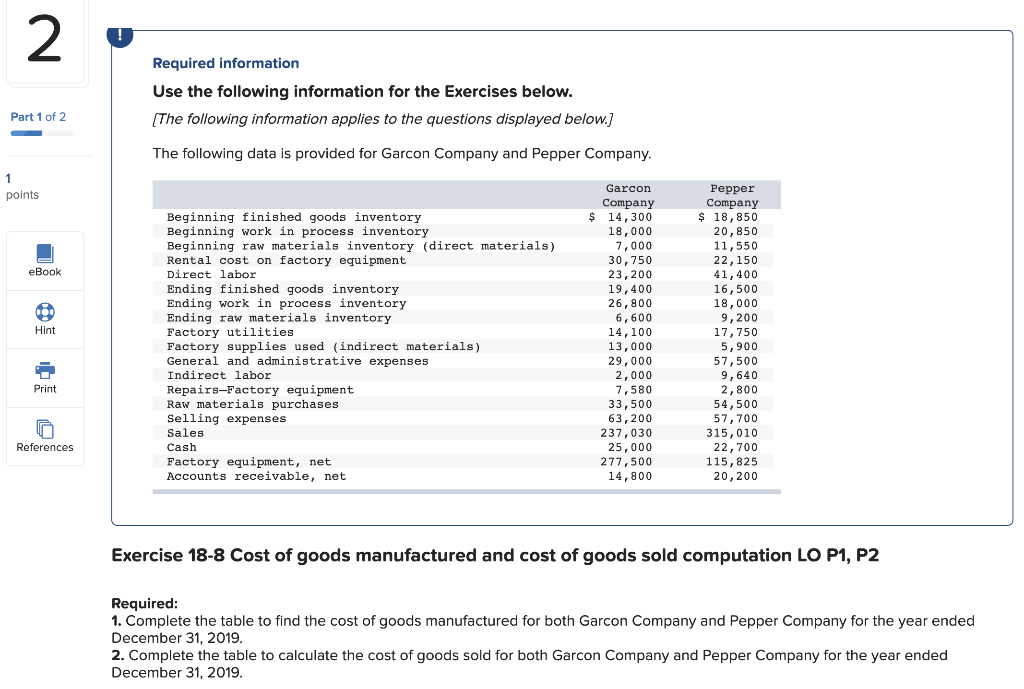

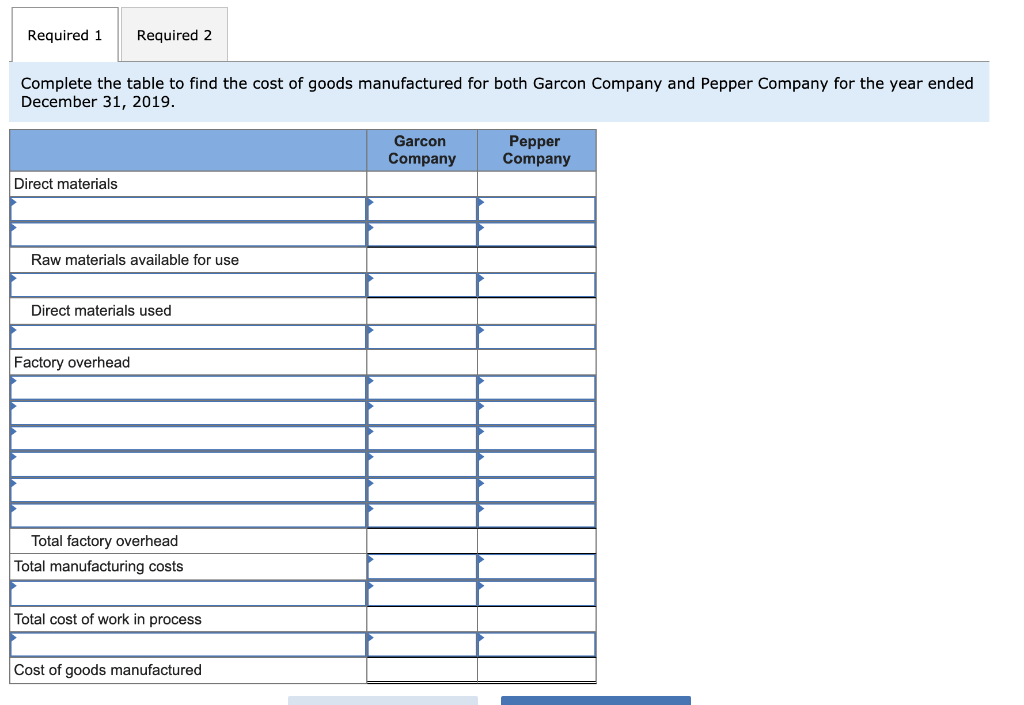

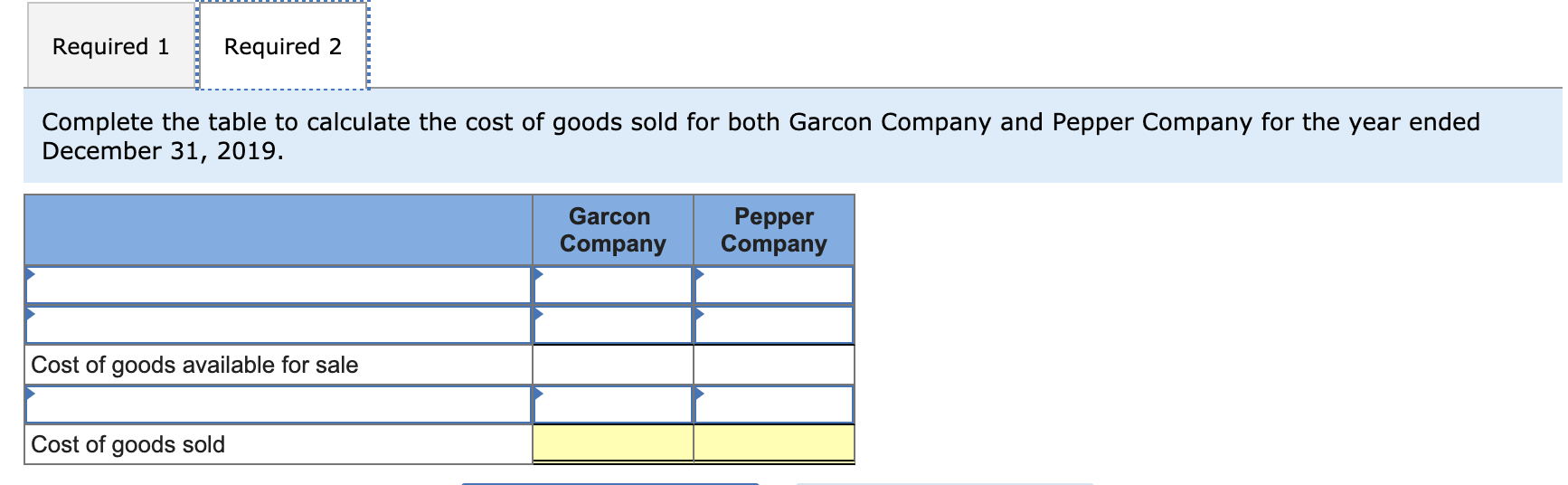

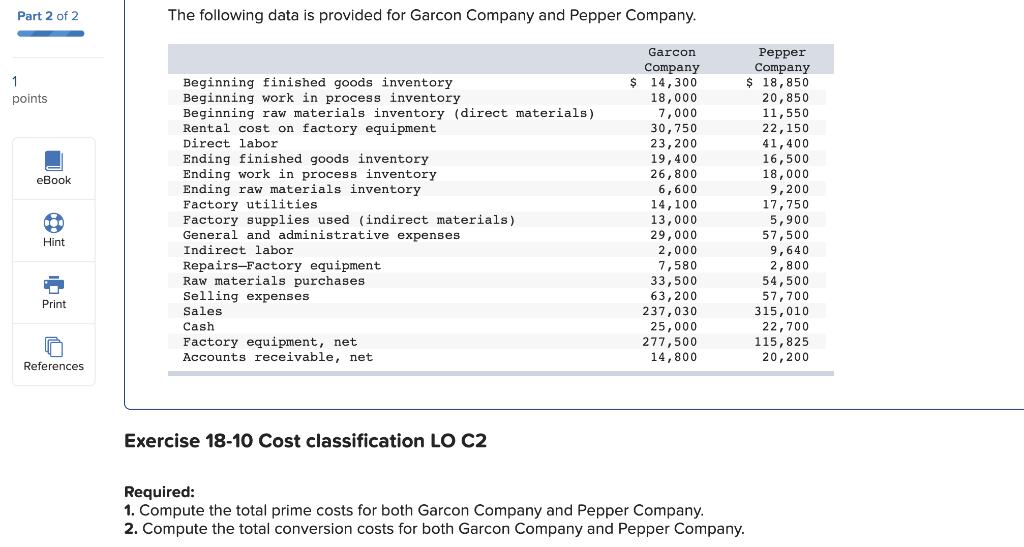

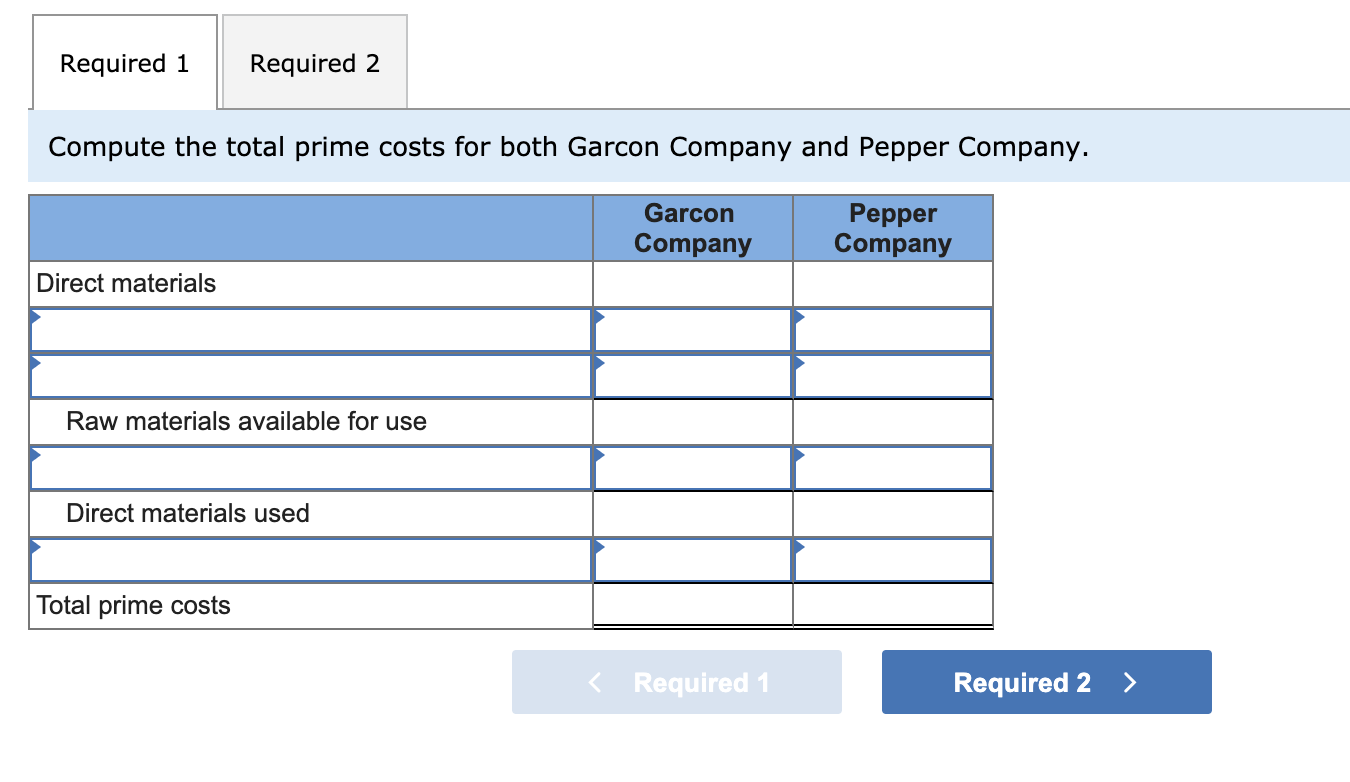

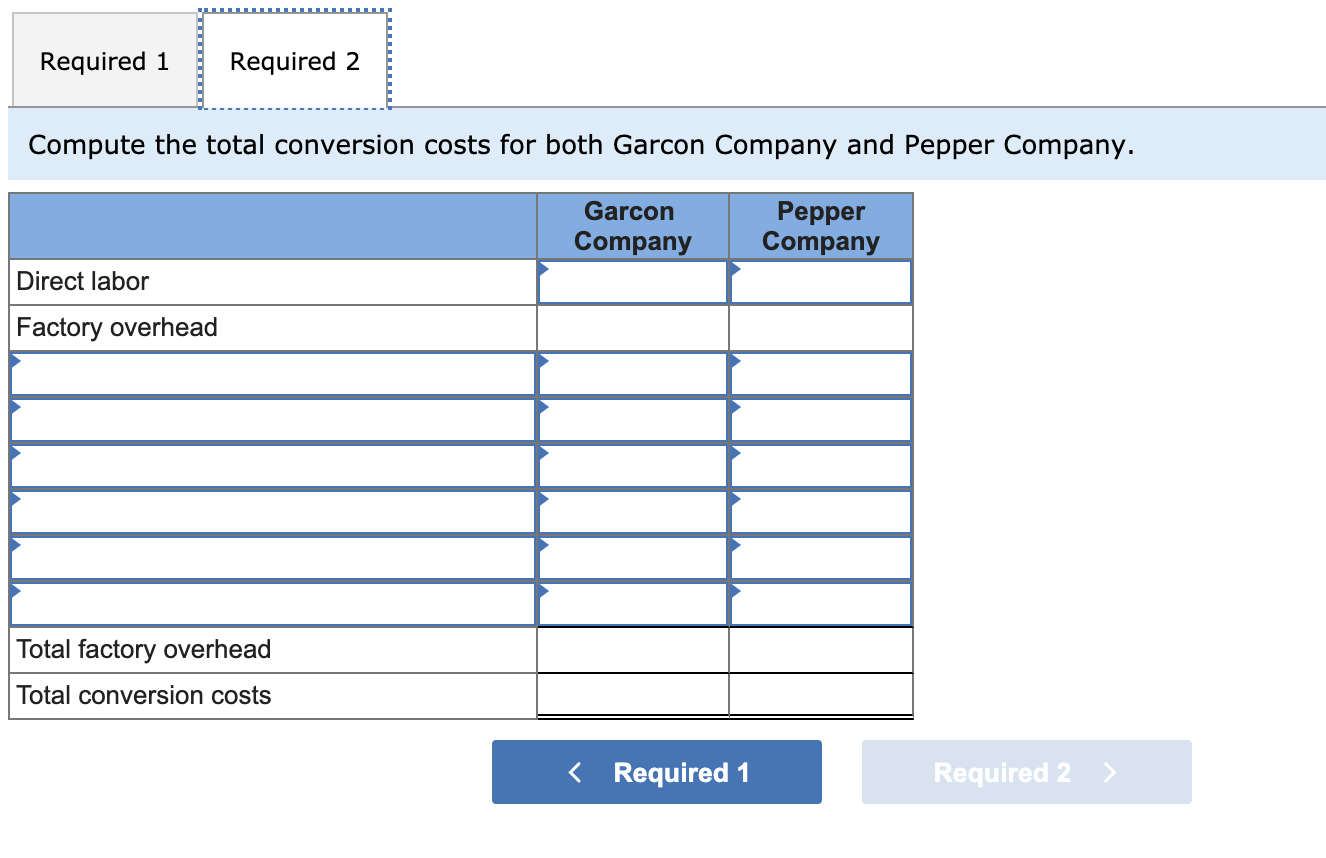

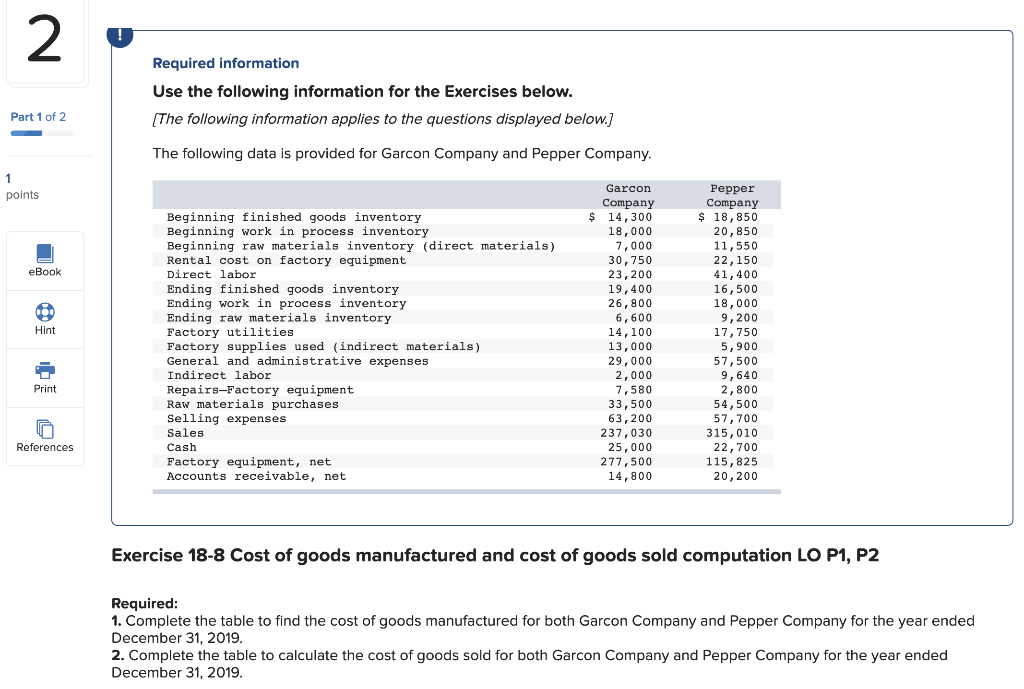

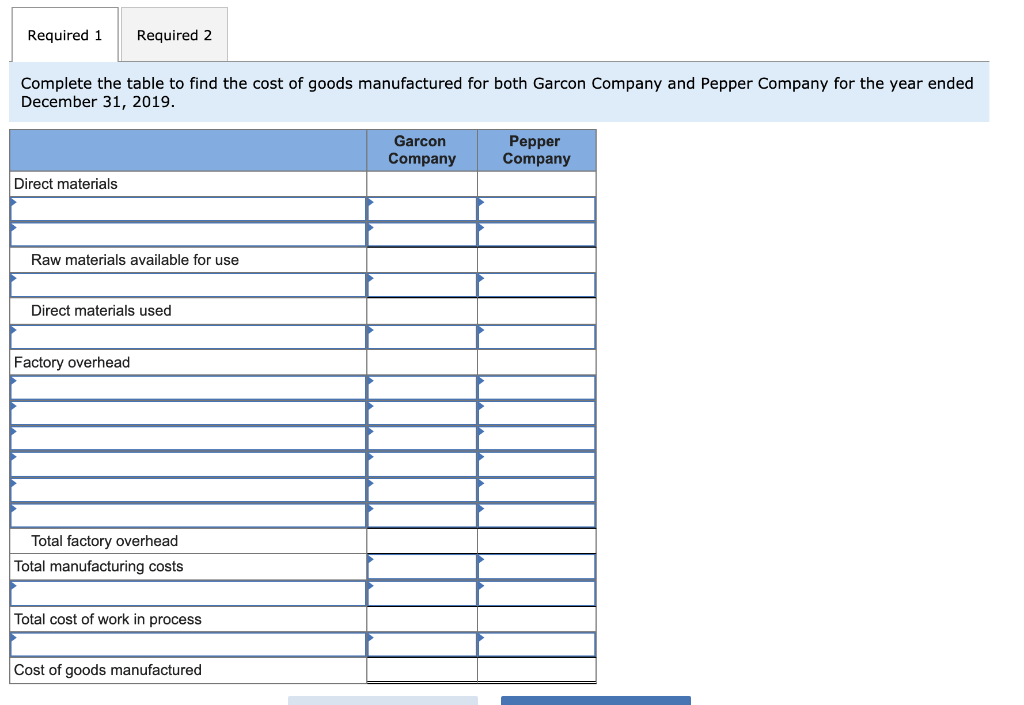

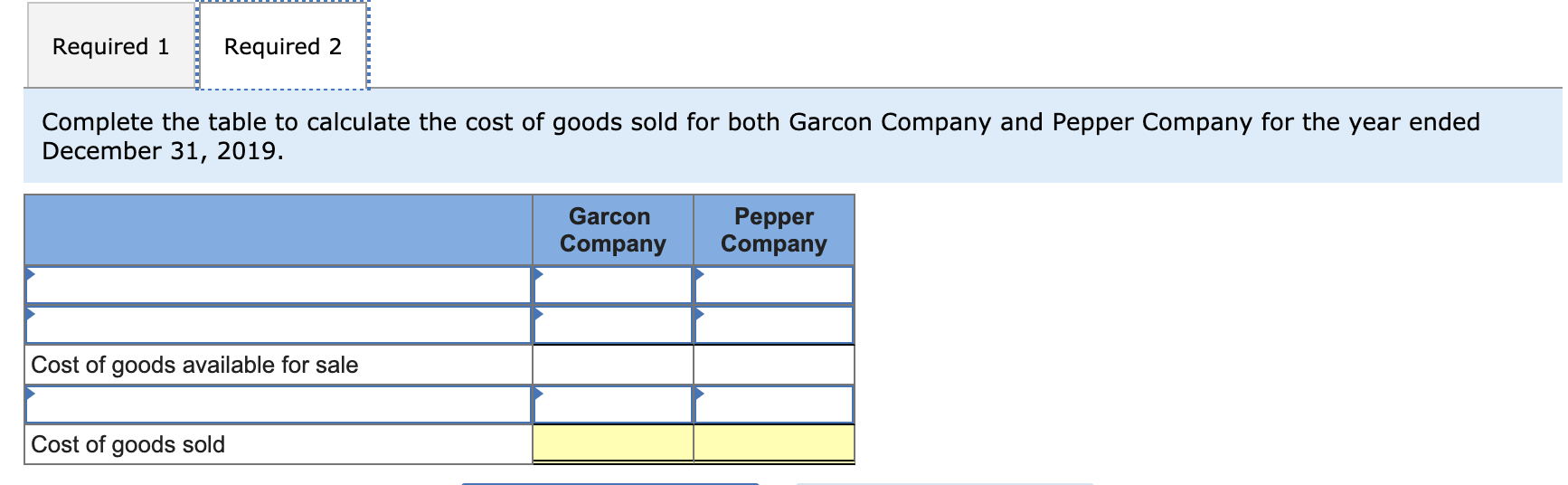

