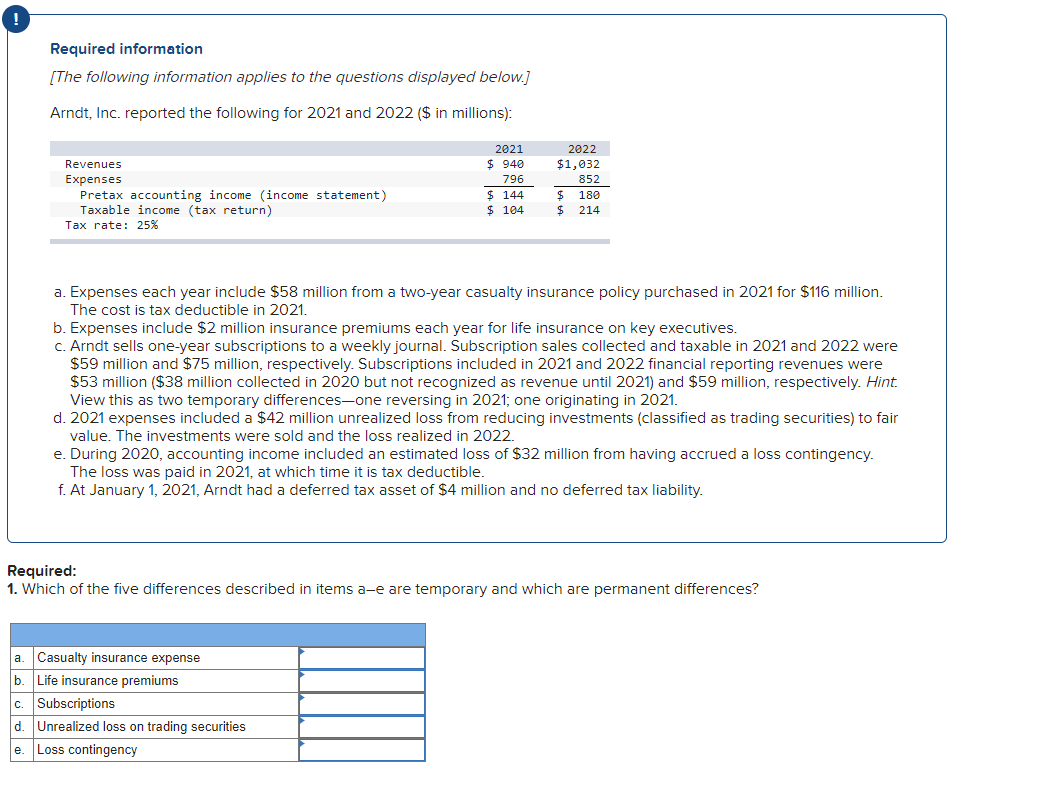

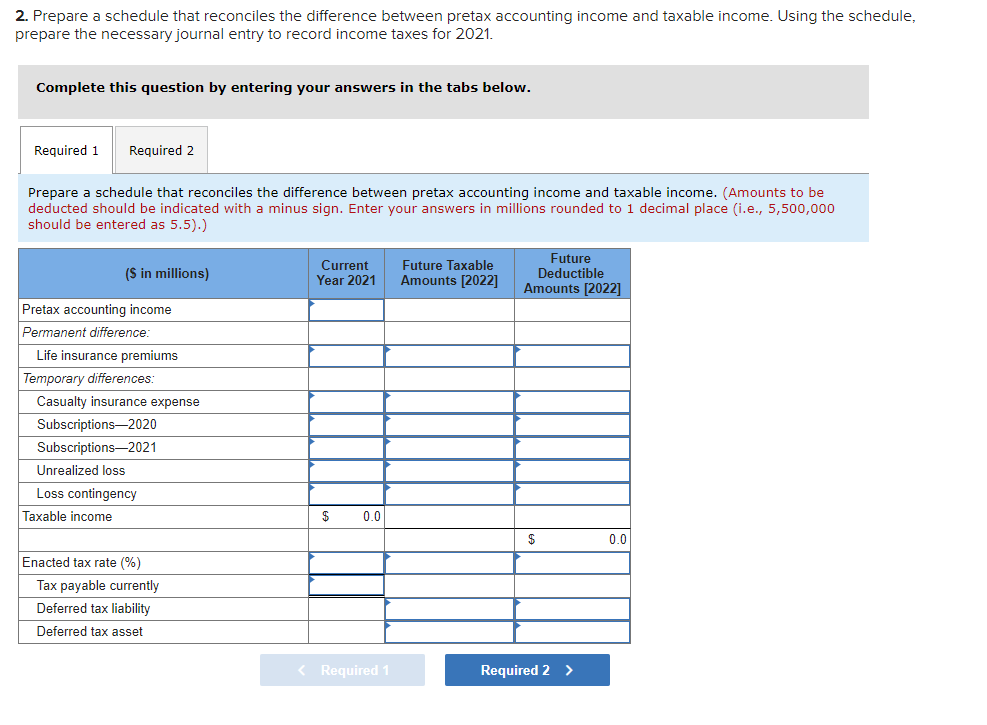

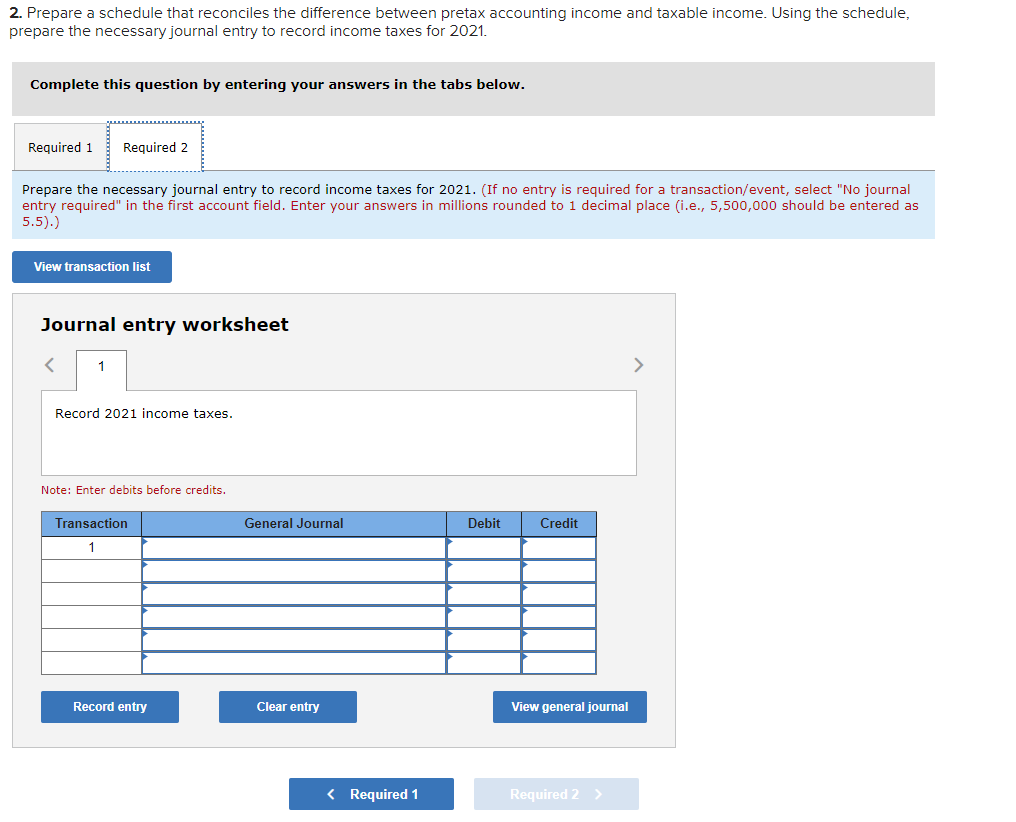

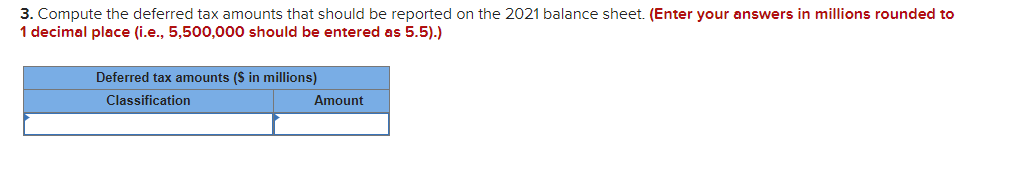

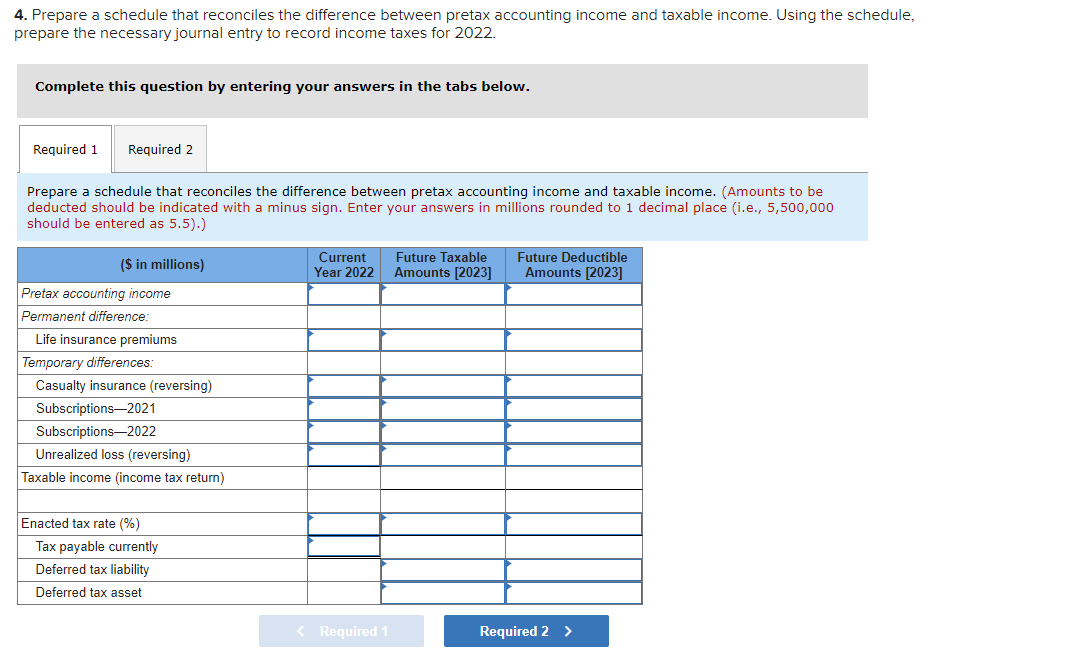

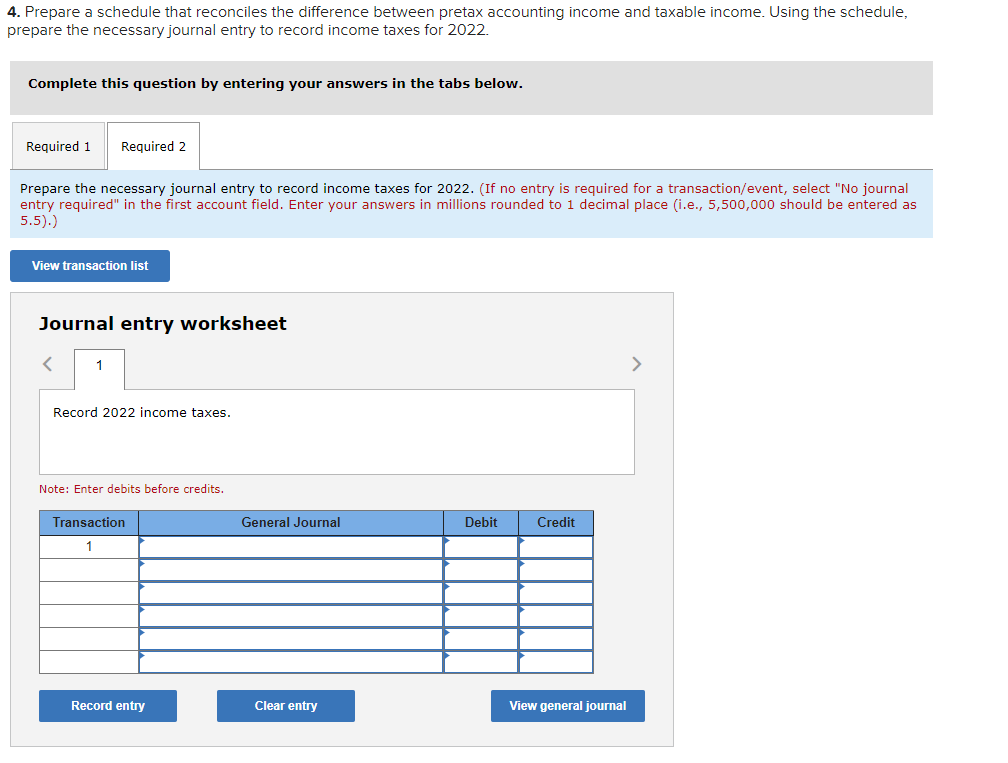

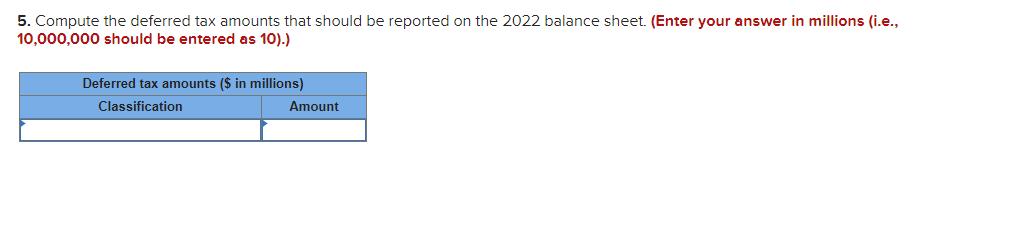

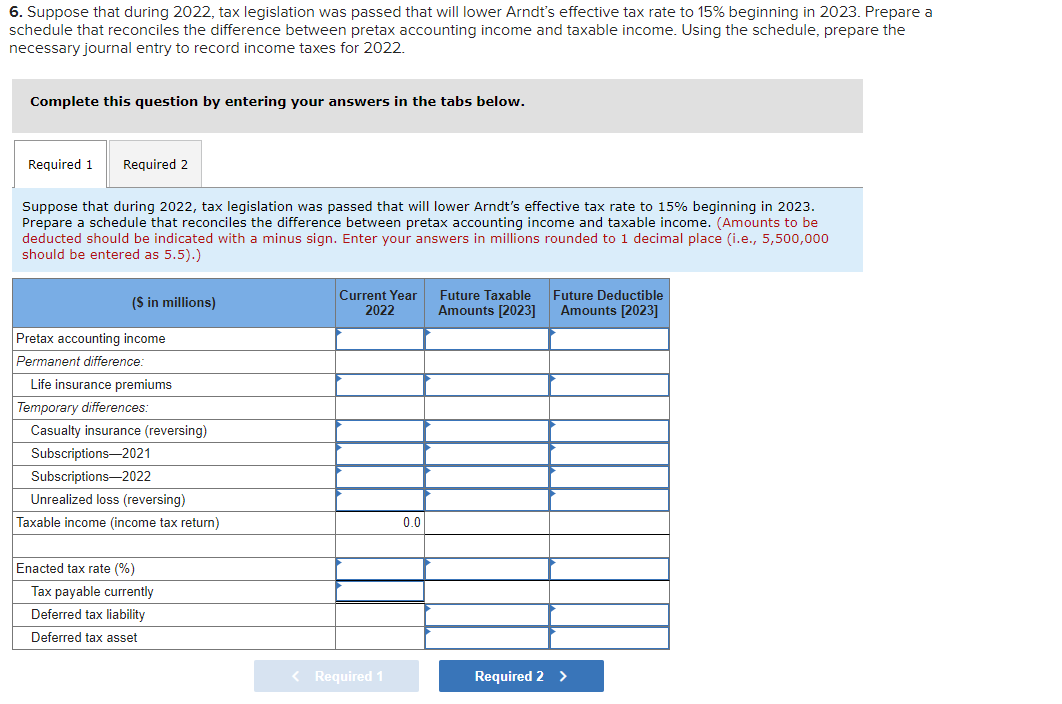

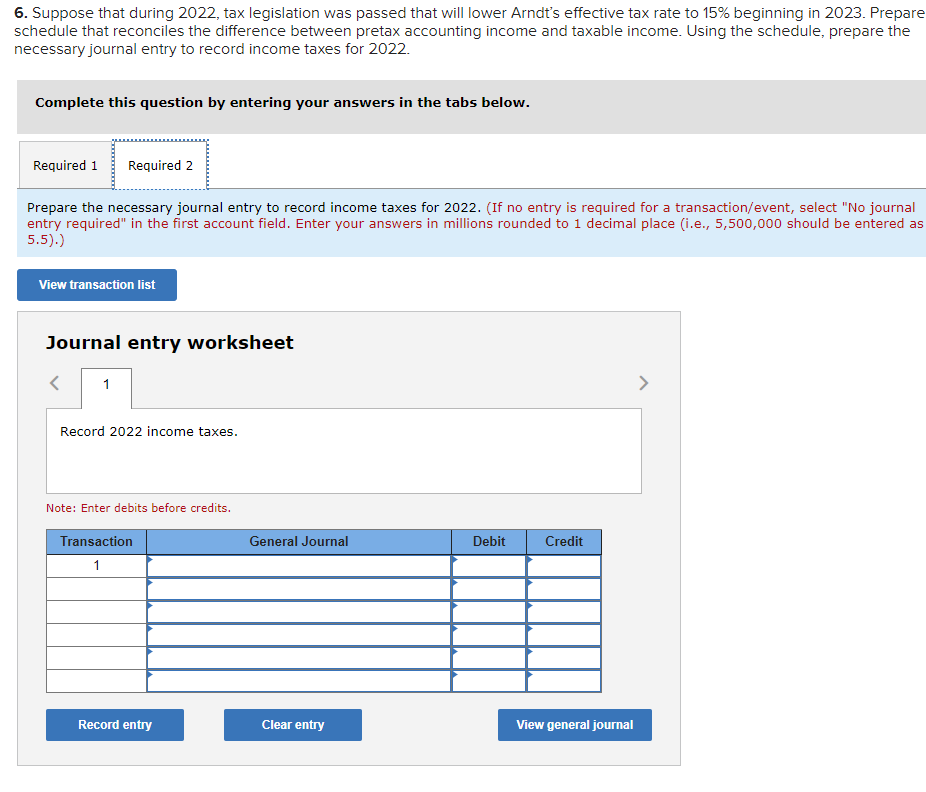

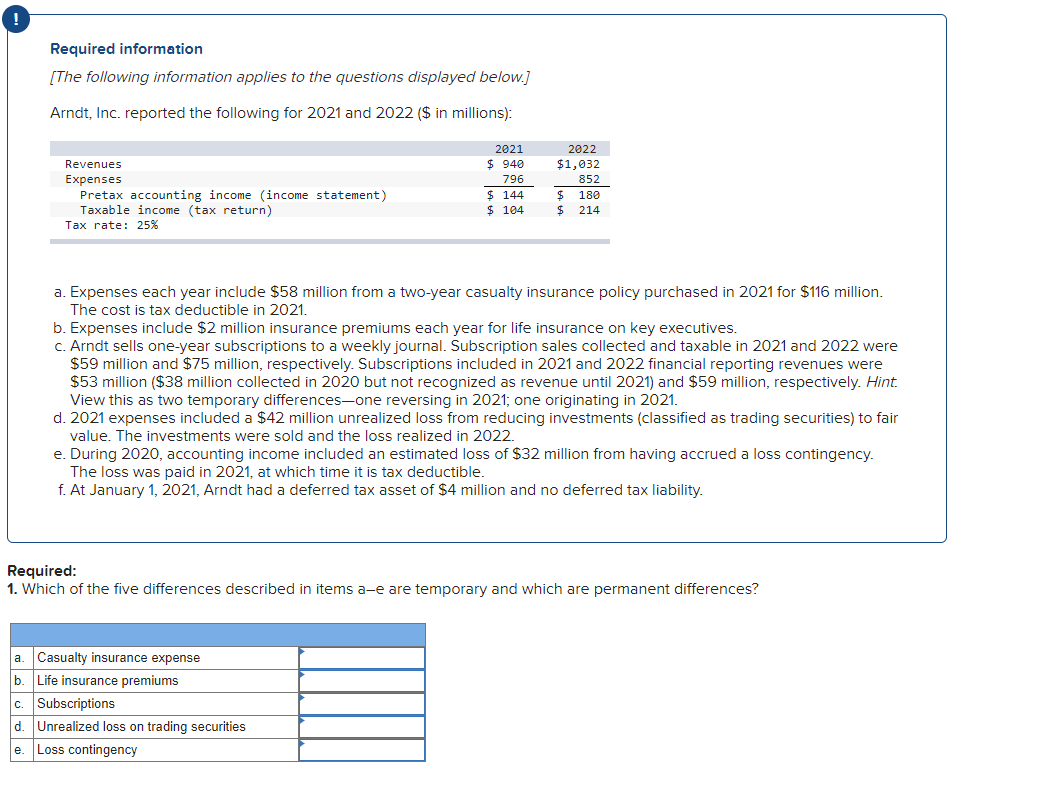

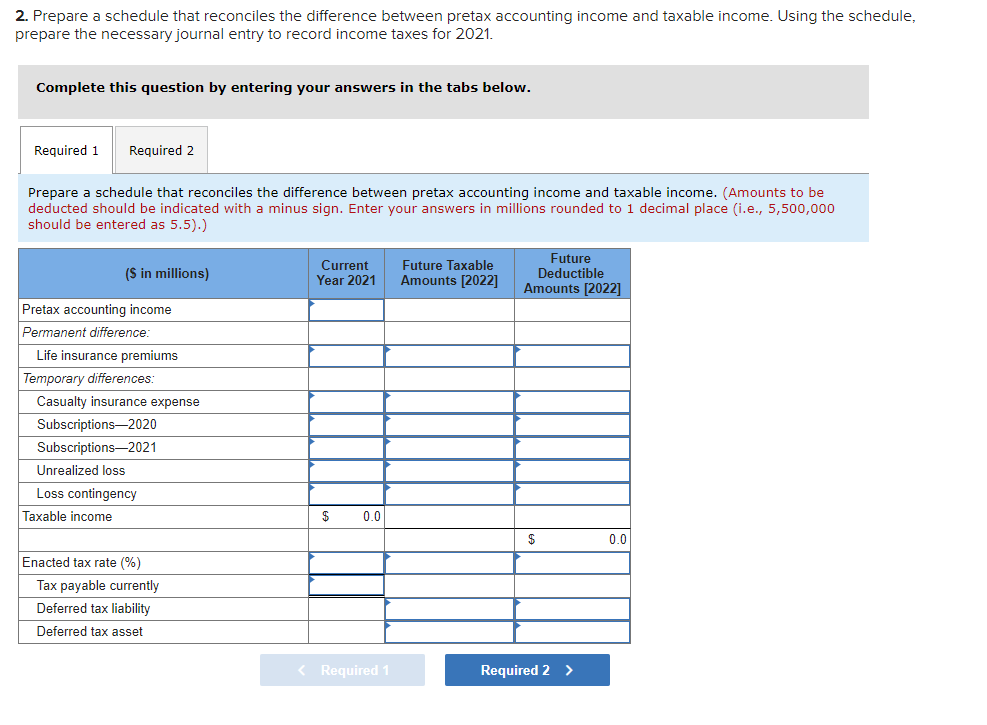

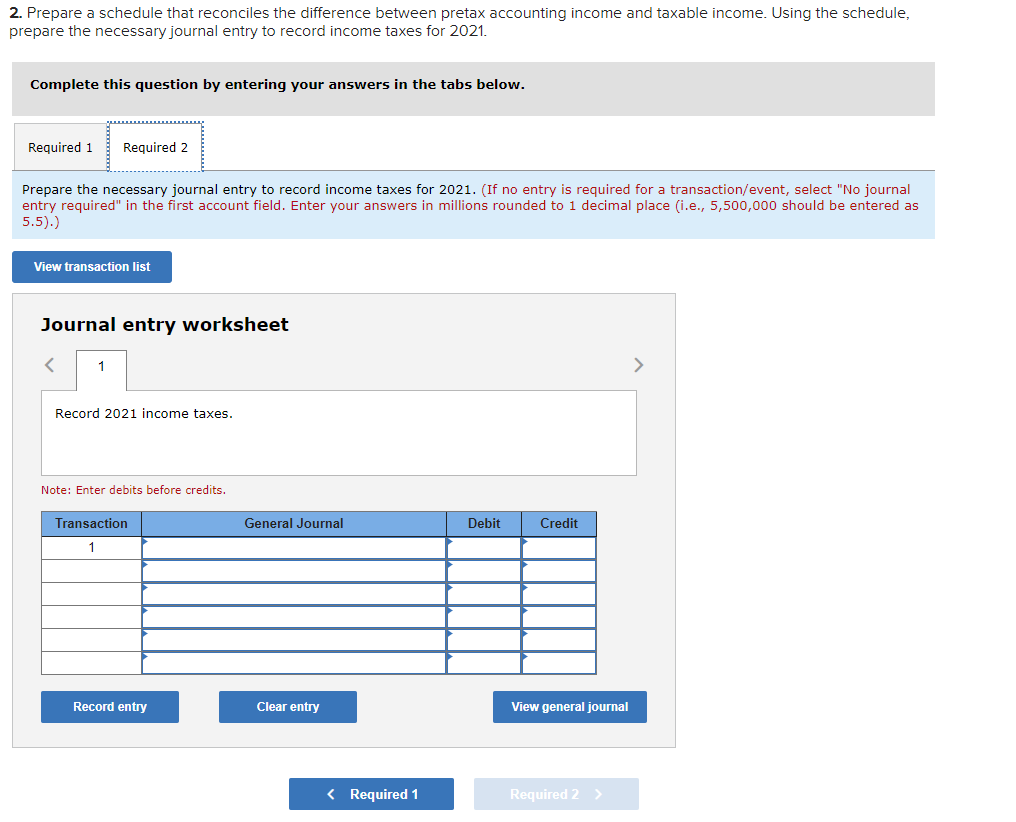

