Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Ryan is entitled to an annuity of $100 000 per year at retirement, paid monthly in advance, and the normal retirement age is

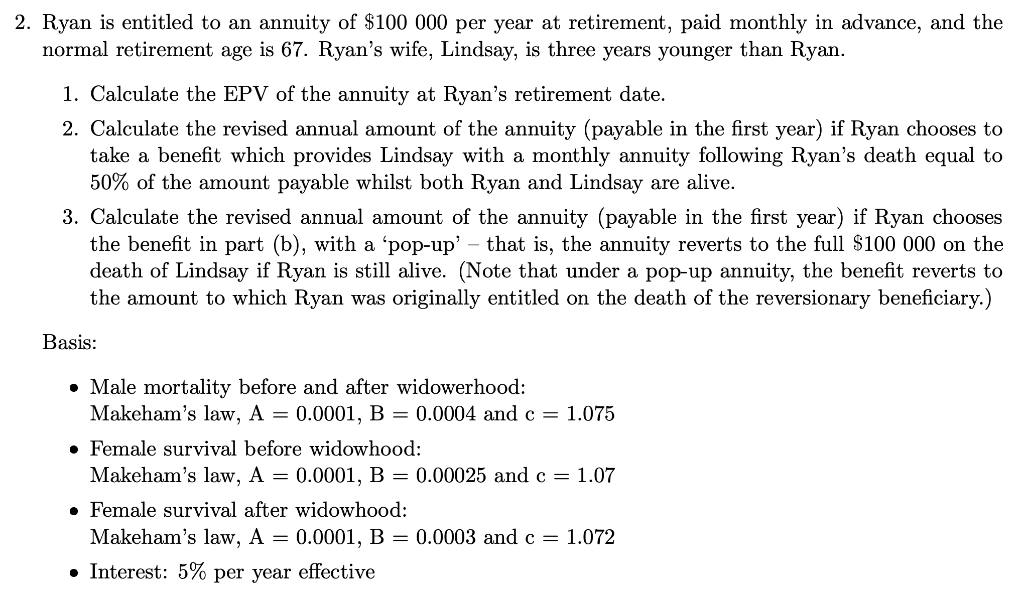

2. Ryan is entitled to an annuity of $100 000 per year at retirement, paid monthly in advance, and the normal retirement age is 67. Ryan's wife, Lindsay, is three years younger than Ryan. 1. Calculate the EPV of the annuity at Ryan's retirement date. 2. Calculate the revised annual amount of the annuity (payable in the first year) if Ryan chooses to take a benefit which provides Lindsay with a monthly annuity following Ryan's death equal to 50% of the amount payable whilst both Ryan and Lindsay are alive. 3. Calculate the revised annual amount of the annuity (payable in the first year) if Ryan chooses the benefit in part (b), with a 'pop-up' - that is, the annuity reverts to the full $100 000 on the death of Lindsay if Ryan is still alive. (Note that under a pop-up annuity, the benefit reverts to the amount to which Ryan was originally entitled on the death of the reversionary beneficiary.) Basis: Male mortality before and after widowerhood: Makeham's law, A = 0.0001, B = 0.0004 and c = : 1.075 Female survival before widowhood: Makeham's law, A = 0.0001, B = 0.00025 and c = 1.07 Female survival after widowhood: Makeham's law, A = 0.0001, B = 0.0003 and c = 1.072 Interest: 5% per year effective

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The EPV of the annuity is the sum of the present value of each payment PV PMT x 1 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started