Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(2 questions on this) An employee's basic wage is $15 per hour, and they are paid double for work over 40 hours a week. The

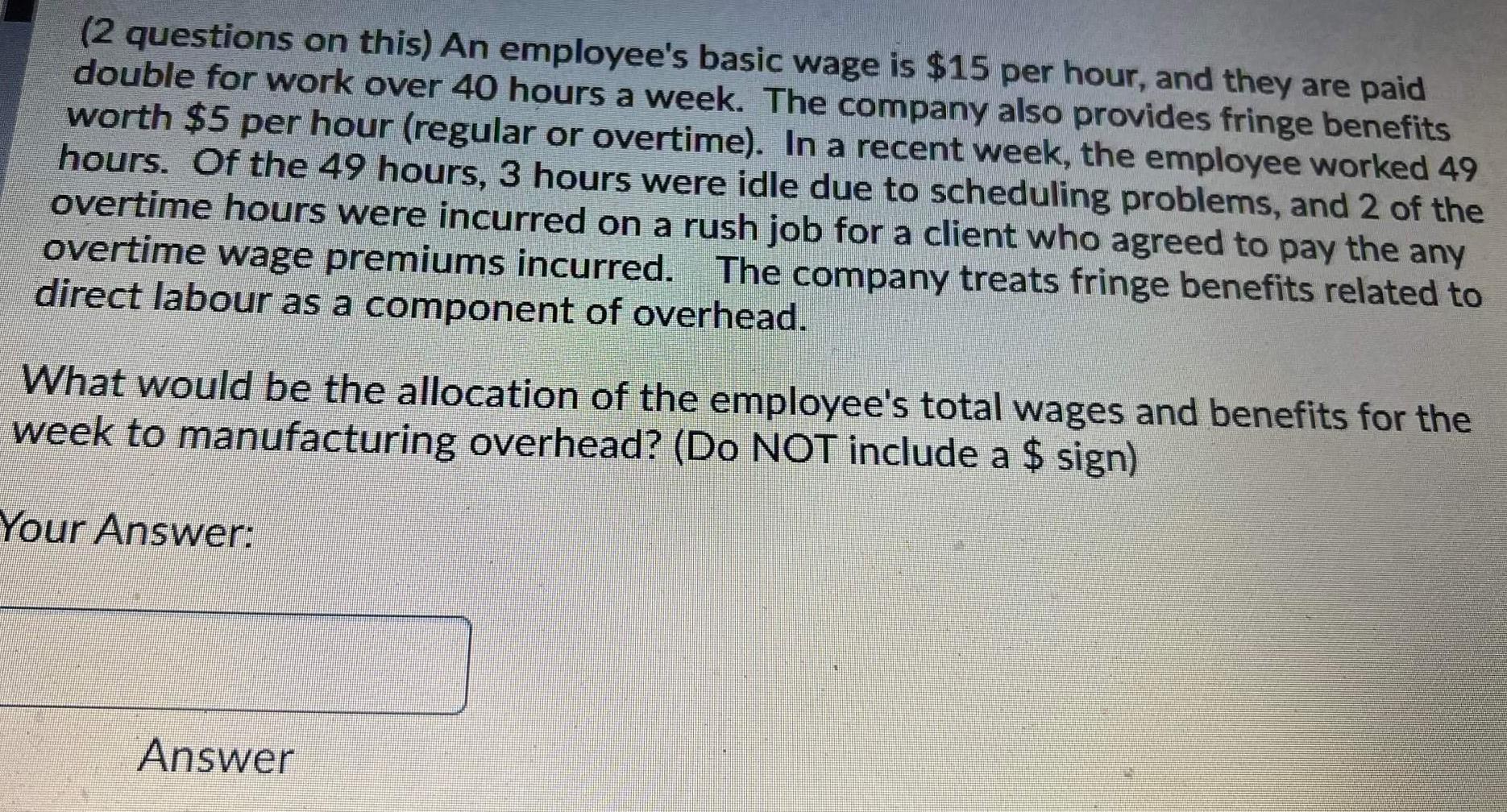

(2 questions on this) An employee's basic wage is $15 per hour, and they are paid double for work over 40 hours a week. The company also provides fringe benefits worth $5 per hour (regular or overtime). In a recent week, the employee worked 49 hours. Of the 49 hours, 3 hours were idle due to scheduling problems, and 2 of the overtime hours were incurred on a rush job for a client who agreed to pay the any overtime wage premiums incurred. The company treats fringe benefits related to direct labour as a component of overhead. What would be the allocation of the employee's total wages and benefits for the week to manufacturing overhead? (Do NOT include a $ sign) Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started