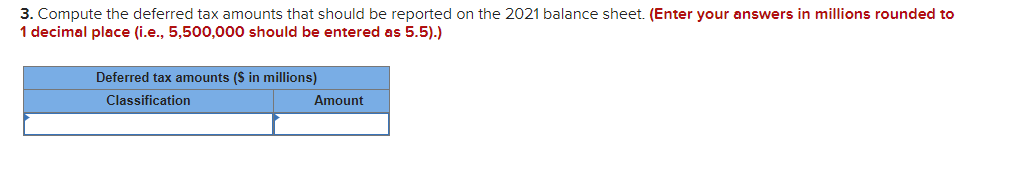

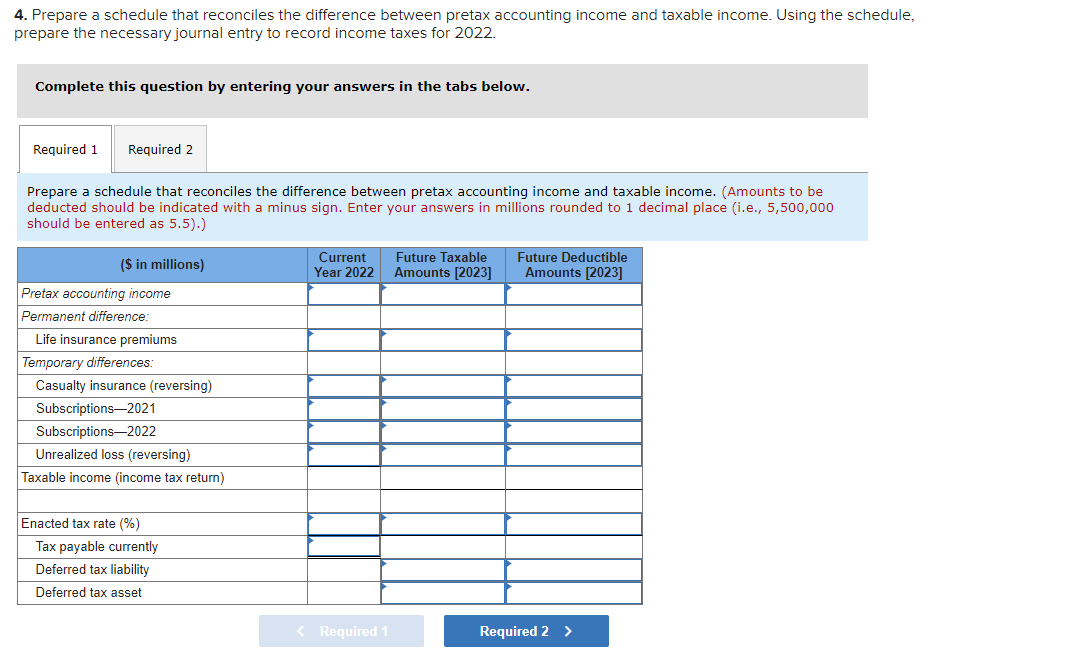

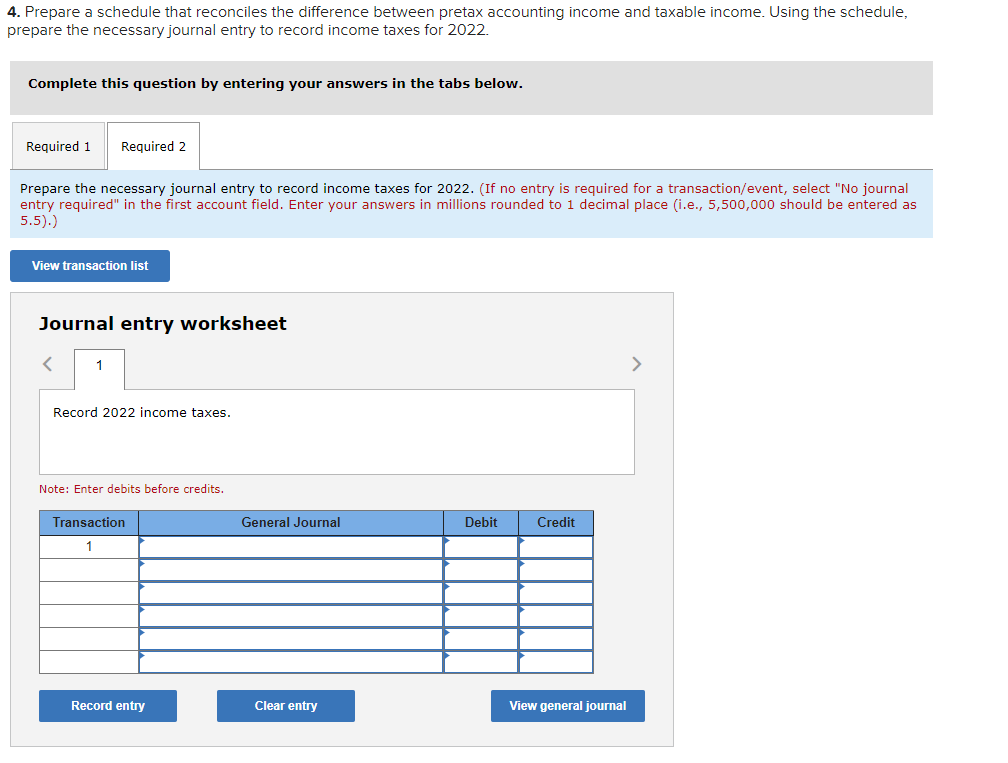

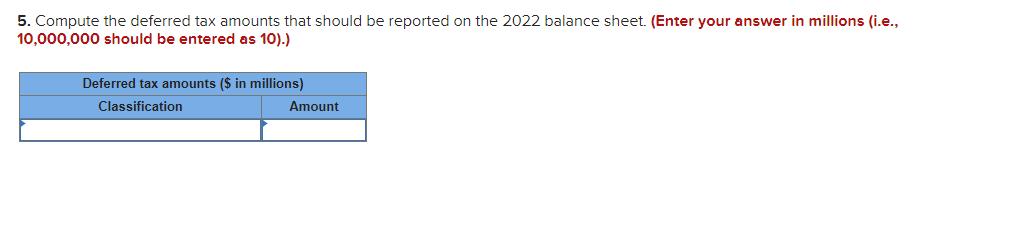

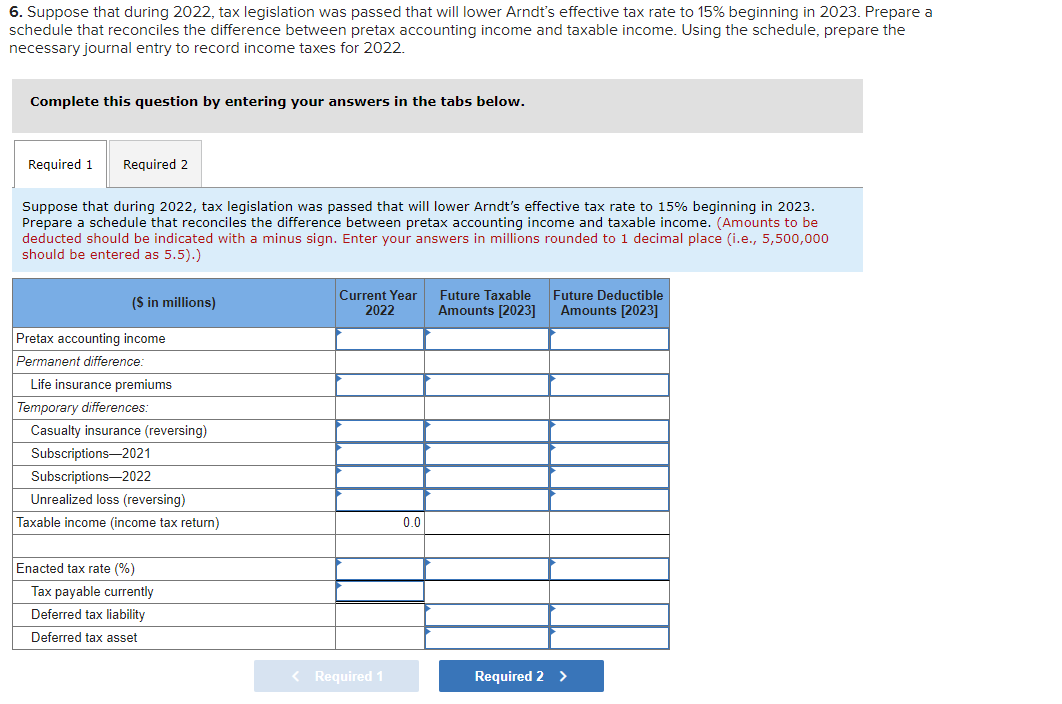

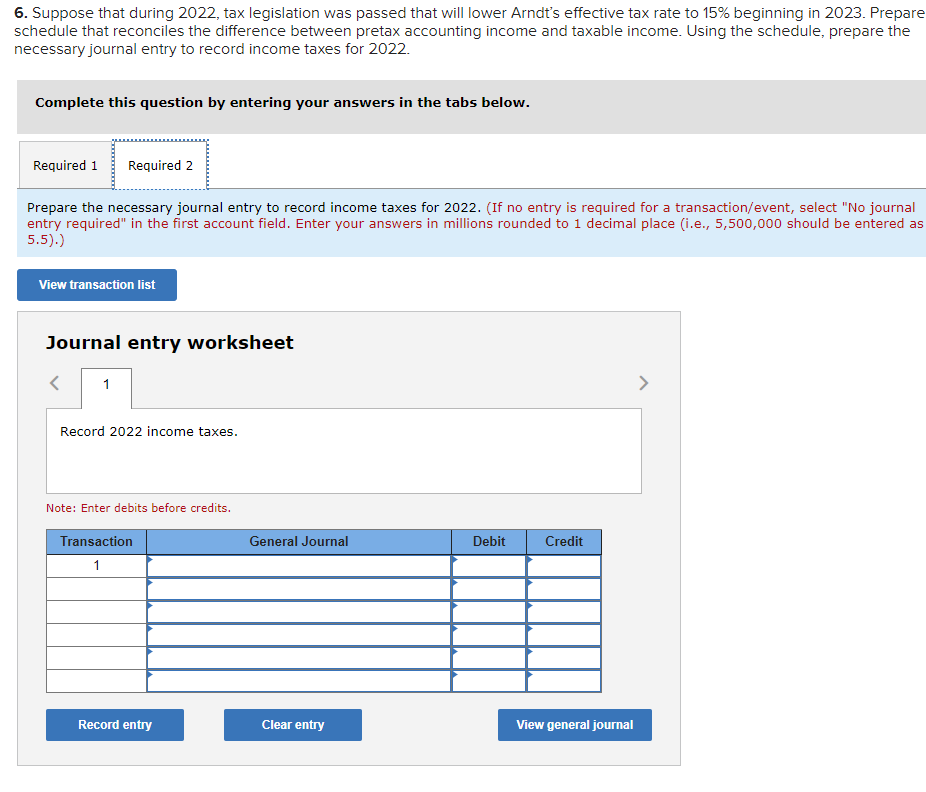

2. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the necessary journal entry to record income taxes for 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) ($ in millions) Current Year 2021 Future Taxable Amounts [2022] Future