Question

2 Recent financial statements for Zimmer, Inc. are as follows: 3 5 6 Assets 7 Current assets: 9 Cash 9 10 13 Total current assets

2 Recent financial statements for Zimmer, Inc. are as follows: 3 5 6 Assets 7 Current assets: 9 Cash 9 10 13 Total current assets 14 Plant and eqipment, net 15 Other assets 16 Total assets

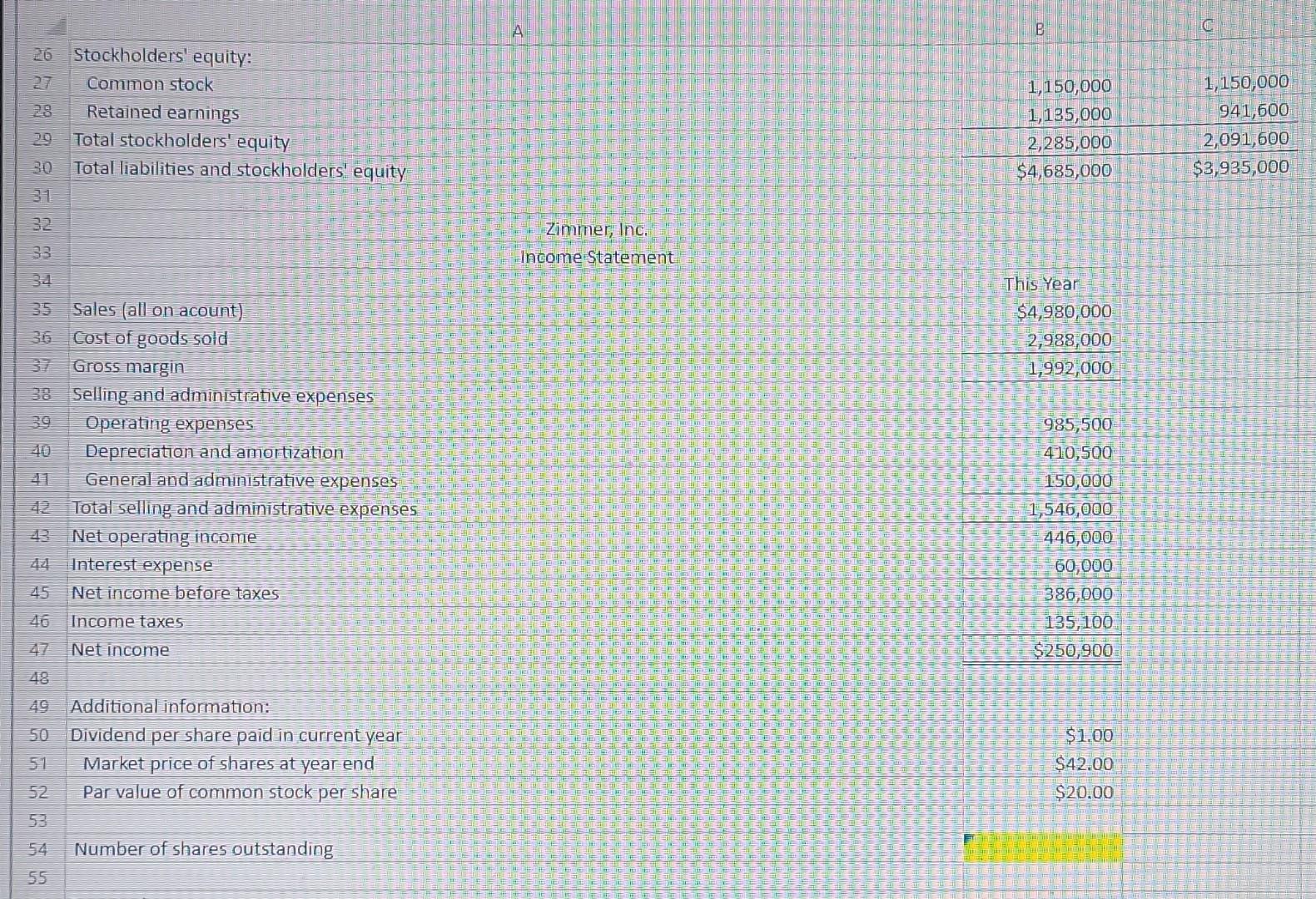

Liabilities and Stockholders' Equity Current Liabilities: 18 19 Accounts payable 20 21 22 3 24 25 6 7 28 29 30 31 32 5 23 Marketable securities Accounts receivable, net Inventory Other current assets 27 Short-term bank loans payables current liabilities Accrued Other Total current liabilities payable, 10% Bonds Total liabilities 26 Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 4 Zimmer, Inc. Comparative Balance Sheet Zimmer, Inc. Incomo Statamant This Year $360,000 220,000 775,000 925,000 355,000 2,635,000 1,975,000 75,000 $4,685,000 $250,000 750,000 550,000 275,000 1,825,000 575,000 2,400,000 1,150,000 1,135,000 2,285,000 $4,685,000 Last Year $310,000 80,000 700,000 750,000 195,000 2,035,000 1,800,000 100,000 $3,935,000 $225,000 600,000 395,000 223,400 1,443,400 400,000 1,843,400 1,150,000 941,600 2,091,600 $3,935,000

