Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rx Corp wants to acquire all the stock of Vit B corp. Vit B is wholly owned by Honey, an individual shareholder who has

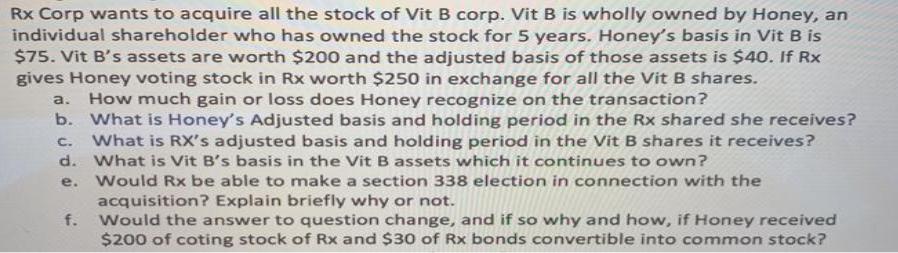

Rx Corp wants to acquire all the stock of Vit B corp. Vit B is wholly owned by Honey, an individual shareholder who has owned the stock for 5 years. Honey's basis in Vit B is $75. Vit B's assets are worth $200 and the adjusted basis of those assets is $40. If Rx gives Honey voting stock in Rx worth $250 in exchange for all the Vit B shares. How much gain or loss does Honey recognize on the transaction? b. What is Honey's Adjusted basis and holding period in the Rx shared she receives? What is RX's adjusted basis and holding period in the Vit B shares it receives? a. C. d. What is Vit B's basis in the Vit B assets which it continues to own? . Would Rx be able to make a section 338 election in connection with the acquisition? Explain briefly why or not. f. Would the answer to question change, and if so why and how, if Honey received $200 of coting stock of Rx and $30 of Rx bonds convertible into common stock?

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

In the Factual Incident Rx Corp wants to acquire all the stock of Vit B corp Vit B is wholly owned by Honey an individual shareholder who has owned the stock for 5 years Honeys basis in Vit B is 75 Vi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started