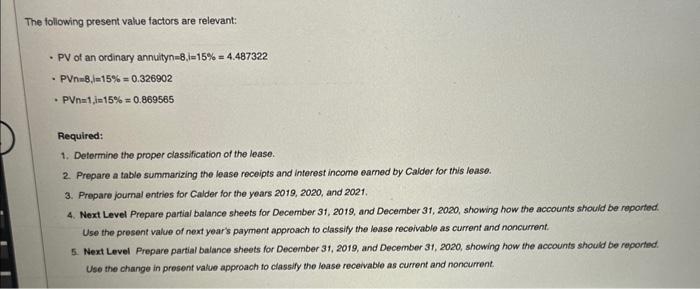

2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease.

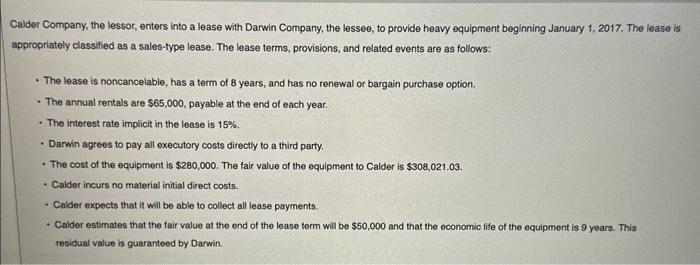

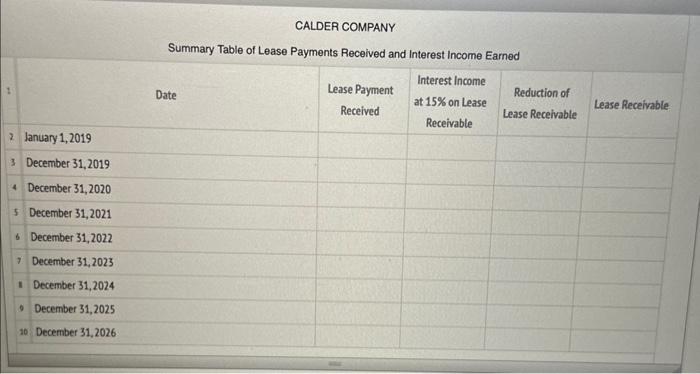

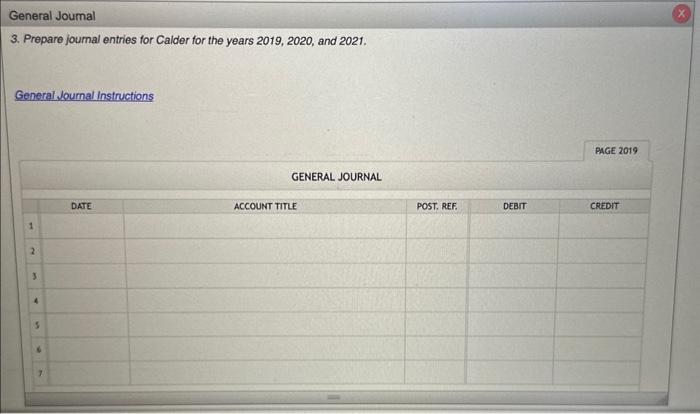

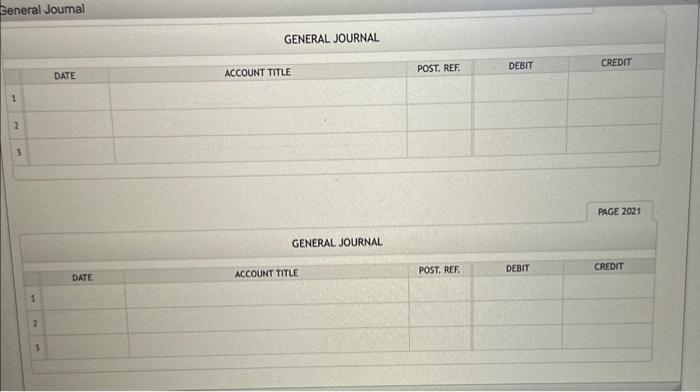

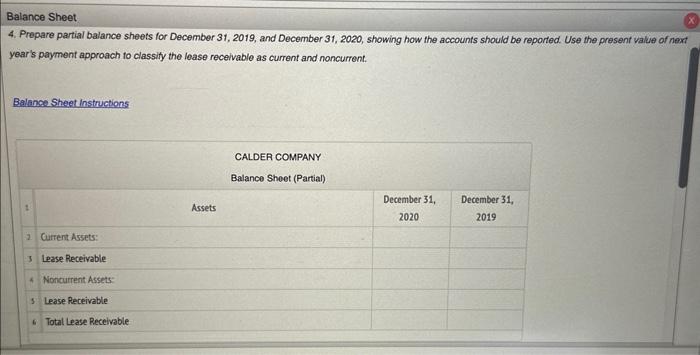

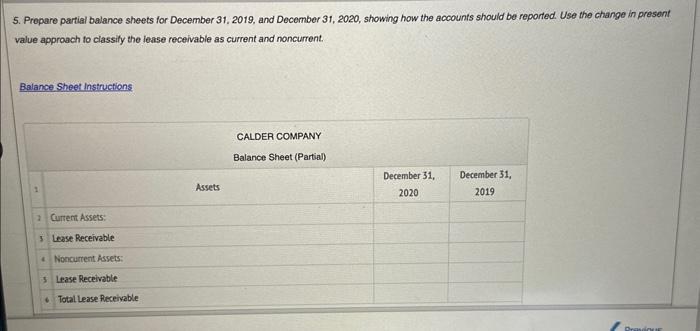

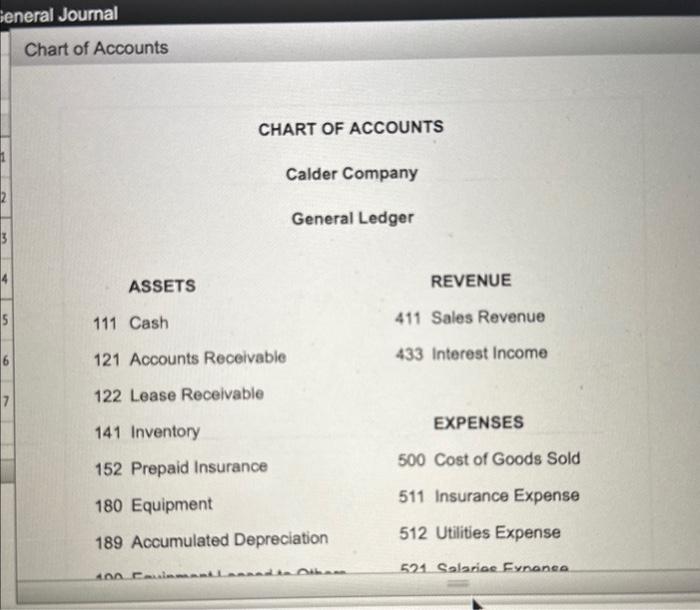

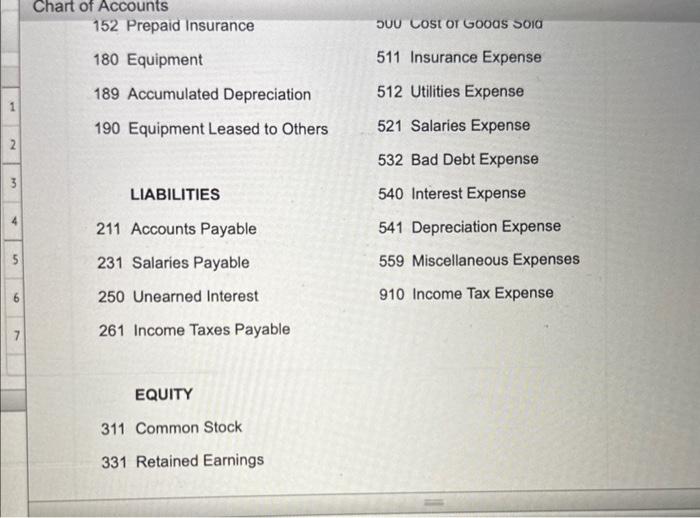

Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: - The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. - The annual rentals are $65,000, payable at the end of each year. - The interest rate implicit in the lease is 15%. - Darwin agrees to pay all executory costs directly to a third party. - The cost of the equipment is $280,000. The fair value of the equipment to Calder is $308,021.03. - Calder incurs no material initial direct costs. - Calder expects that it will be able to collect all lease payments. - Caider estimates that the fair value at the end of the lease term will be $50,000 and that the economic life of the equipment is 9 years. This residual value is guaranteed by Darwin. following present value factors are relevant: - PV of an ordinary annuityn =8,i=15%=4.487322 - PVn=8,1=15%=0.326902 - PVn=1,i=15%=0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income eamed by Calder for this lease. 3. Prepare journal entries for Calder for the yoars 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next year's payment approach to classily the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reporied. Use the change in present value approach fo classily the lease receivable as current and noncurrent. Summary Table of Lease Payments Received and Interest Income Eamed 3. Prepare joumal entries for Calder for the years 2019, 2020, and 2021. General Journal instructions GENERAL JOURNAL 4. Prepare partial balance sheets for December 31, 