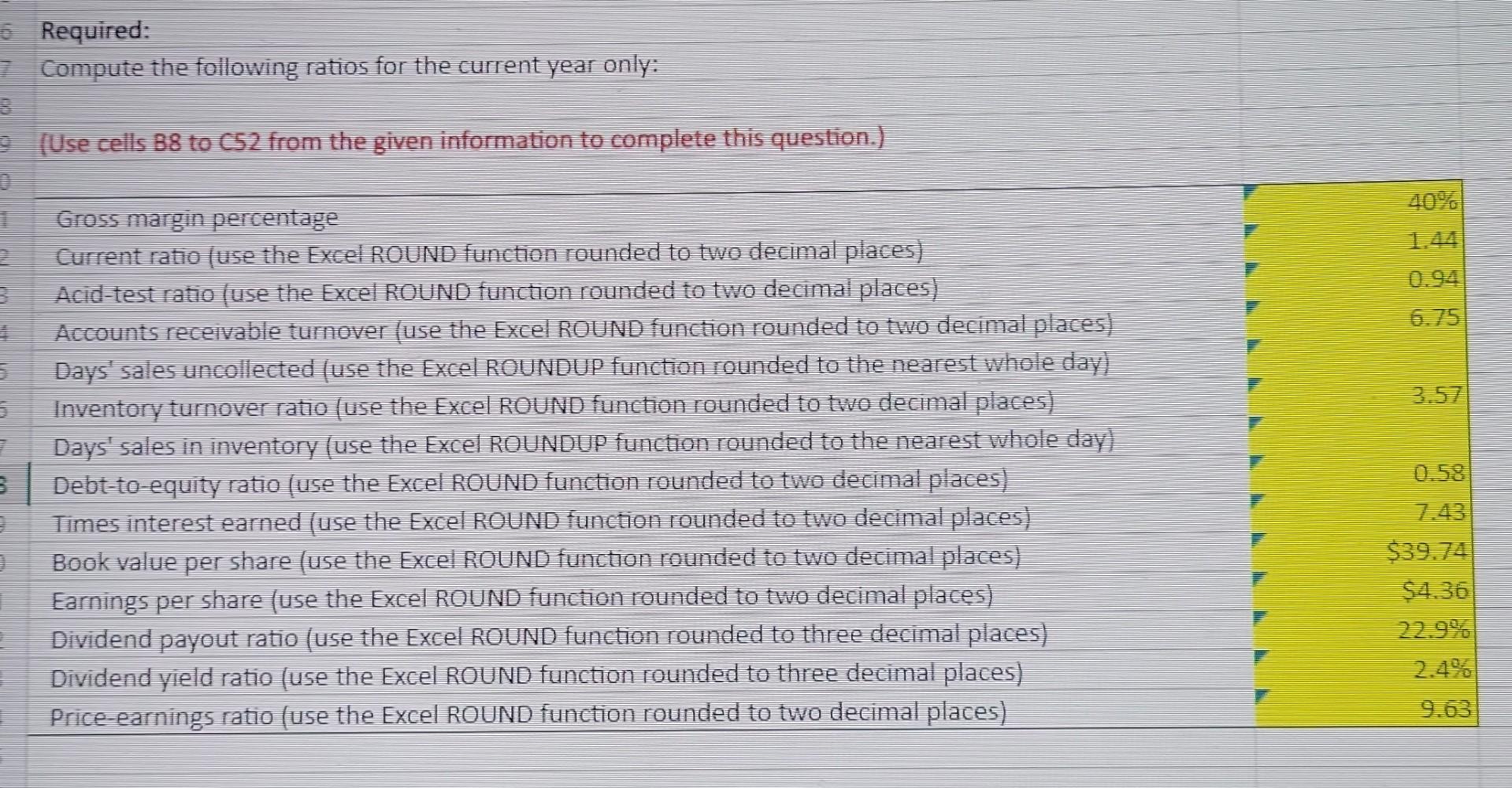

A 26 Stockholders equity: 27 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 3231= 33 35 Sales (all on acount) 36 Cost of goods sold 37 Gross margin 38 Selling and administrative expenses 39 Operating expenses 40 Depreciation and amortization 41 General and administrative expenses 42 Total selling and administrative expenses 43 Net operating income 44 Interest expense 45 Net income before taxes 46 Income taxes 47 Net income 48 Additional information: 50 Dividend per share paid in current year 51 Market price of shares at year end 52 Par value of common stock per share 53 54 Number of shares outstanding 55 Required: Compute the following ratios for the current year only: (Use cells B8 to C52 from the given information to complete this question.) Gross margin percentage Current ratio (use the Excel ROUND function rounded to two decimal places) Acid-test ratio (use the Excel ROUND function rounded to two decimal places) Accounts receivable turnover (use the Excel ROUND function rounded to two decimal places) Days' sales uncollected (use the Excel ROUNDUP function rounded to the nearest whole day) Inventory turnover ratio (use the Excel ROUND function rounded to two decimal places) Days' sales in inventory (use the Excel ROUNDUP function rounded to the nearest whole day) Debt-to-equity ratio (use the Excel ROUND function rounded to two decimal places) Times interest earned (use the Excel ROUND function rounded to two decimal places) Book value per share (use the Excel ROUND function rounded to two decimal places) Earnings per share (use the Excel ROUND function rounded to two decimal places) Dividend payout ratio (use the Excel ROUND function rounded to three decimal places) Dividend yield ratio (use the Excel ROUND function rounded to three decimal places) Price-earnings ratio (use the Excel ROUND function rounded to two decimal places) YYYYYYYYYYYY40%1.440.946.753.570.587.43$39.74$4.3622.9%2.4%9.63 A 26 