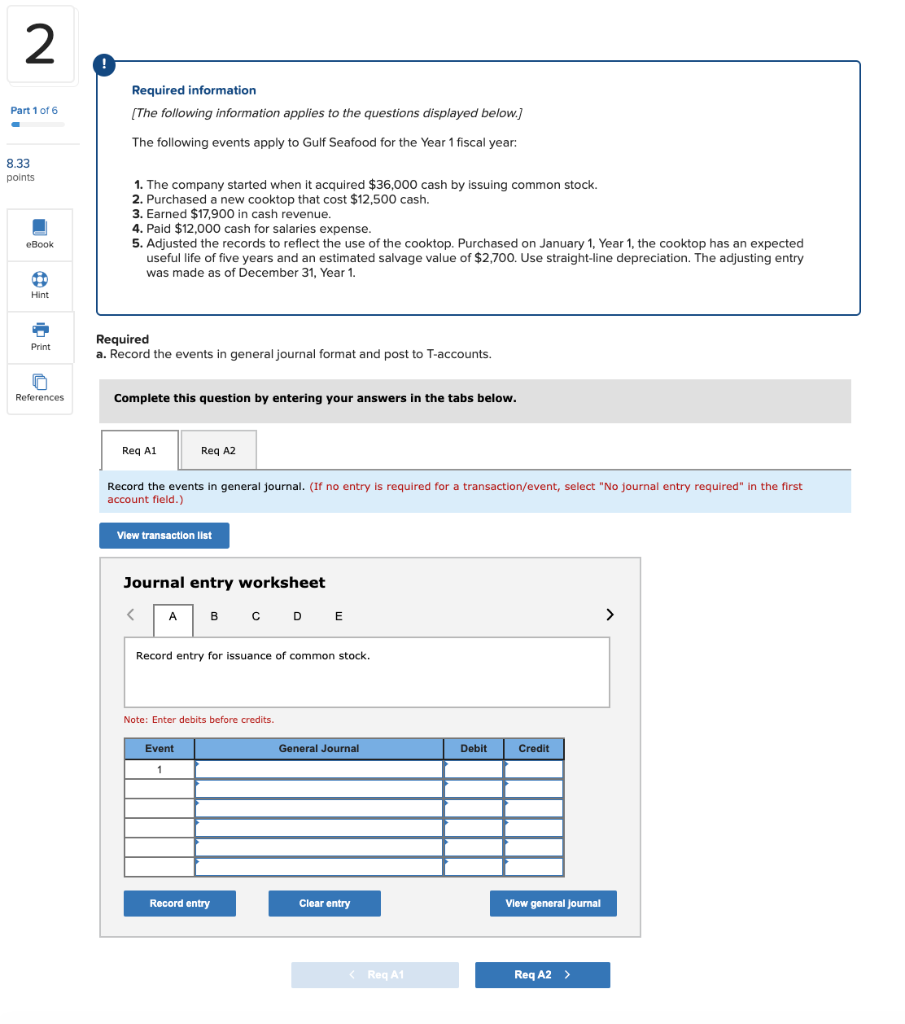

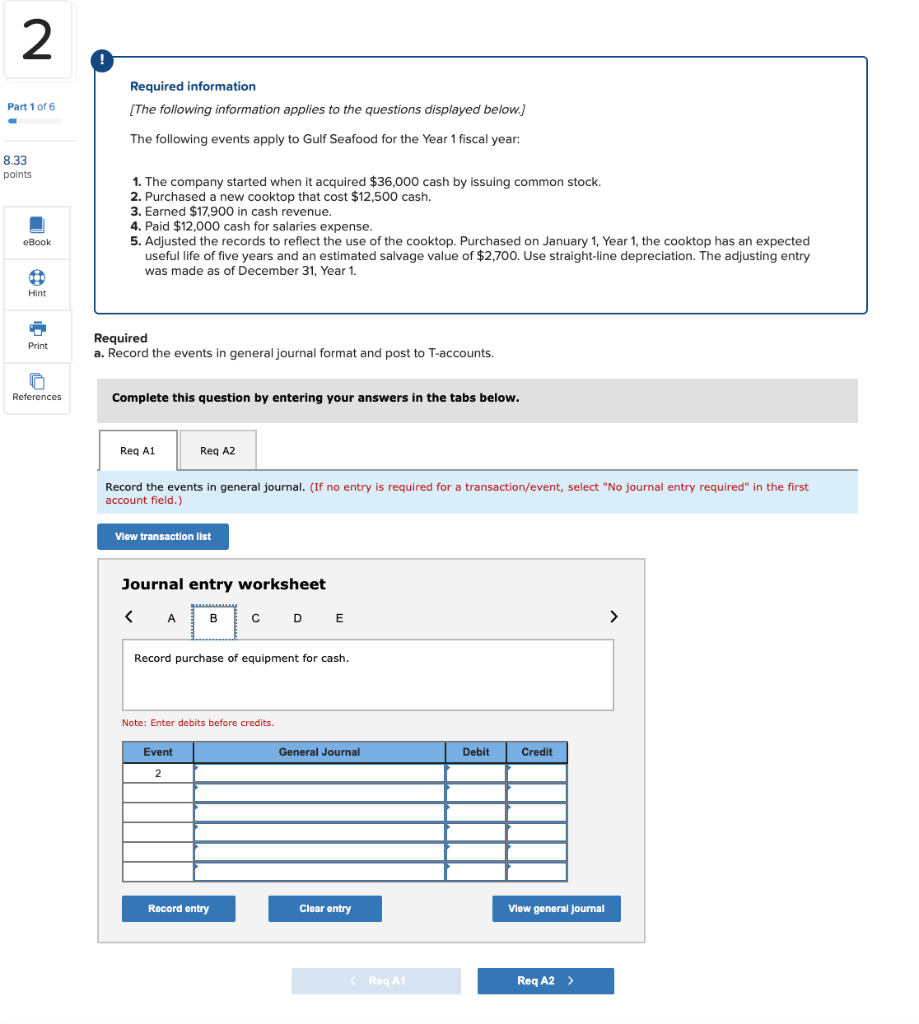

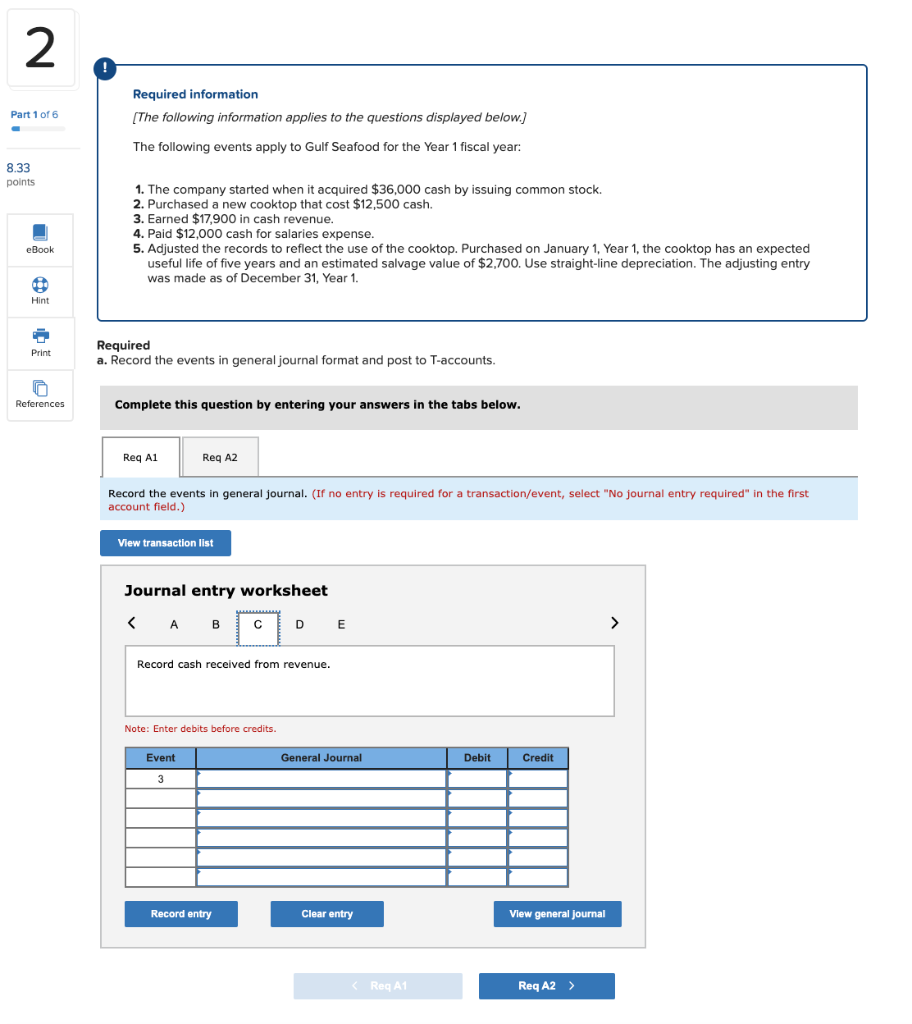

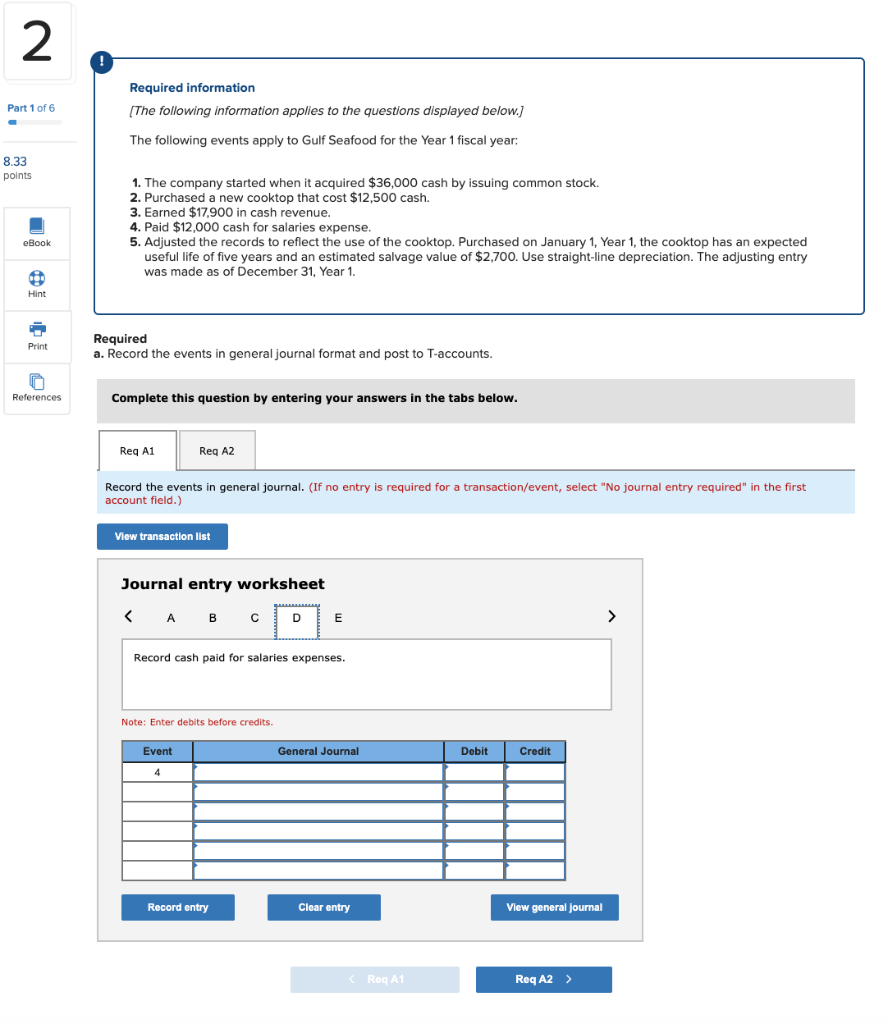

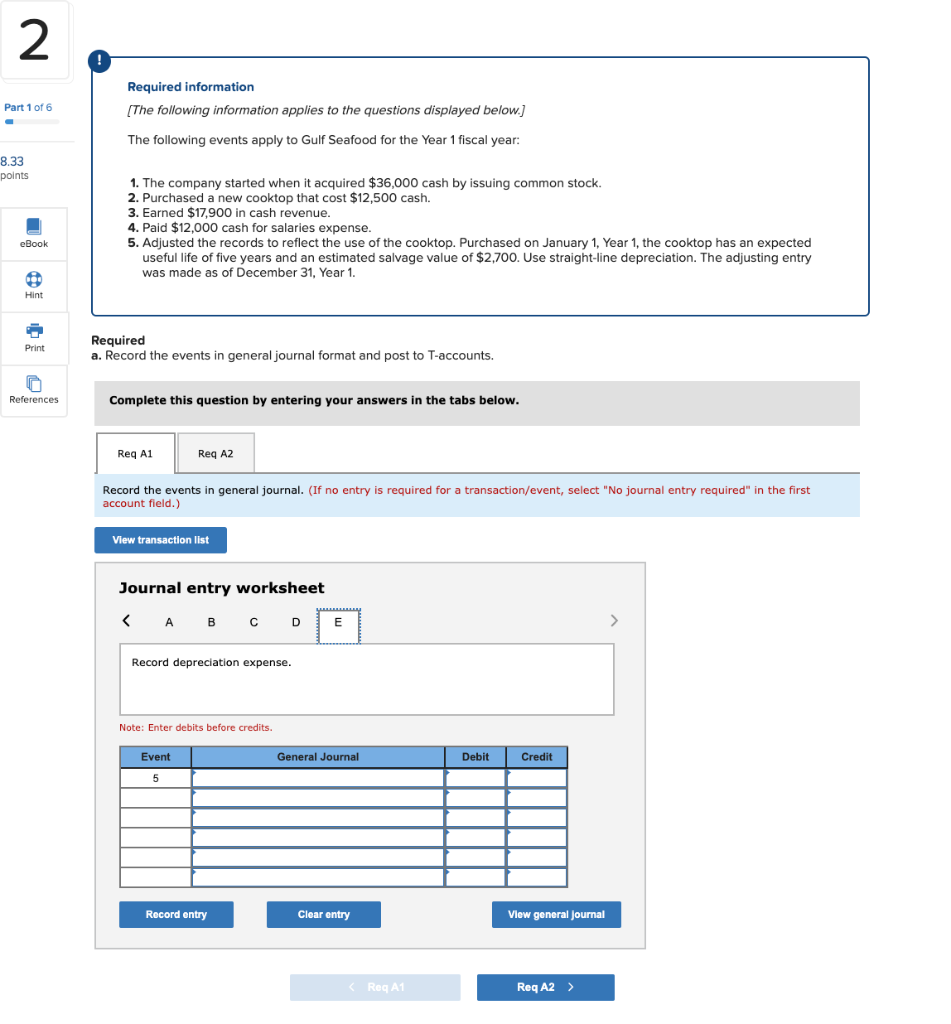

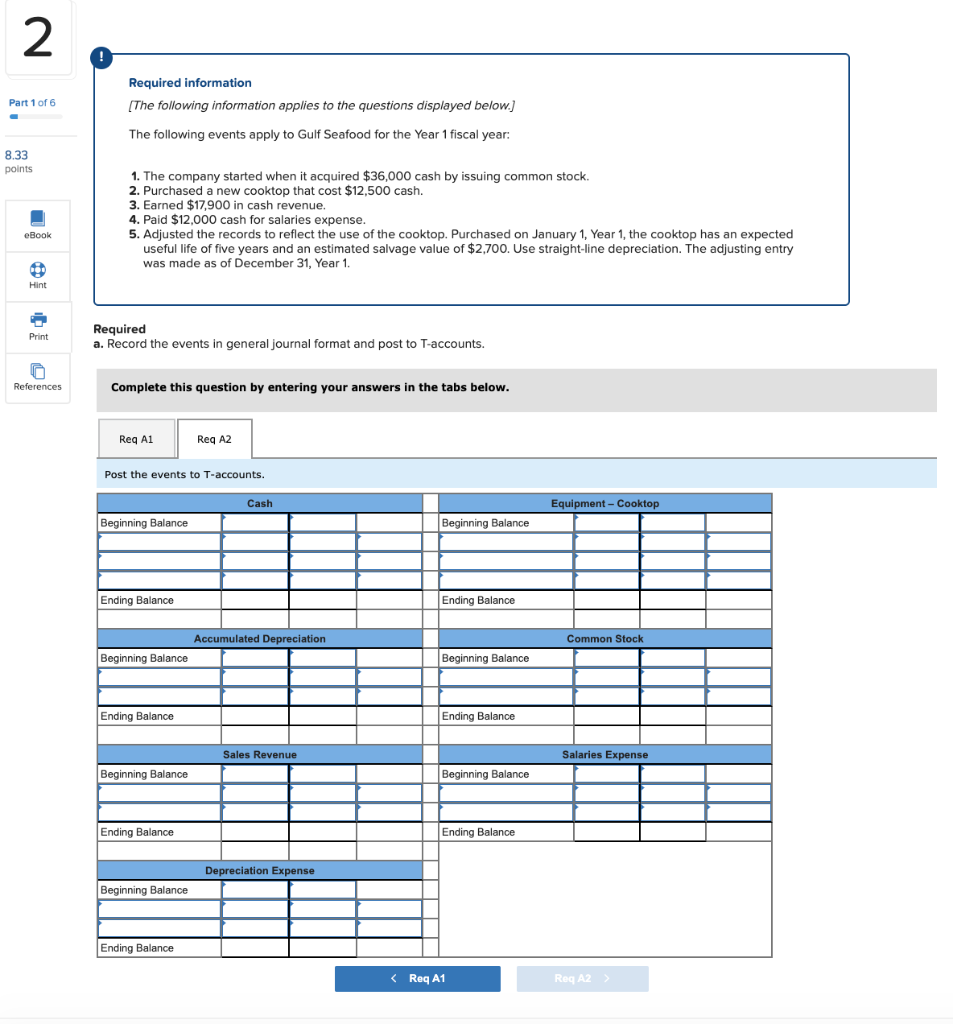

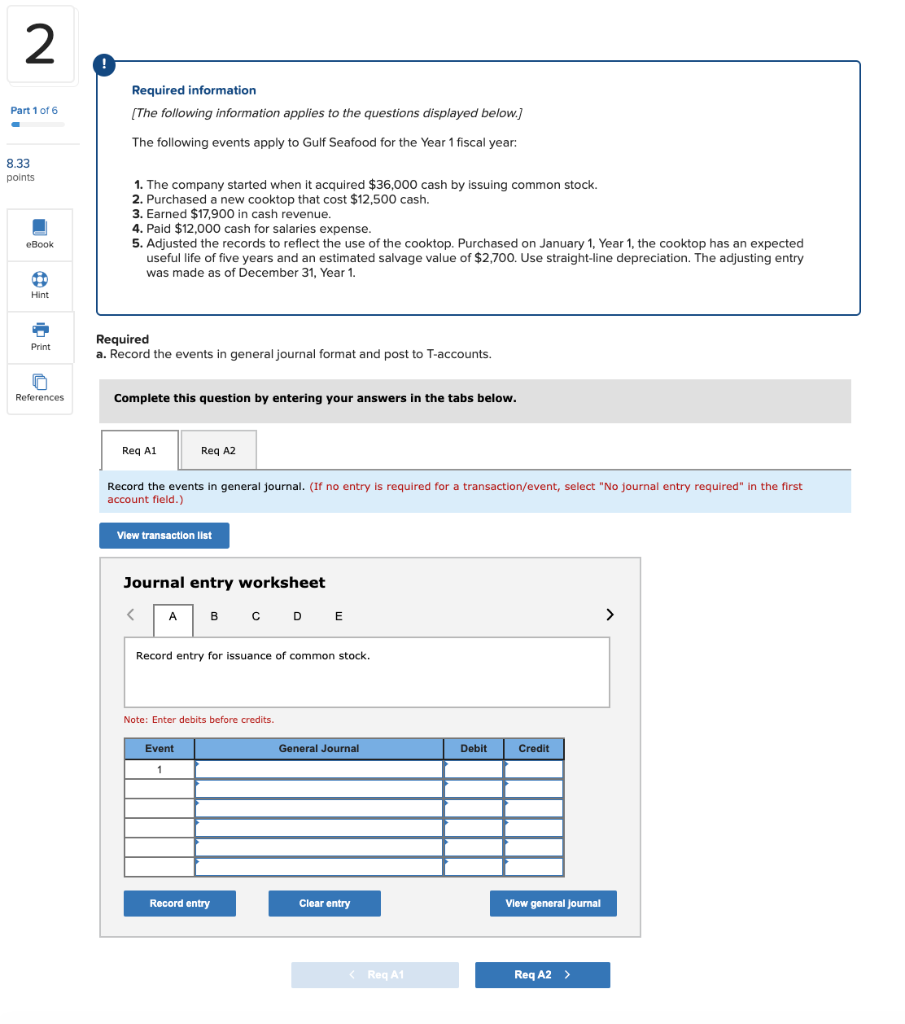

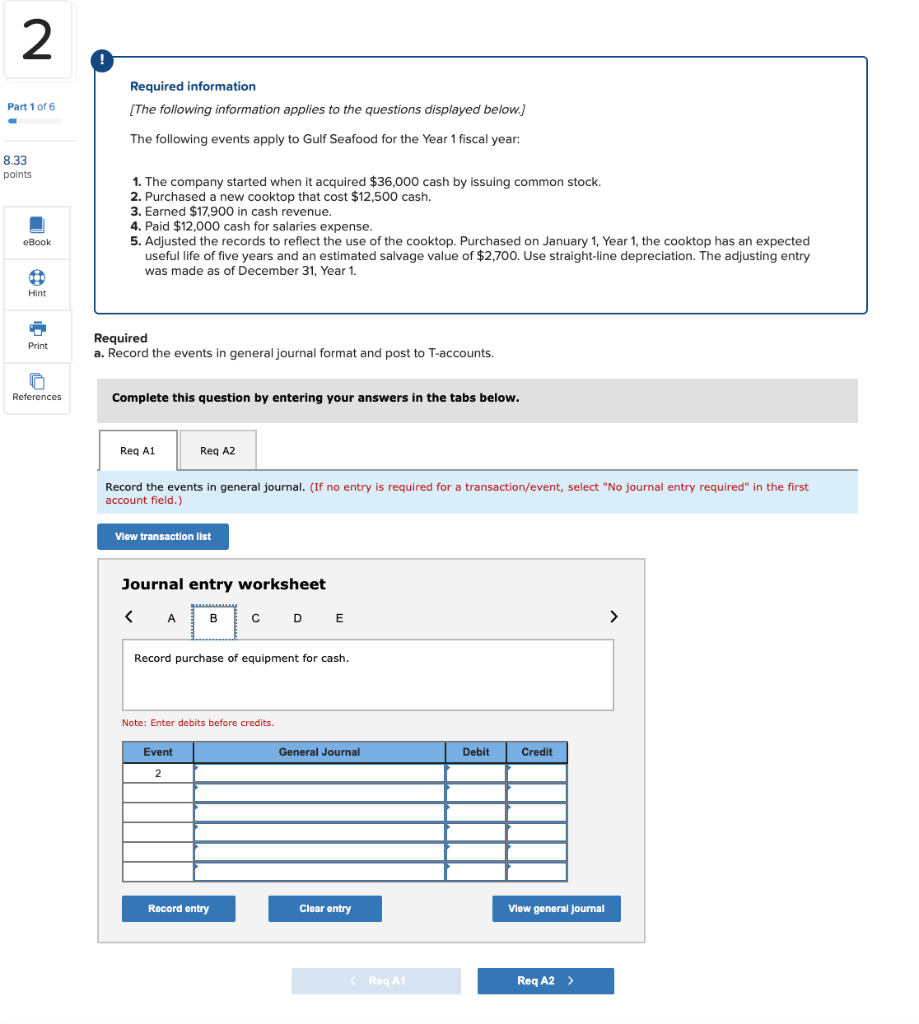

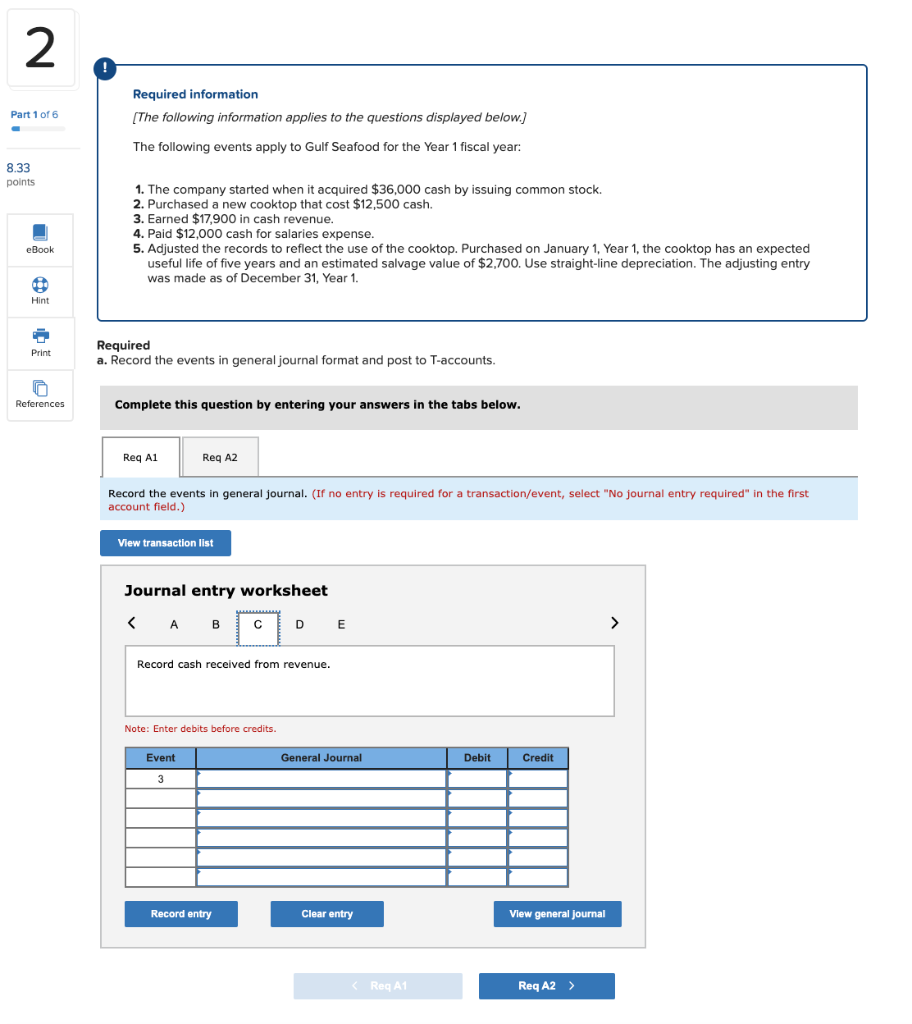

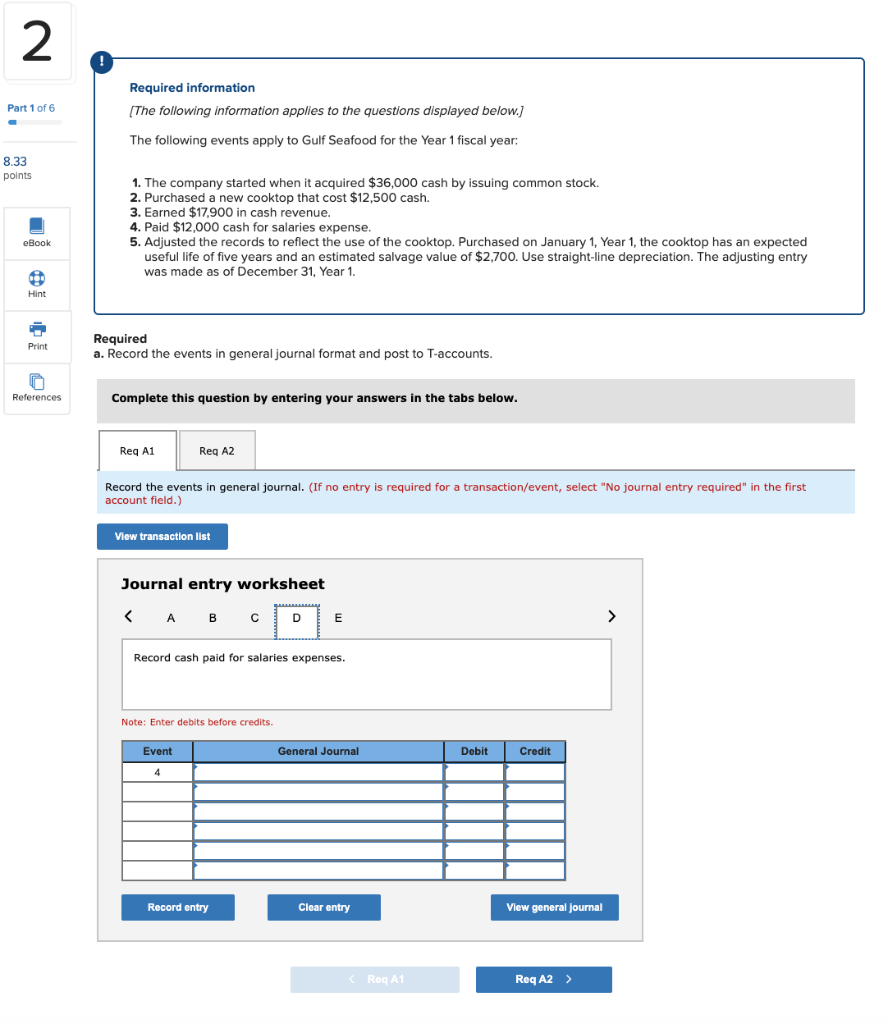

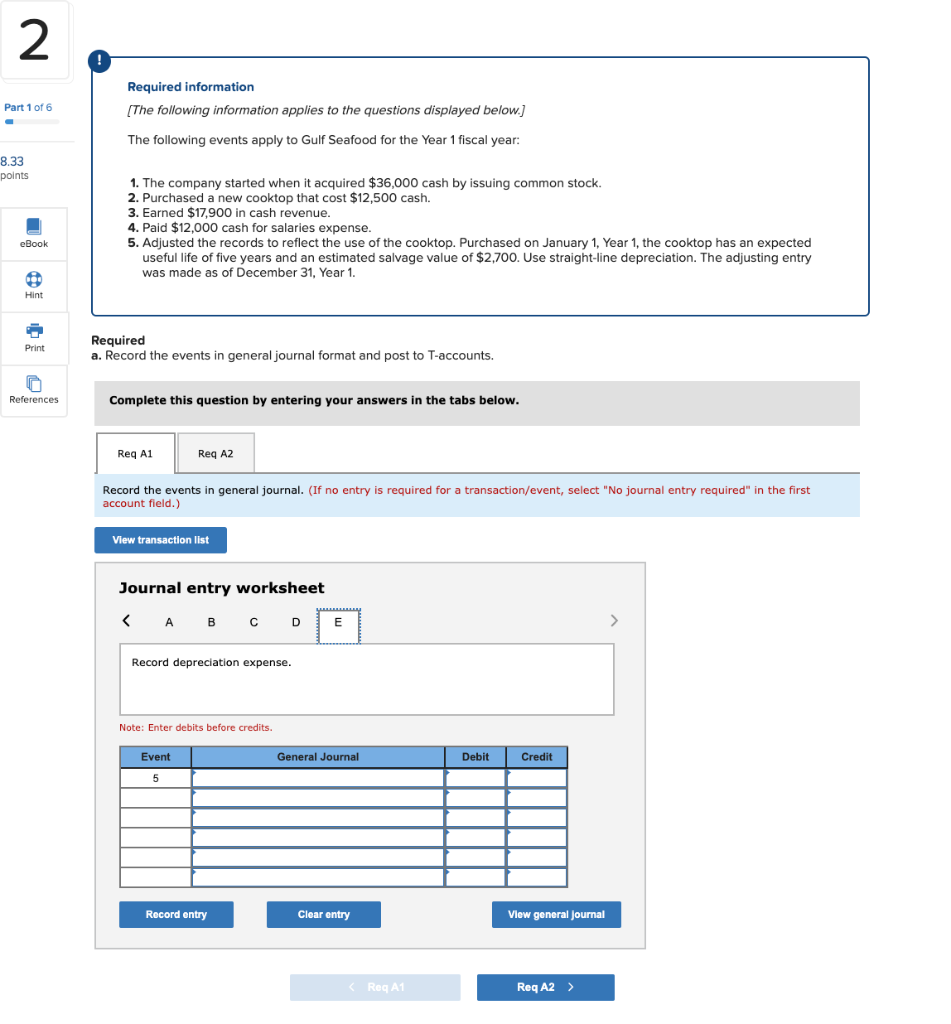

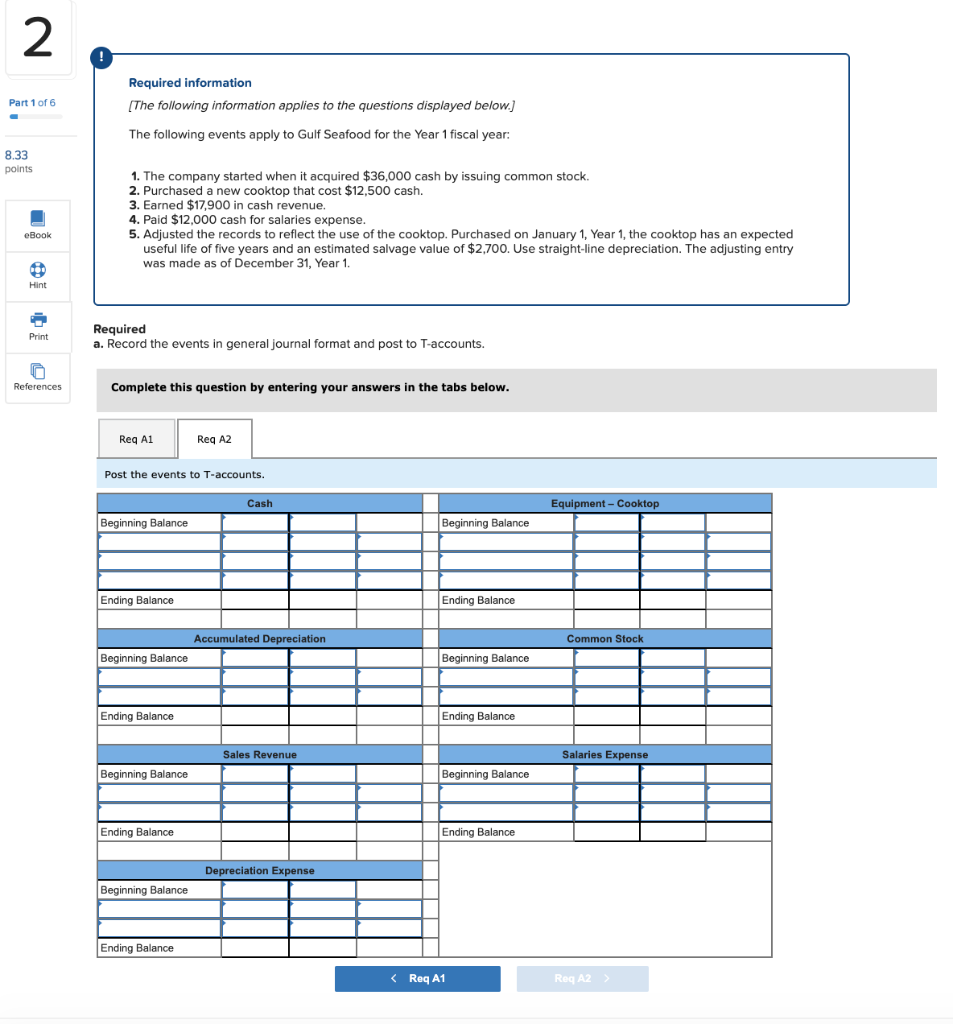

2 Required information [The following information applies to the questions displayed below.) Part 1 of 6 