2019, and December 31,2020 , showing how the accounts should be reported. Use the present valie of neat year's payment approach to classity the lease receivable as current and noncurrent. Balance Sheat instructions 5. Prepare partial balance sheets for December 31,2019, and December 31,2020 , showing how the accounts should be reported. Use the change in present value approach to classily the lease receivable as current and noncurrent. Chart of Accounts CHART OF ACCOUNTS Calder Company General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivabie 433 Interest Income 122 Lease Recelvable 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 180 Equipment 511 Insurance Expense 189 Accumulated Depreciation 512 Utilities Expense 521 Salariec Fynanea Chart of Accounts 152 Prepaid Insurance JuU Cost or Gooas Sola 180 Equipment 511 Insurance Expense 189 Accumulated Depreciation 512 Utilities Expense 190 Equipment Leased to Others 521 Salaries Expense 532 Bad Debt Expense LIABILITIES 540 Interest Expense 211 Accounts Payable 541 Depreciation Expense 231 Salaries Payable 559 Miscellaneous Expenses 250 Unearned Interest 910 Income Tax Expense 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: - The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. - The annual rentals are $65,000, payable at the end of each year. - The interest rate implicit in the lease is 15%. - Darwin agrees to pay all executory costs directly to a third party. - The cost of the equipment is $280,000. The fair value of the equipment to Calder is $308,021.03. - Calder incurs no material initial direct costs. - Calder expects that it will be able to collect all lease payments. - Caider estimates that the fair value at the end of the lease term will be $50,000 and that the economic life of the equipment is 9 years. This residual value is guaranteed by Darwin. following present value factors are relevant: - PV of an ordinary annuityn =8,i=15%=4.487322 - PVn=8,1=15%=0.326902 - PVn=1,i=15%=0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income eamed by Calder for this lease. 