Answered step by step

Verified Expert Solution

Question

1 Approved Answer

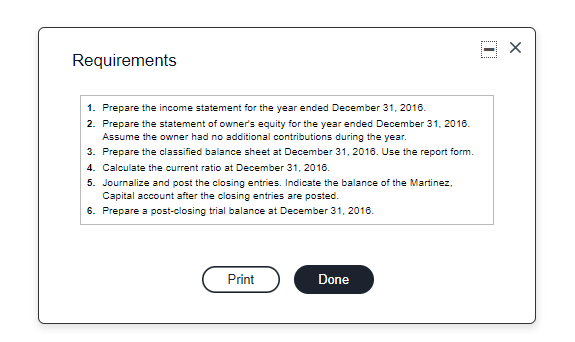

2. Prepare the statement of owner's equity for the year ended December 31, 2016. Assume the owner had no additional contributions during the year. 3.

2. Prepare the statement of owner's equity for the year ended December 31, 2016. Assume the owner had no additional contributions during the year.

3. Prepare the classified balance sheet at December 31, 2016. Use the report form.

4. Calculate the current ratio at December 31, 2016.

5. Journalize and post the closing entries. Indicate the balance of the Martinez, Capital account after the closing entries are posted.

6. Prepare a post-closing trial balance at December 31, 2016.

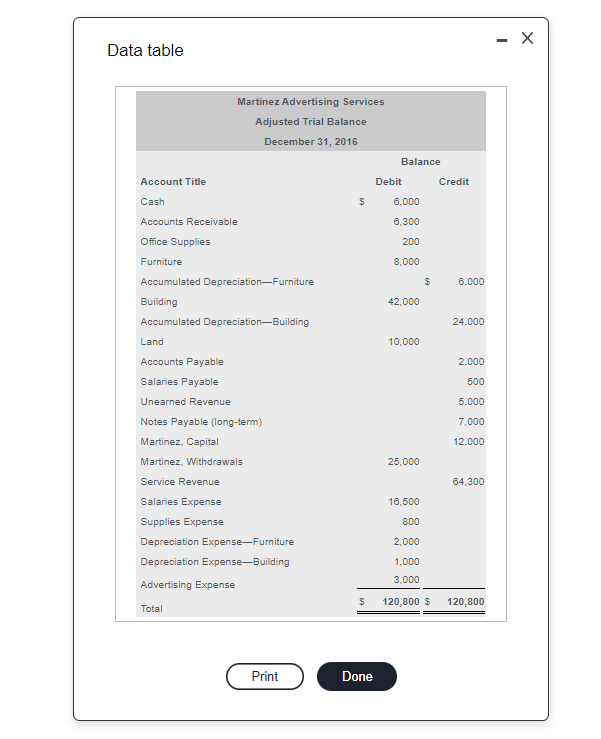

- X Data table Martinez Advertising Services Adjusted Trial Balance December 31, 2016 Balance Account Title Debit Credit Cash $ 6.000 Accounts Receivable 6.300 Office Supplies 200 Furniture 8.000 Accumulated Depreciation Furniture $ 6,000 Building 42.000 Accumulated DepreciationBuilding 24,000 Land 10,000 Accounts Payable 2.000 Salaries Payable 500 Unearned Revenue 5,000 Notes Payable (long-term) 7.000 Martinez, Capital 12.000 Martinez, Withdrawals 25.000 Service Revenue 64,300 Salaries Expense 16.500 800 Supplies Expense Depreciation Expense-Furniture Depreciation ExpenseBuilding 2.000 1.000 3.000 Advertising Expense $ Total 120,800 120,800 $ Print Done - Requirements 1. Prepare the income statement for the year ended December 31, 2016 2. Prepare the statement of owner's equity for the year ended December 31, 2016. Assume the owner had no additional contributions during the year. 3. Prepare the classified balance sheet at December 31, 2016. Use the report form. 4. Calculate the current ratio at December 31, 2016. 5. Journalize and post the closing entries. Indicate the balance of the Martinez, Capital account after the closing entries are posted. 6. Prepare a post-closing trial balance at December 31, 2016. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started