Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the senior audit manager of Nafip Independent Accountants Firm (Nafip), you are now carrying out the analytical procedures for the financial statements

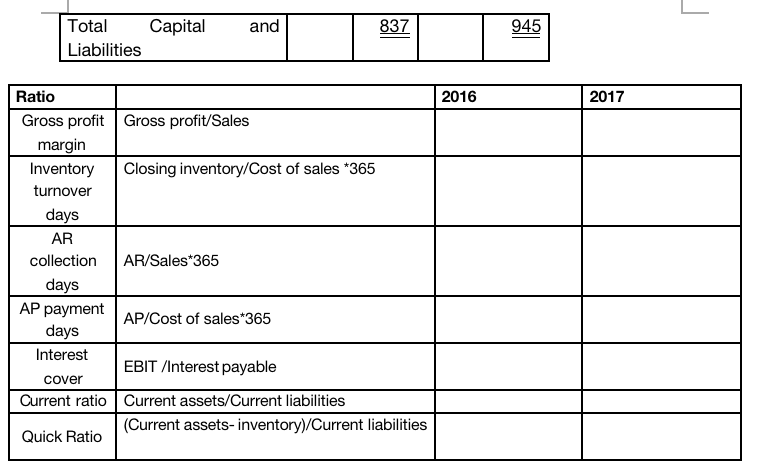

You are the senior audit manager of Nafip Independent Accountants Firm (Nafip), you are now carrying out the analytical procedures for the financial statements of Rabita Cosmetic Ltd., Co (Rabita). Rabita is a local private electronic products manufacturer. The following were its draft financial statements for the latest two financial years. Draft Statement of profit or loss for the year ended 30 September, 2018 2017 2018 $00 $000 Revenue 1204 1402 Cost of sales (865) (1201) Gross profit 339 201 Interest expenses (13) (130) (124) (42) (132) (122) Operating expenses Administration expenses Net profit 84 (95) Draft Statement of financial position of 30 September 2018 2017 2018 $000 $000 $000 $000 Non-current assets Tangible non-current 500 400 assets 500 400 Current assets Inventory 203 343 Trade receivable 80 198 Cash in bank 54 337 545 Total Assets 837 945 Capital and reserves Share capital Retained earnings 300 300 100 5 400 305 Current liabilities Bank overdraft 80 Trade payable 65 185 65 265 Non-current liabilities Bank loan 372 375 372 375 Total apital and 837 945 Liabilities Ratio 2016 2017 Gross profit Gross profit/Sales margin Inventory Closing inventory/Cost of sales *365 turnover days AR collection AR/Sales*365 days P payment days AP/Cost of sales*365 Interest EBIT /Interest payable cover Current ratio Current assets/Current liabilities (Current assets- inventory)/Current liabilities Quick Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ratio 2016 2017 Gross Profit Margin Gross Profitsales Note 1 2816 1434 Inventory Turnover days Closi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started