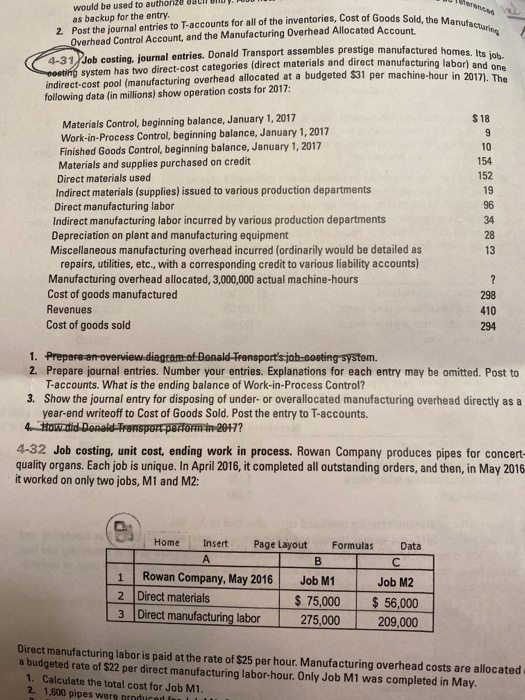

2. Post the journal entries to T-accounts for all of the inventories, Cost of Goods Sold, the Maruta cu would be used to authorized as backup for the entry. Overhead Control Account, and the Manufacturing Overhead Allocated 4-31 Job costing, journal entries. Donald Transport assembles prestige manufactured homes. Its job. indirect-cost pool (manufacturing overhead allocated at a budgeted $31 per machine-hour in 2017). The following data (in millions) show operation costs for 2017: Materials Control, beginning balance, January 1, 2017 Work-in-Process Control, beginning balance, January 1, 2017 Finished Goods Control, beginning balance, January 1, 2017 Materials and supplies purchased on credit Direct materials used Indirect materials (supplies) issued to various production departments Direct manufacturing labor Indirect manufacturing labor incurred by various production departments Depreciation on plant and manufacturing equipment Miscellaneous manufacturing overhead incurred (ordinarily would be detailed as repairs, utilities, etc., with a corresponding credit to various liability accounts) Manufacturing overhead allocated, 3,000,000 actual machine-hours Cost of goods manufactured Revenues Cost of goods sold $18 9 10 154 152 19 96 34 28 13 ? 298 410 294 1. Prepare an overview diagram of Donald Transport's job-costing system. 2. Prepare journal entries. Number your entries. Explanations for each entry may be omitted. Post to T-accounts. What is the ending balance of Work-in-Process Control? 3. Show the journal entry for disposing of under-or overallocated manufacturing overhead directly as a year-end writeoff to Cost of Goods Sold. Post the entry to T-accounts. 4. How did Donald Transport perform in 2017? 4-32 Job costing, unit cost, ending work in process. Rowan Company produces pipes for concert- quality organs. Each job is unique. In April 2016, it completed all outstanding orders, and then, in May 2016 it worked on only twojobs, M1 and M2: Home Insert Page Layout Formulas Data B C 1 Rowan Company, May 2016 Job M1 Job M2 2 Direct materials $ 75,000 $ 56,000 3 Direct manufacturing labor 275,000 209,000 Direct manufacturing labor is paid at the rate of $25 per hour. Manufacturing overhead costs are allocated a budgeted rate of $22 per direct manufacturing labor-hour. Only Job M1 was completed in May. 1. Calculate the total cost for Job Mi. 2 1,600 pipes were produced