The following events apply to Gulf Seafood for the Year 1 fiscal year: 8.33 points 1. The company started when it acquired $36,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $12,500 cash. 3. Earned $17,900 in cash revenue. 4. Paid $12.000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,700. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. , eBook 8 Hint Print Required a. Record the events in general journal format and post to T-accounts. References Complete this question by entering your answers in the tabs below. Req A1 Req AZ Record the events in general journal. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record entry for issuance of common stock. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general Journal 2 Part 1 of 6 Required information [The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 8.33 points 1. The company started when it acquired $36,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $12,500 cash. 3. Earned $17,900 in cash revenue. 4. Paid $12,000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,700. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. eBook Hint Print Required a. Record the events in general journal format and post to T-accounts. References Complete this question by entering your answers in the tabs below. Req Al Reg A2 Record the events in general journal. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record cash received from revenue. Note: Enter de bits before credits. Event General Journal Debit Credit 3 Record entry Clear entry View general Journal Reg A1 Req A2 > N Part 1 of 6 Required information [The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 8.33 points 1. The company started when it acquired $36,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $12,500 cash. 3. Earned $17,900 cash revenue. 4. Paid $12,000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,700. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. eBook Hint Print Required a. Record the events in general journal format and post to T-accounts. References Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Record the events in general journal. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record cash paid for salaries expenses. Note: Enter debits before credits Event General Journal Debit Credit 4 Record entry Clear entry View general Journal (Reg A1 Req A2 > 2. Part 1 of 6 Required information (The following information