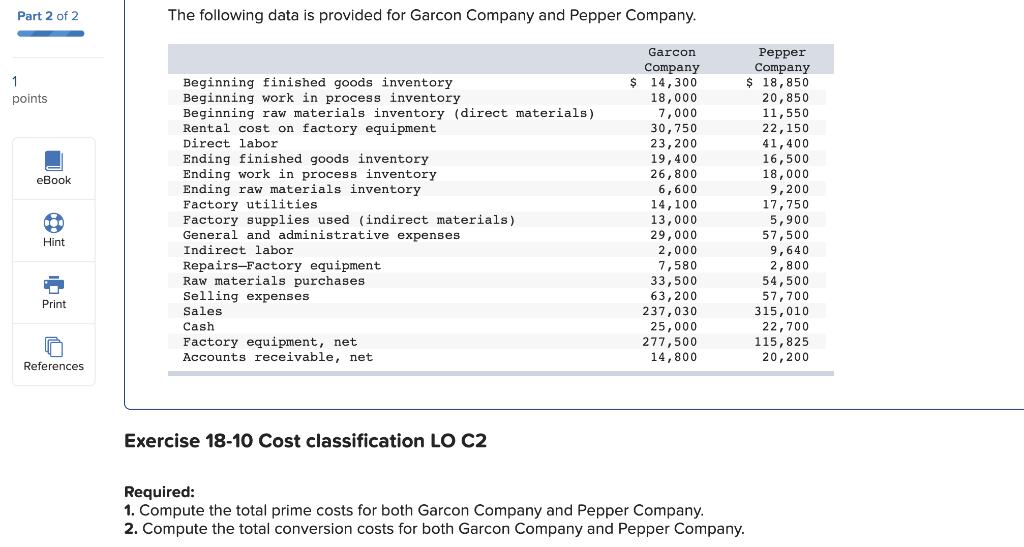

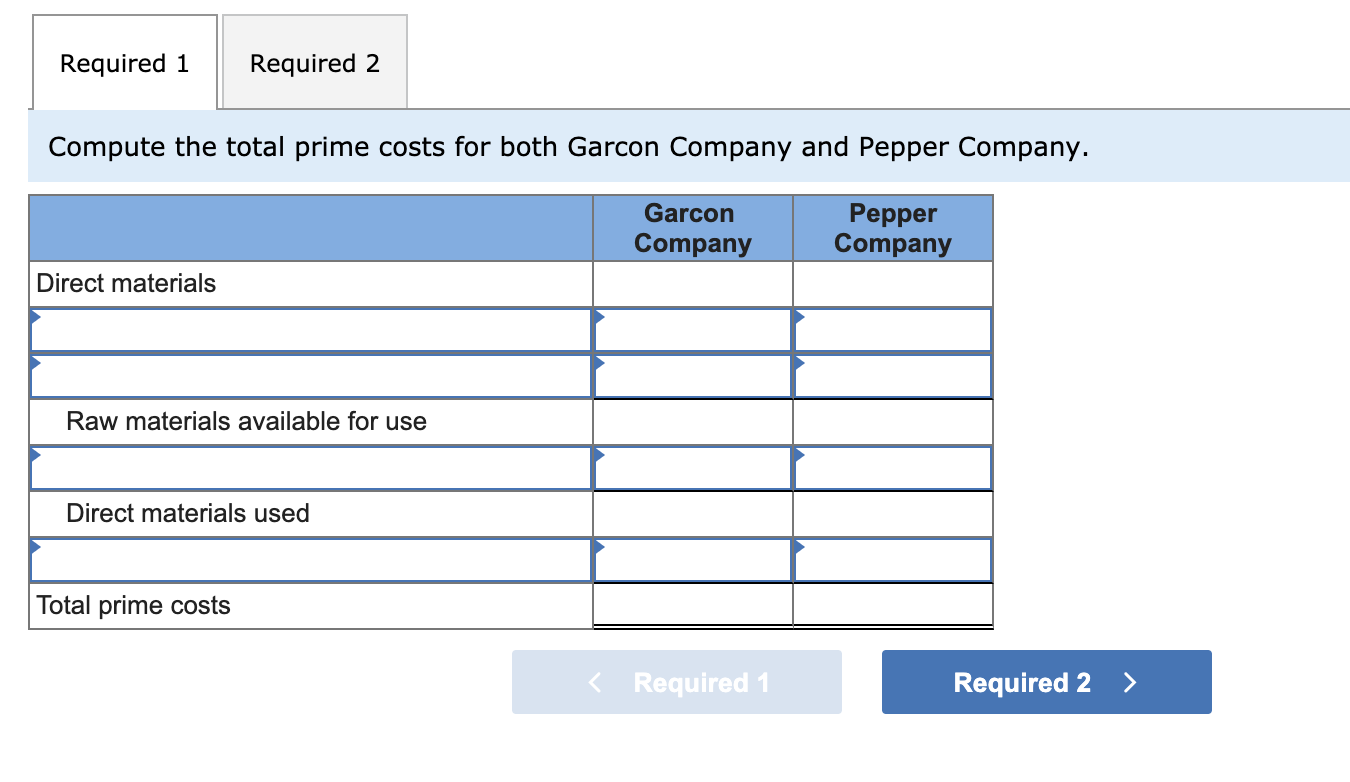

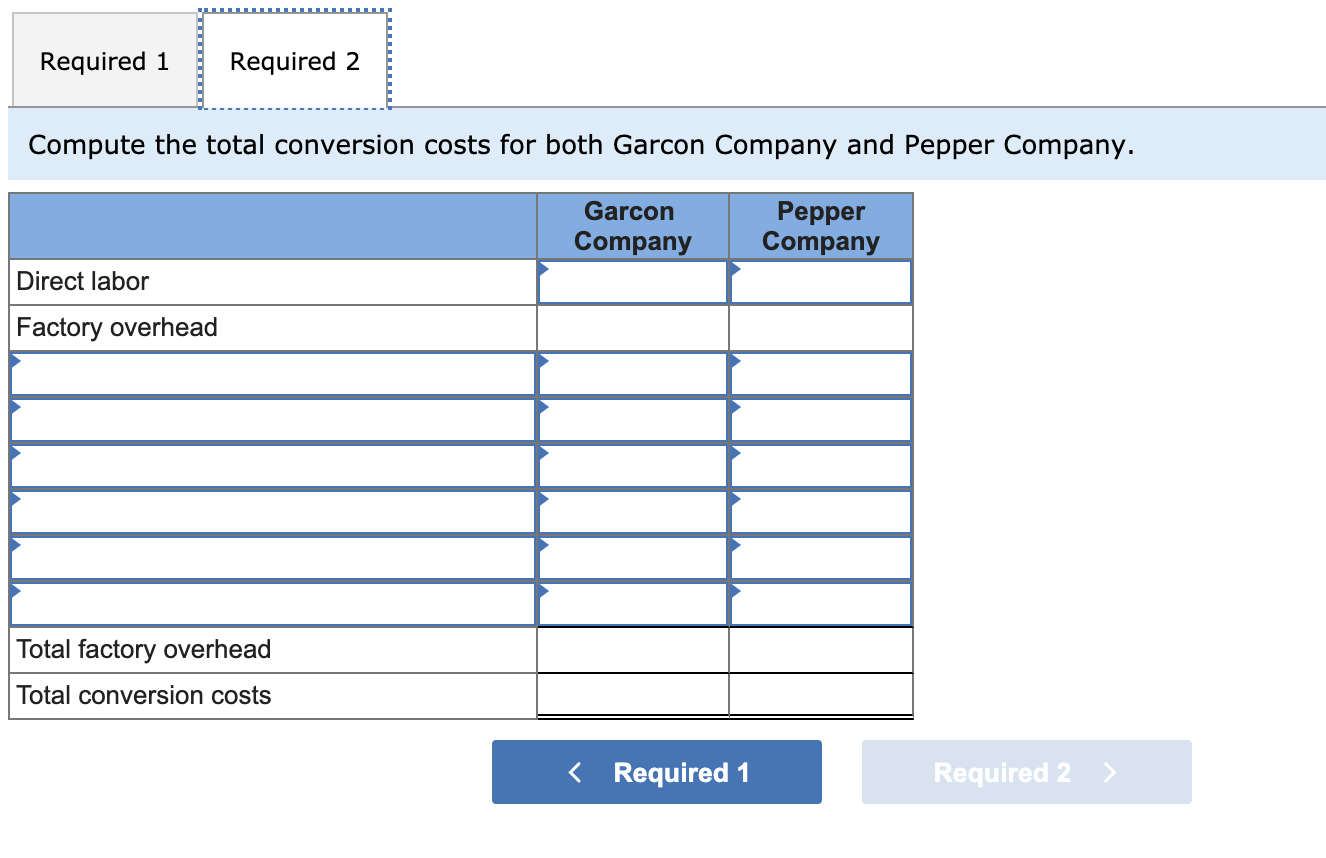

2 Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below.) Part 1 of 2 The following data is provided for Garcon Company and Pepper Company. 1 points eBook Hint Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Factory