Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Present Value of a Single Sum a. Springfield wishes to match a state investment in a solar farm in four years. In order

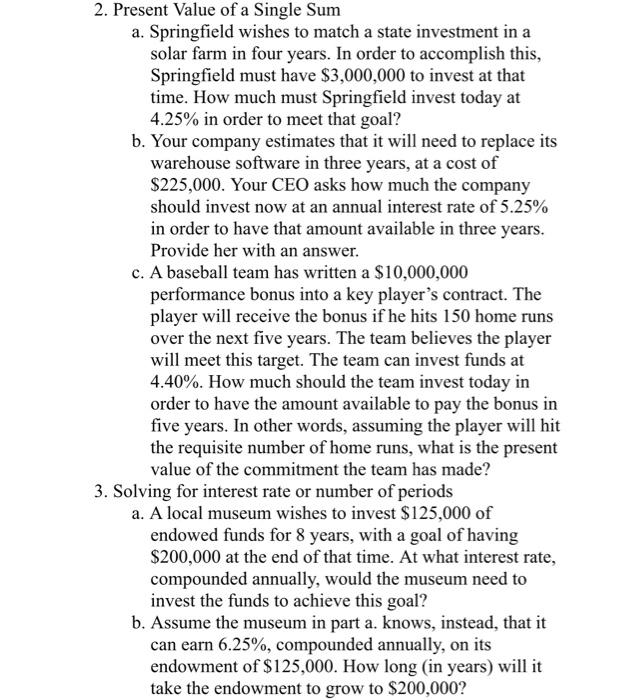

2. Present Value of a Single Sum a. Springfield wishes to match a state investment in a solar farm in four years. In order to accomplish this, Springfield must have $3,000,000 to invest at that time. How much must Springfield invest today at 4.25% in order to meet that goal? b. Your company estimates that it will need to replace its warehouse software in three years, at a cost of S225,000. Your CEO asks how much the company should invest now at an annual interest rate of 5.25% in order to have that amount available in three years. Provide her with an answer. c. A baseball team has written a $10,000,000 performance bonus into a key player's contract. The player will receive the bonus if he hits 150 home runs over the next five years. The team believes the player will meet this target. The team can invest funds at 4.40%. How much should the team invest today in order to have the amount available to pay the bonus in five years. In other words, assuming the player will hit the requisite number of home runs, what is the present value of the commitment the team has made? 3. Solving for interest rate or number of periods a. A local museum wishes to invest $125,000 of endowed funds for 8 years, with a goal of having $200,000 at the end of that time. At what interest rate, compounded annually, would the museum need to invest the funds to achieve this goal? b. Assume the museum in part a. knows, instead, that it can earn 6.25%, compounded annually, on its endowment of $125,000. How long (in years) will it take the endowment to grow to $200,000?

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

2 PV FV1r n PV Present value FV Future value r Rate of interest n Number of periods a FV 300000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started