Stockholders equity: 27 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 3231= 33 35 Sales (all on acount) 36 Cost of goods sold 37 Gross margin 38 Selling and administrative expenses 39 Operating expenses 40 Depreciation and amortization 41 General and administrative expenses 42 Total selling and administrative expenses 43 Net operating income 44 Interest expense 45 Net income before taxes 46 Income taxes 47 Net income 48 Additional information: 50 Dividend per share paid in current year 51 Market price of shares at year end 52 Par value of common stock per share 53 54 Number of shares outstanding 55 Required: Compute the following ratios for the current year only: (Use cells B8 to C52 from the given information to complete this question.) Gross margin percentage Current ratio (use the Excel ROUND function rounded to two decimal places) Acid-test ratio (use the Excel ROUND function rounded to two decimal places) Accounts receivable turnover (use the Excel ROUND function rounded to two decimal places) Days' sales uncollected (use the Excel ROUNDUP function rounded to the nearest whole day) Inventory turnover ratio (use the Excel ROUND function rounded to two decimal places) Days' sales in inventory (use the Excel ROUNDUP function rounded to the nearest whole day) Debt-to-equity ratio (use the Excel ROUND function rounded to two decimal places) Times interest earned (use the Excel ROUND function rounded to two decimal places) Book value per share (use the Excel ROUND function rounded to two decimal places) Earnings per share (use the Excel ROUND function rounded to two decimal places) Dividend payout ratio (use the Excel ROUND function rounded to three decimal places) Dividend yield ratio (use the Excel ROUND function rounded to three decimal places) Price-earnings ratio (use the Excel ROUND function rounded to two decimal places) YYYYYYYYYYYY40%1.440.946.753.570.587.43$39.74$4.3622.9%2.4%9.63

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started