Deductible Amounts [2022] Pretax accounting income Permanent difference: Life insurance premiums Temporary differences: Casualty insurance expense Subscriptions2020 Subscriptions2021 Unrealized loss Loss contingency Taxable income $ 0.0 $ 0.0 Enacted tax rate (%) Tax payable currently Deferred tax liability Deferred tax asset 2. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the necessary journal entry to record income taxes for 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the necessary journal entry to record income taxes for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal 3. Compute the deferred tax amounts that should be reported on the 2021 balance sheet. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Deferred tax amounts ($ in millions) Classification Amount 4. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the necessary journal entry to record income taxes for 2022. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) ($ in millions) Current Year 2022 Future Taxable Amounts [2023] Future Deductible Amounts [2023] Pretax accounting income Permanent difference: Life insurance premiums Temporary differences: Casualty insurance (reversing) Subscriptions2021 Subscriptions2022 Unrealized loss (reversing) Taxable income (income tax return) Enacted tax rate (%) Tax payable currently Deferred tax liability Deferred tax asset the 2022 balance sheet. (Enter your answer in millions (i.e., 5. Compute the deferred tax amounts that should be reported 10,000,000 should be entered as 10).) Deferred tax amounts ($ in millions) Classification Amount 6. Suppose that during 2022, tax legislation was passed that will lower Arndt's effective tax rate to 15% beginning in 2023. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the necessary journal entry to record income taxes for 2022. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Suppose that during 2022, tax legislation was passed that will lower Arndt's effective tax rate to 15% beginning in 2023. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) (S in millions) Current Year 2022 Future Taxable Amounts [2023] Future Deductible Amounts [2023] Pretax accounting income Permanent difference: Life insurance premiums Temporary differences: Casualty insurance (reversing) Subscriptions2021 Subscriptions2022 Unrealized loss (reversing) Taxable income (income tax return) 0.0 Enacted tax rate (%) Tax payable currently Deferred tax liability Deferred tax asset 6. Suppose that during 2022, tax legislation was passed that will lower Arndt's effective tax rate to 15% beginning in 2023. Prepare schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the necessary journal entry to record income taxes for 2022. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the necessary journal entry to record income taxes for 2022. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet 1 > Record 2022 income taxes. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journal