3. Prepare journal entries for Calder for the yoars 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next year's payment approach to classily the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reporied. Use the change in present value approach fo classily the lease receivable as current and noncurrent. Summary Table of Lease Payments Received and Interest Income Eamed 3. Prepare joumal entries for Calder for the years 2019, 2020, and 2021. General Journal instructions GENERAL JOURNAL 4. Prepare partial balance sheets for December 31, 2019, and December 31,2020 , showing how the accounts should be reported. Use the present valie of neat year's payment approach to classity the lease receivable as current and noncurrent. Balance Sheat instructions 5. Prepare partial balance sheets for December 31,2019, and December 31,2020 , showing how the accounts should be reported. Use the change in present value approach to classily the lease receivable as current and noncurrent. Chart of Accounts CHART OF ACCOUNTS Calder Company General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivabie 433 Interest Income 122 Lease Recelvable 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 180 Equipment 511 Insurance Expense 189 Accumulated Depreciation 512 Utilities Expense 521 Salariec Fynanea Chart of Accounts 152 Prepaid Insurance JuU Cost or Gooas Sola 180 Equipment 511 Insurance Expense 189 Accumulated Depreciation 512 Utilities Expense 190 Equipment Leased to Others 521 Salaries Expense 532 Bad Debt Expense LIABILITIES 540 Interest Expense 211 Accounts Payable 541 Depreciation Expense 231 Salaries Payable 559 Miscellaneous Expenses 250 Unearned Interest 910 Income Tax Expense 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings