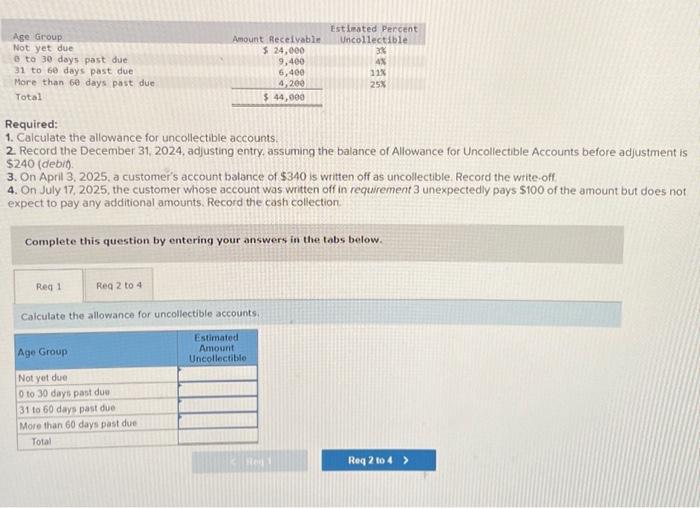

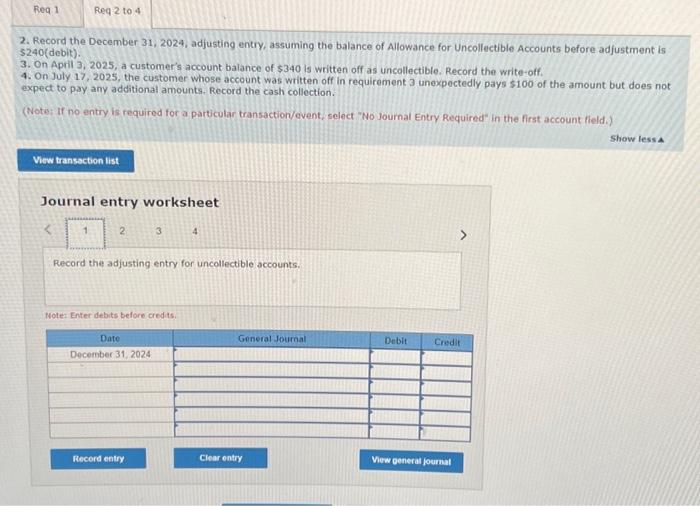

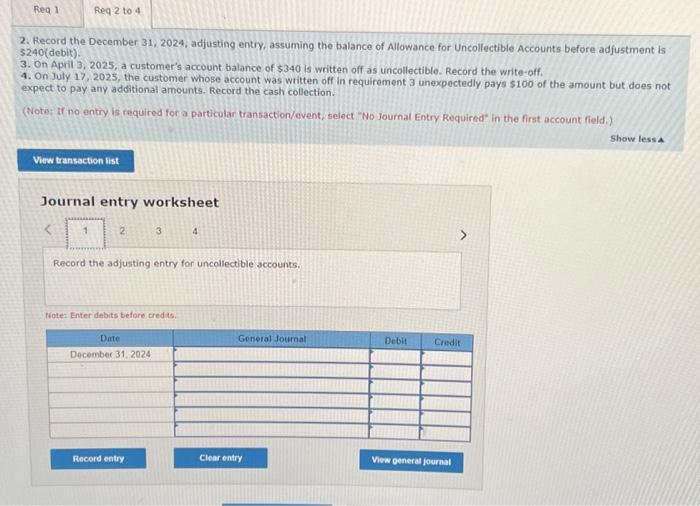

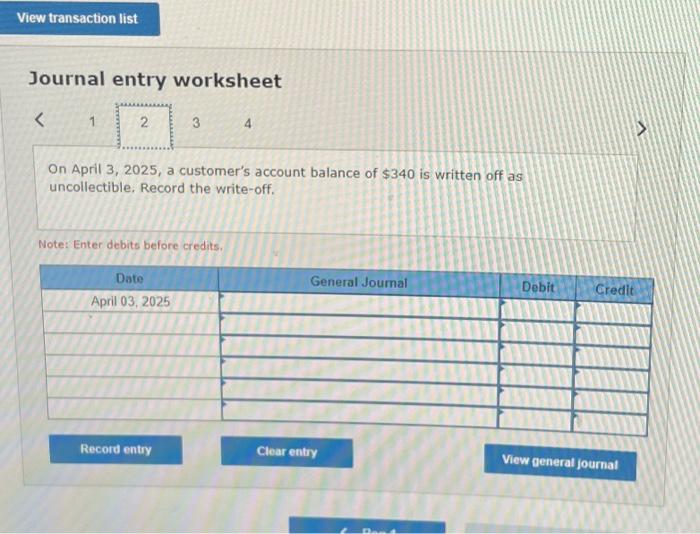

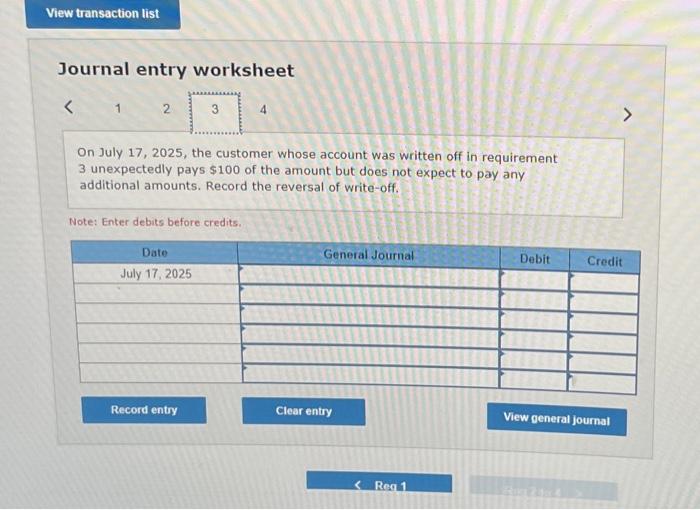

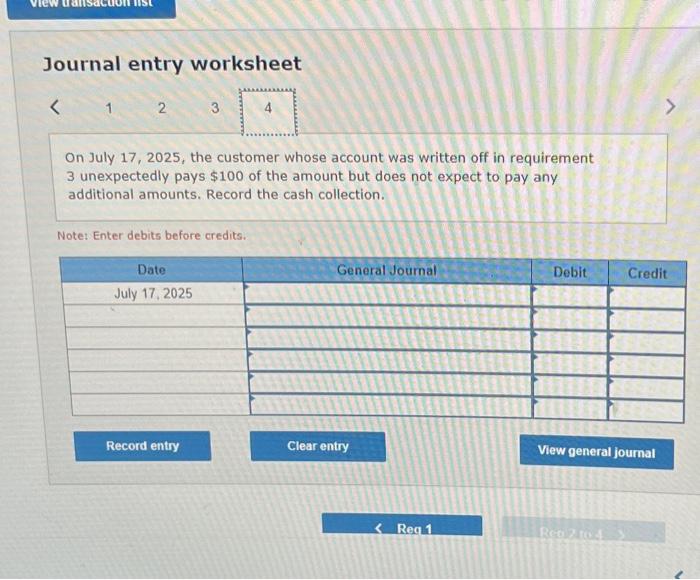

2. Record the December 31,2024 , adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adfustment is $240 (debit) 3. On April 3,2025 , a customer's account balance of $340 is written off as uncollectible. Record the write-off. 4. On July 17,2025 , the customer whose account was written off in requirement 3 unexpectedly pays $100 of the amount but does not expect to pay any additional amounts. Record the cash collection. (Note: If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Show lessa Journal entry worksheet 4 Record the adjusting entry for uncollectible sccounts. Noter Enter debits before credits. Journal entry worksheet On July 17,2025 , the customer whose account was written off in requirement 3 unexpectedly pays $100 of the amount but does not expect to pay any additional amounts. Record the cash collection. Note: Enter debits before credits. Journal entry worksheet On April 3, 2025, a customer's account balance of $340 is written off as uncollectible, Record the write-off. Note: Enter debits before credits. Journal entry worksheet On July 17,2025 , the customer whose account was written off in requirement 3 unexpectedly pays $100 of the amount but does not expect to pay any additional amounts. Record the reversal of write-off. Note: Enter debits before credits. 2. Record the December 31,2024 , adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adfustment is $240 (debit) 3. On April 3,2025 , a customer's account balance of $340 is written off as uncollectible. Record the write-off. 4. On July 17,2025 , the customer whose account was written off in requirement 3 unexpectedly pays $100 of the amount but does not expect to pay any additional amounts. Record the cash collection. (Note: If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Show lessa Journal entry worksheet 4 Record the adjusting entry for uncollectible sccounts. Noter Enter debits before credits. 1. Calculate the allowance for uncollectible accounts. 2. Record the December 31,2024, adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustment $240 (debit). 3. On April 3, 2025, a customer's account balance of $340 is written off as uncollectible. Record the write-off. 4. On July 17,2025 , the customer whose account was written off in requirement 3 unexpectedly pays $100 of the amount but does no expect to pay any additional amounts. Record the cash collection. Complete this question by entering your answers in the tabs below. Calculate the allowance for uncollectible accounts