applies to the questions displayed below. The following events apply to Gulf Seafood for the Year 1 fiscal year: 8.33 points 1. The company started when it acquired $36,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $12,500 cash. 3. Earned $17,900 in cash revenue. 4. Paid $12,000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,700. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. eBook Hint Print Required a. Record the events in general journal format and post to T-accounts. References Complete this question by entering your answers in the tabs below. Req A1 Reg A2 Record the events in general journal. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet B D E Record depreciation expense. Note: Enter debits before credits. Event General Journal Debit Credit 5 Record entry Clear entry View general Journal Reg A1 Req A2 > 2 Required information Part 1 of 6 6 [The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 8.33 points 1. The company started when it acquired $36,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $12,500 cash. 3. Earned $17,900 in cash revenue. 4. Paid $12.000 cash for salaries expense 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,700. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. eBook Hint Print Required a. Record the events in general journal format and post to T-accounts. References Complete this question by entering your answers in the tabs below. Req A1 Reg A2 Post the events to T-accounts. - Cash Equipment - Cooktop Beginning Balance Beginning Balance Ending Balance Ending Balance Accumulated Depreciation Common Stock Beginning Balance Beginning Balance Ending Balance Ending Balance Sales Revenue Salaries Expense Beginning Balance Beginning Balance Ending Balance Ending Balance Depreciation Expense Beginning Balance Ending Balance