Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. quesiton % in the floating-rate market and In the fixed-rate market or at LIBOR 175% in the ents. You want to design a swap

2. quesiton

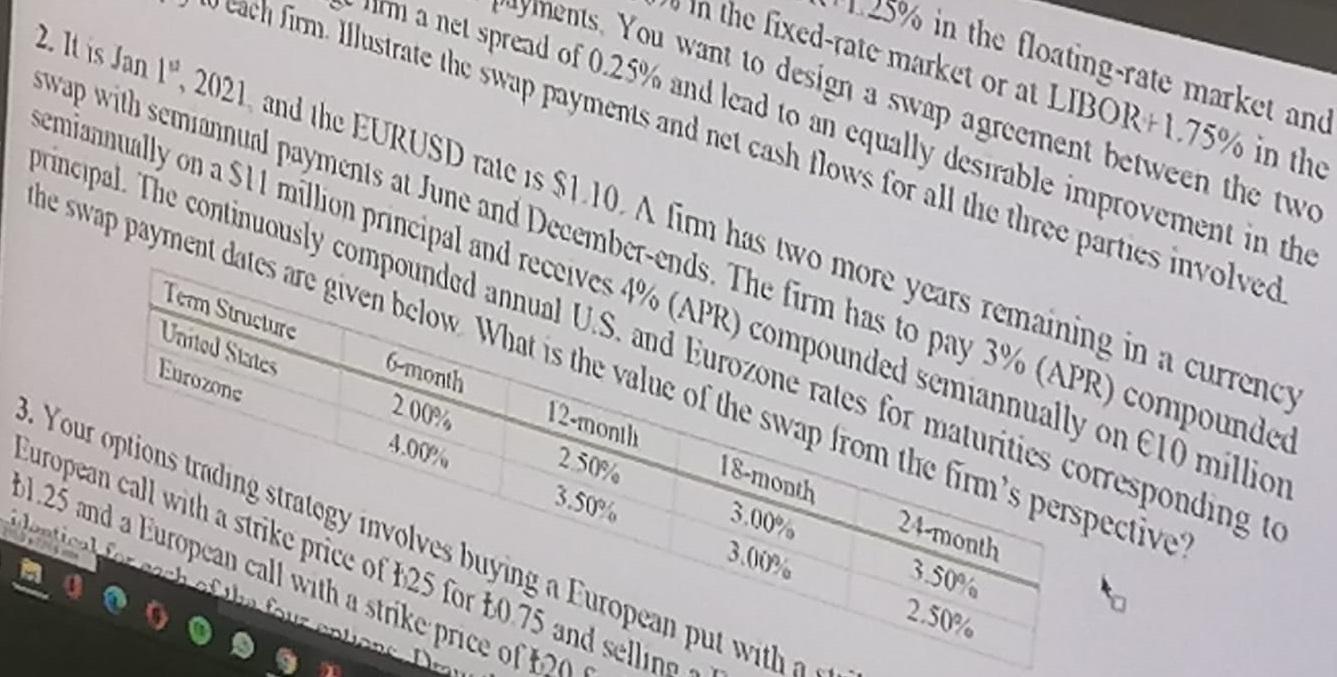

% in the floating-rate market and In the fixed-rate market or at LIBOR 175% in the ents. You want to design a swap agreement between the two ma net spread of 0.25% and lead to an equally desirable improvement in the Sim. Illustrate the swap payments and net cash flows for all the three parties involved. 2. It is Jan 1, 2021 and the EURUSD rate is $110. A fim has two more years remaining in a currency swap with semiannual payments at June and December-ends. The firm has to pay 3% (APR) compounded semiannually on a S11 million principal and receives 4% (APR) compounded semiannually on 10 million principal. The continuously compounded annual U.S. and Eurozone rates for maturities corresponding to the swap payment dates are given below What is the value of the swap from the film's perspective? Term Structure Untou States Eurozons 6-month 200% 4.00% 3. Your options trading strategy involves buying a Furopean put with European call with a strike price of 125 for 1075 and selling +1.25 md a European call with a stnke price of 120 pna 12-monili 2 50% 3.50% Antical 18-month 3.00% 3.00% 24-month 3.50% 2.50% stStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started