Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Q 2. A man aged 64 and his wife aged 62 purchase an annuity by paying a lump sum premium of $600,000. The annuity

2

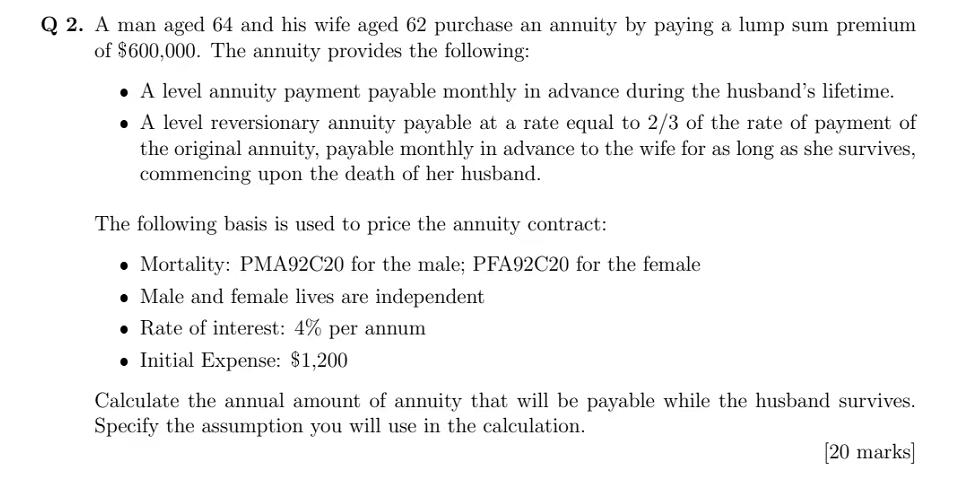

Q 2. A man aged 64 and his wife aged 62 purchase an annuity by paying a lump sum premium of $600,000. The annuity provides the following: A level annuity payment payable monthly in advance during the husband's lifetime. A level reversionary annuity payable at a rate equal to 2/3 of the rate of payment of the original annuity, payable monthly in advance to the wife for as long as she survives, commencing upon the death of her husband. The following basis is used to price the annuity contract: Mortality: PMA92C20 for the male; PFA92C20 for the female Male and female lives are independent Rate of interest: 4% per annum Initial Expense: $1,200 Calculate the annual amount of annuity that will be payable while the husband survives. Specify the assumption you will use in the calculation. [20 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started