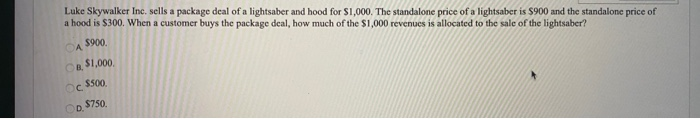

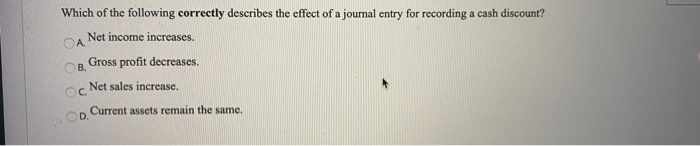

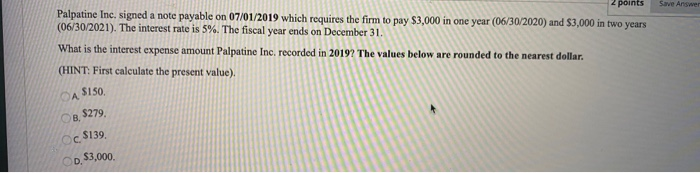

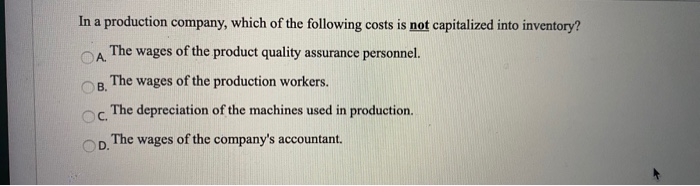

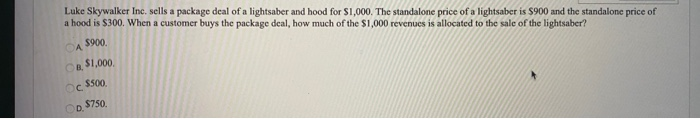

2 points You bought an iPhone 11 for $800. S700 are allocated to the iPhone and $100 are allocated to AppleCare warranty for two years. How much Apple would recognize on the date of the sale? $700 $100. $800 Which of the following correctly describes the effect of a journal entry for recording a cash discount? CANet income increases. B. Gross profit decreases. Net sales increase. p. Current assets remain the same. Palpatine Inc, signed a note payable on 07/01/2019 which requires the firm to pay $3,000 in one year (06/30/2020) and $3,000 in two years (06/30/2021). The interest rate is 5%. The fiscal year ends on December 31 What is the interest expense amount Palpatine Inc. recorded in 20192 The values below are rounded to the nearest dollar. (HINT: First calculate the present value) CA $150 8.5279 c $139, D. $3,000 In a production company, which of the following costs is not capitalized into inventory? The wages of the product quality assurance personnel. B. The wages of the production workers. The depreciation of the machines used in production. p. The wages of the company's accountant. Luke Skywalker Inc. sells a package deal of a lightsaber and hood for $1,000. The standalone price of a lightsaber is $900 and the standalone price of a hood is $300. When a customer buys the package deal, how much of the $1,000 revenues is allocated to the sale of the lightsaber? AS900. C. $1,000 c $500 D $750

2 points You bought an iPhone 11 for $800. S700 are allocated to the iPhone and $100 are allocated to AppleCare warranty for two years. How much Apple would recognize on the date of the sale? $700 $100. $800 Which of the following correctly describes the effect of a journal entry for recording a cash discount? CANet income increases. B. Gross profit decreases. Net sales increase. p. Current assets remain the same. Palpatine Inc, signed a note payable on 07/01/2019 which requires the firm to pay $3,000 in one year (06/30/2020) and $3,000 in two years (06/30/2021). The interest rate is 5%. The fiscal year ends on December 31 What is the interest expense amount Palpatine Inc. recorded in 20192 The values below are rounded to the nearest dollar. (HINT: First calculate the present value) CA $150 8.5279 c $139, D. $3,000 In a production company, which of the following costs is not capitalized into inventory? The wages of the product quality assurance personnel. B. The wages of the production workers. The depreciation of the machines used in production. p. The wages of the company's accountant. Luke Skywalker Inc. sells a package deal of a lightsaber and hood for $1,000. The standalone price of a lightsaber is $900 and the standalone price of a hood is $300. When a customer buys the package deal, how much of the $1,000 revenues is allocated to the sale of the lightsaber? AS900. C. $1,000 c $500 D $750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started