Answered step by step

Verified Expert Solution

Question

1 Approved Answer

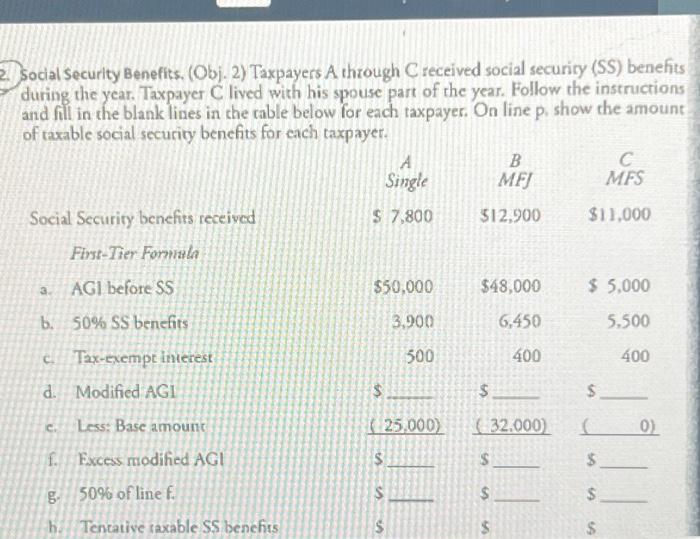

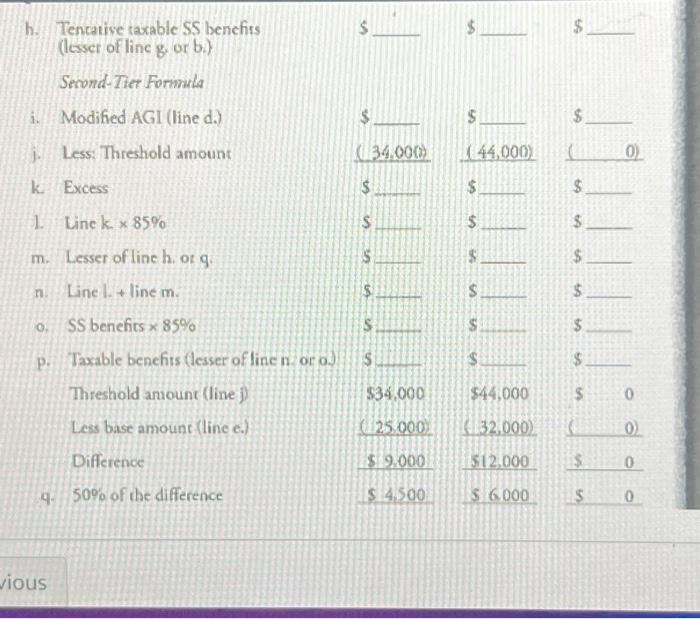

2. Social Security Benefits. (Obj. 2) Taxpayers A through C received social security (SS) benefits during the year. Taxpayer C lived with his spouse part

2. Social Security Benefits. (Obj. 2) Taxpayers A through C received social security (SS) benefits during the year. Taxpayer C lived with his spouse part of the year. