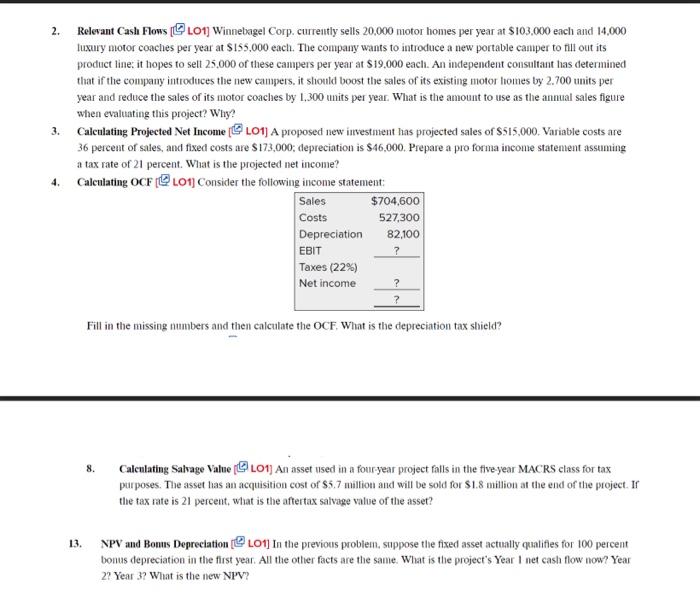

2. Relevant Cash Flows [15 LO1] Winnebagel Corp. currently sells 20,000 motor homes per year at $103,000 each and 14,000 luxury motor coaches per year at $155,000 each. The company wants to introduce a new portable camper to fill out its product line: it hopes to selt 25,000 of these campers per year at $19,000 each. An independent consultant has determined that if the company introduces the new campers, it should boost the sales of its existing motor homes by 2.700 units per year and reduce the sales of its motor coaches by 1,300 units per year. What is the amount to use as the annual sales figure when evaluating this project? Why? 3. Calculating Projected Net Income [ LO1] A proposed new investment has projected sales of $515,000. Variable costs are 36 percent of sales, and fixed costs are $173,000; depreciation is $46,000. Prepare a pro forma income statement assuming a tax rate of 21 percent. What is the projected net income? 4. Calculating OCF [ LO1] Consider the following income statement: Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield? 8. Calculating Salvage Value [ LO1] An asset nsed in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $5.7 million and will be sold for $1.8 million at the end of the project. If the tax rate is 21 percent, what is the aftertax salvage value of the asset? 13. NPV and Bonus Depreciation [ LO1] In the previous problem, suppose the fixed asset actually qualifies for 100 percent bonus depreciation in the first year. All the other facts are the same. What is the project's Year I net cash flow now? Year 2 ? Year 3 ? What is the new NPV? 2. Relevant Cash Flows [15 LO1] Winnebagel Corp. currently sells 20,000 motor homes per year at $103,000 each and 14,000 luxury motor coaches per year at $155,000 each. The company wants to introduce a new portable camper to fill out its product line: it hopes to selt 25,000 of these campers per year at $19,000 each. An independent consultant has determined that if the company introduces the new campers, it should boost the sales of its existing motor homes by 2.700 units per year and reduce the sales of its motor coaches by 1,300 units per year. What is the amount to use as the annual sales figure when evaluating this project? Why? 3. Calculating Projected Net Income [ LO1] A proposed new investment has projected sales of $515,000. Variable costs are 36 percent of sales, and fixed costs are $173,000; depreciation is $46,000. Prepare a pro forma income statement assuming a tax rate of 21 percent. What is the projected net income? 4. Calculating OCF [ LO1] Consider the following income statement: Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield? 8. Calculating Salvage Value [ LO1] An asset nsed in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $5.7 million and will be sold for $1.8 million at the end of the project. If the tax rate is 21 percent, what is the aftertax salvage value of the asset? 13. NPV and Bonus Depreciation [ LO1] In the previous problem, suppose the fixed asset actually qualifies for 100 percent bonus depreciation in the first year. All the other facts are the same. What is the project's Year I net cash flow now? Year 2 ? Year 3 ? What is the new NPV