equipment, net Accounts receivable, net Garcon Company $ 14,300 18,000 7,000 30,750 23,200 19,400 26,800 6,600 14, 100 13,000 29,000 2,000 7,580 33,500 63,200 237,030 25,000 277,500 14,800 Pepper Company $ 18,850 20,850 11,550 22,150 41,400 16,500 18,000 9,200 17,750 5,900 57,500 9,640 2,800 54,500 57,700 315,010 22,700 115,825 20,200 Print References Exercise 18-8 Cost of goods manufactured and cost of goods sold computation LO P1, P2 Required: 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2019. 2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2019 Required 1 Required 2 Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2019. Garcon Company Pepper Company Direct materials Raw materials available for use Direct materials used Factory overhead Total factory overhead Total manufacturing costs Total cost of work in process Cost of goods manufactured Required 1 Required 2 Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2019. Garcon Company Pepper Company Cost of goods available for sale Cost of goods sold Part 2 of 2 The following data is provided for Garcon Company and Pepper Company. points Pepper Company $ 18,850 20,850 11,550 22,150 41,400 16,500 eBook Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Factory equipment, net Accounts receivable, net Garcon Company $ 14,300 18,000 7,000 30,750 23,200 19,400 26,800 6,600 14,100 13,000 29,000 2,000 7,580 33,500 63,200 237,030 25,000 277,500 14,800 18,000 9,200 17,750 5,900 Hint 57,500 9,640 Print 2,800 54,500 57,700 315,010 22,700 115, 825 20,200 References Exercise 18-10 Cost classification LO C2 Required: 1. Compute the total prime costs for both Garcon Company and Pepper Company. 2. Compute the total conversion costs for both Garcon Company and Pepper Company. Required 1 Required 2 Compute the total prime costs for both Garcon Company and Pepper Company. Garcon Company Pepper Company Direct materials Raw materials available for use Direct materials used Total prime costs Required 1 Required 2 Required 1 Required 2 Compute the total conversion costs for both Garcon Company and Pepper Company. Garcon Company Pepper Company Direct labor Factory overhead Total factory overhead Total conversion costs