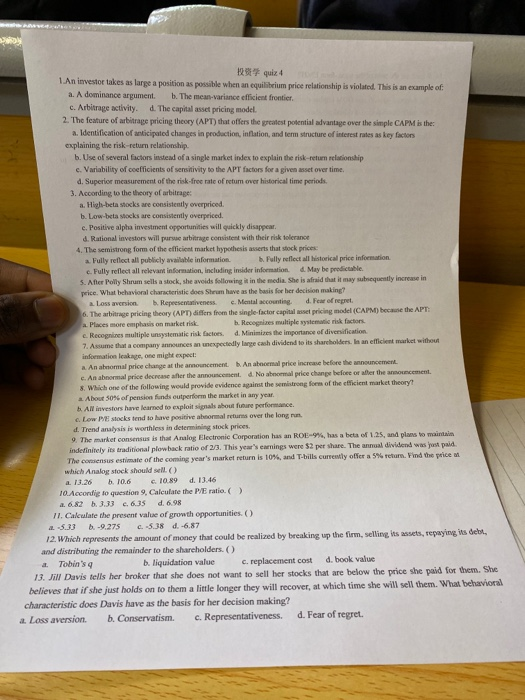

2 quiz 4 1An investor takes as large a position as possible when an equilibrium price relationship is violated. This is an example of: a. A dominance argument. b. The mean-variance efficient frontier, c. Arbitrage activity. 2. The feature of arbitrage pricing theory (APT) that offers the greatest potential advantage over the simple CAPM is the: a. Identification of anticipated changes in production, inflation, and term structure of interest rates as key factors d. The capital asset pricing model. explaining the risk-return relationship. b. Use of several factors instead of a single market index to explain the risk-retum relationship c. Variability of coefficients of sensitivity to the APT factors for a given asset over time. d. Superior measurement of the risk-free rate of returm over historical time periods. 3. According to the theory of arbitrage: a. High-beta stocks are consistently overpriced. b. Low-beta stocks are consistently overpriced. e. Positive alpha investment opportunities will quickly disappear. d. Rational investors will pursue arbitrage consistent with their risk tolerance 4. The semistrong form of the efficient market hypothesis asserts that stock prices: a Fully reflect all publicly available information b. Fully reflect all historical price information d. May be predictable. e. Fully reflect all relevant information, including imider information. 5. After Polly Shrum sells a stock, she avoids following it in the media. She is afraid that it may subsequently increase in price. What behavioral characteristic does Shrum have as the basis for her decision making? b. Repesentativeness. c. Mental accounting. d. Fear of regret. a Loss aversion 6. The arbitrage pricing theory (APT) differs from the single-factor capital asset pricing model (CAPM) because the APT: a. Places more emphasis on market risk e Recognines multiple unsystematic risk factors. 7. Assume that a company announces an unexpectedly large cash dividend to its sharcholders. In an efficient market without information leakage, one might expect: b. Recognizes multiple systematic risk factors d. Minimizes the importance of diversification a An abnormal price change at the announcement. An abnormal price increase before the announcement. c. An abnormal price decrease after the announcement. d. No abnomal price change befoee or after the announcement. 8. Which one of the following would provide evidence against the semistrong form of the efficient market theory? a About 50% of pension funds outperform the market in any year. b All investors have learned to exploit signals about funure performance. c. Low PE stocks tend to have positive abnormal returns over the long run. d. Trend analysis is worthless in determining stock prices. 9. The market consensus is that Analog Electronic Corporation has an ROE-9%, has a beta of 1.25, and plans to maintain indefinitely its traditional plowback ratio of 2/3, This year's earnings were $2 per share. The annual dividend was yust paid The consensus estimate of the coming year's market return is 10%, and T-bills currently offer a 5% return. Find the price at which Analog stock should sell. () s. 10.89 d. 13.46 b. 10.6 a 13.26 10.Accordig to question 9, Calculate the P/E ratio. () a. 6.82 b. 3.33 c. 6.35 11. Calculate the present value of growth opportunities. () d. 6.98 C-5.38 d. -6.87 b. -9.275 a 5.33 12. Which represents the amount of money that could be realized by breaking up the firm, selling its assets, repaying its debt and distributing the remainder to the shareholders. () Tobin's q d. book value c. replacement cost b. liquidation value a. 13. Jill Davis tells her broker that she does not want to sell her stocks that are below the price she paid for them. She believes that if she just holds on to them a little longer they will recover, at which time she will sell them. What behavioral characteristic does Davis have as the basis for her decision making? d. Fear of regret. c. Representativeness. b. Conservatism. a Loss aversion