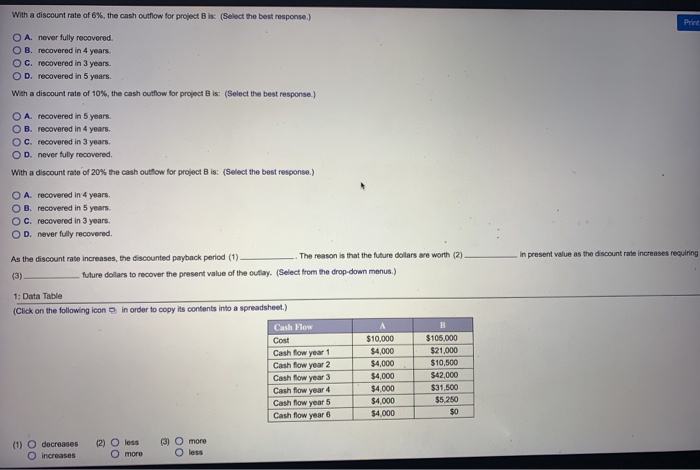

2 Print Discounted payback period. Given the following two projects and their cash flows, calculate the discounted payback period with a discount rate 10%, and 20%. What do you notice about the payback period as the discount rate rises? Explain this relationship. With a discount rate of 6%, the cash outflow for project Als: (Select the best response.) O A. recovered in 2.79 years. OB. recovered in 5 years. OC. recovered in 4 years. OD. never fully recovered. With a discount rate of 10%, the cash outflow for project A is: (Select the best response.) O A. recovered in 3.02 years. OB. recovered in 5 years. O c. recovered in 3 years OD. never fully recovered. With a discount rate of 20%, the cash outflow for project A is: (Select the best response.) O A. recovered in 3.82 years. OB. recovered in 5 years. OC. recovered in 3 years. OD. never fully recovered. With a discount rate of 6%, the cash outflow for project B is: (Select the best response.) O A. never fully recovered. OB. recovered in 4 years. OC. recovered in 3 years. OD With a discount rate of 6%, the cash outflow for project is: (Select the best response.) Print O A. never fully recovered. OB recovered in 4 years O C. recovered in 3 years OD. recovered in 5 years. With a discount rate of 10%, the cash outflow for project is: (Select the best response) O A recovered in 5 years. OB. recovered in 4 years O c. recovered in 3 years. OD. never fully recovered. With a discount rate of 20% the cash outflow for project Bis: (Select the best response.) O A recovered in 4 years OB. recovered in 5 years. OC. recovered in 3 years. OD. never fully recovered. in present value as the discount rate increases requiring As the discount rate increases the discounted payback period (1) - The reason is that the future dollars are worth (2) (3) _ future dollars to recover the present value of the outlay. (Select from the drop-down menus) 1: Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash Bow year A $10,000 $4,000 $4,000 $4,000 $4,000 $4.000 54 000 $105.000 $21,000 $10,500 542,000 $31.500 $5.250 mo decreases as on oma