Answered step by step

Verified Expert Solution

Question

1 Approved Answer

APPLICA TION ASSIGNMENT #4- ACCT305 (Chapter 10) Students - Please utilize Excel to complete the requirements listed below. Make sure your answers are transferred to

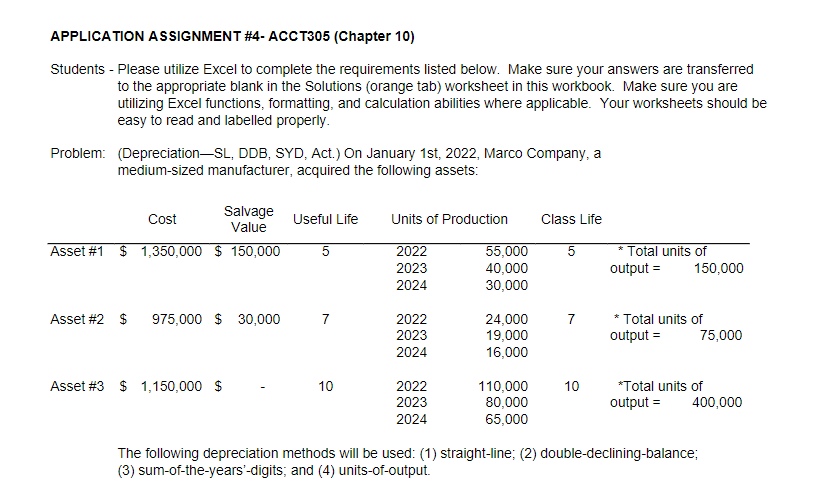

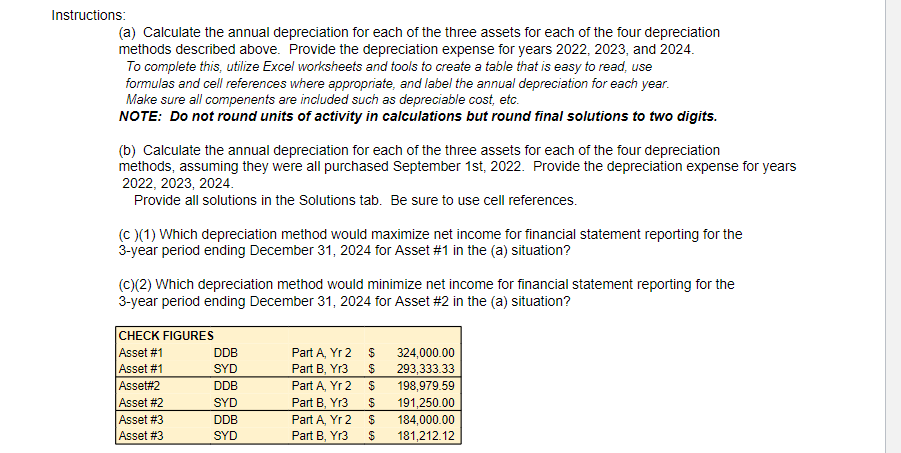

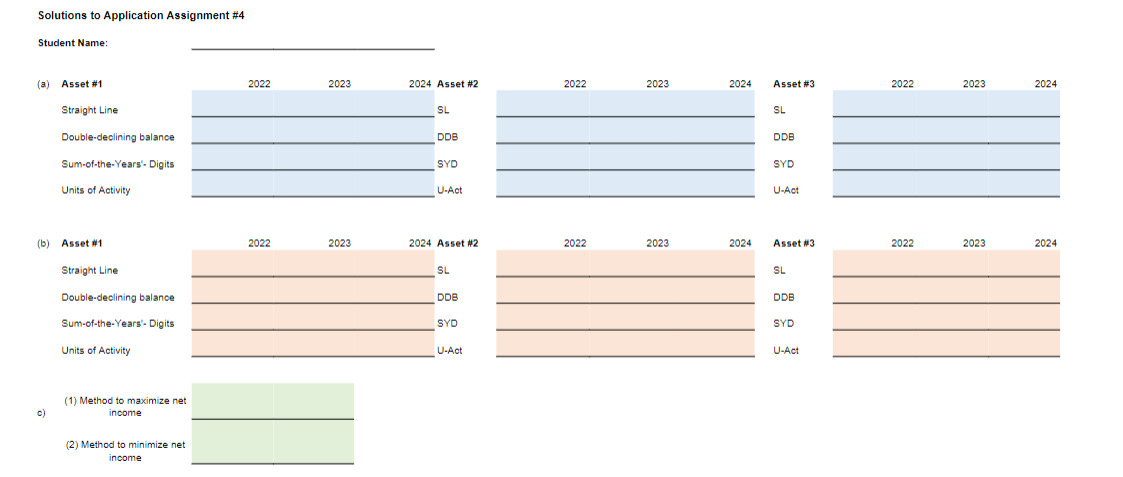

APPLICA TION ASSIGNMENT \#4- ACCT305 (Chapter 10) Students - Please utilize Excel to complete the requirements listed below. Make sure your answers are transferred to the appropriate blank in the Solutions (orange tab) worksheet in this workbook. Make sure you are utilizing Excel functions, formatting, and calculation abilities where applicable. Your worksheets should be easy to read and labelled properly. Problem: (Depreciation-SL, DDB, SYD, Act.) On January 1st, 2022, Marco Company, a medium-sized manufacturer, acquired the following assets: The following depreciation methods will be used: (1) straight-line; (2) double-declining-balance; (3) sum-of-the-years'-digits; and (4) units-of-output. (a) Calculate the annual depreciation for each of the three assets for each of the four depreciation methods described above. Provide the depreciation expense for years 2022, 2023, and 2024. To complete this, utilize Excel worksheets and tools to create a table that is easy to read, use formulas and cell references where appropriate, and label the annual depreciation for each year. Make sure all compenents are included such as depreciable cost, etc. NOTE: Do not round units of activity in calculations but round final solutions to two digits. (b) Calculate the annual depreciation for each of the three assets for each of the four depreciation methods, assuming they were all purchased September 1st, 2022. Provide the depreciation expense for years 2022, 2023, 2024. Provide all solutions in the Solutions tab. Be sure to use cell references. (c )(1) Which depreciation method would maximize net income for financial statement reporting for the 3-year period ending December 31, 2024 for Asset \#1 in the (a) situation? (c)(2) Which depreciation method would minimize net income for financial statement reporting for the 3-year period ending December 31,2024 for Asset \#2 in the (a) situation? Solutions to Application Assignment \#4

APPLICA TION ASSIGNMENT \#4- ACCT305 (Chapter 10) Students - Please utilize Excel to complete the requirements listed below. Make sure your answers are transferred to the appropriate blank in the Solutions (orange tab) worksheet in this workbook. Make sure you are utilizing Excel functions, formatting, and calculation abilities where applicable. Your worksheets should be easy to read and labelled properly. Problem: (Depreciation-SL, DDB, SYD, Act.) On January 1st, 2022, Marco Company, a medium-sized manufacturer, acquired the following assets: The following depreciation methods will be used: (1) straight-line; (2) double-declining-balance; (3) sum-of-the-years'-digits; and (4) units-of-output. (a) Calculate the annual depreciation for each of the three assets for each of the four depreciation methods described above. Provide the depreciation expense for years 2022, 2023, and 2024. To complete this, utilize Excel worksheets and tools to create a table that is easy to read, use formulas and cell references where appropriate, and label the annual depreciation for each year. Make sure all compenents are included such as depreciable cost, etc. NOTE: Do not round units of activity in calculations but round final solutions to two digits. (b) Calculate the annual depreciation for each of the three assets for each of the four depreciation methods, assuming they were all purchased September 1st, 2022. Provide the depreciation expense for years 2022, 2023, 2024. Provide all solutions in the Solutions tab. Be sure to use cell references. (c )(1) Which depreciation method would maximize net income for financial statement reporting for the 3-year period ending December 31, 2024 for Asset \#1 in the (a) situation? (c)(2) Which depreciation method would minimize net income for financial statement reporting for the 3-year period ending December 31,2024 for Asset \#2 in the (a) situation? Solutions to Application Assignment \#4 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started