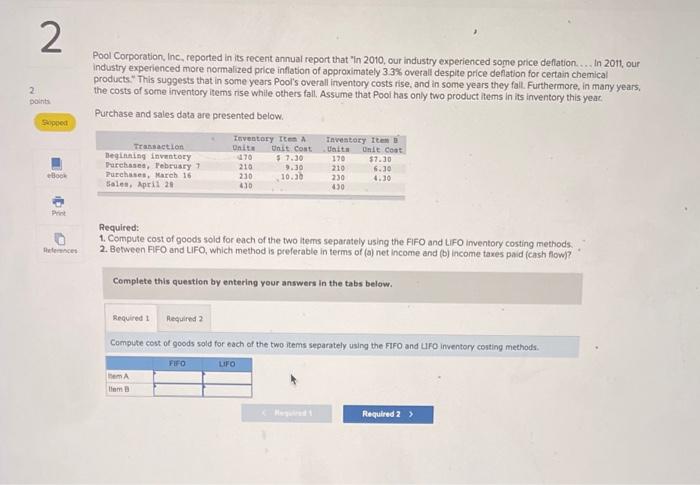

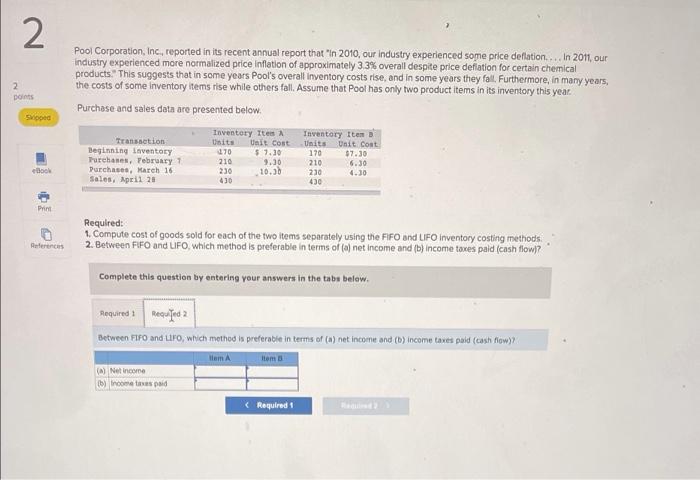

2 Pool Corporation, Inc. reported in its recent annual report that "in 2010, our industry experienced some price deftation... In 2011, our Industry experienced more normalized price inflation of approximately 33% overall despite price deflation for certain chemical products. This suggests that in some years Pool's overall inventory costs rise, and in some years they fall. Furthermore, in many years, the costs of some inventory items rise while others fall, Assume that Pool has only two product items in its inventory this year. Purchase and sales data are presented below. 2 points Speed Laventory Item Unite Unit Cost 470 $ 7.30 210 230 10.30 430 Inventory Item Units Unit cost 170 $7.30 Transaction Beginning inventory Purchases, February 1 Purchases, March 16 Sales, April 20 210 6.30 Bot 230 20 6.30 Required: 1. Compute cost of goods sold for each of the two items separately using the FIFO and LIFO inventory costing methods 2. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow? Defence Complete this question by entering your answers in the tabs below. Required t Required 2 Compute cost of goods sold for each of the two tema separately using the FIFO and Liro Inventory costing methods. FIFO LIFO tem tam Required 2 2 2 points Swood Pool Corporation, Inc, reported in its recent annual report that "in 2010, our industry experienced some price deflation. In 2011, our industry experienced more normalized price inflation of approximately 3.3% overall despite price defiation for certain chemical products. This suggests that in some years Pool's overall inventory costs rise, and in some years they fall. Furthermore, in many years, the costs of some inventory items rise while others fall. Assume that Pool has only two product items in its inventory this year. Purchase and sales data are presented below, Inventory Ites Inventory Iten Transaction Units Unit Cost Units Unit Cont Beginning inventory $ 3.30 170 $7.30 Turchases, Yebruary 1 210 9.30 210 6.30 Purchases, March 16 230 10.30 210 Sales, April 28 430 430 110 Book P Required: 1. Compute cost of goods sold for each of the two items separately using the FIFO and LIFO Inventory costing methods 2. Between FIFO and LIFO, which method is preferable in terms of (a) net Income and (b) income taxes paid (cash flowi? Complete this question by entering your answers in the tabs below. Required: Reqwed 2 Between FIFO and uro, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow? am A Items (A) Net income o nowe paid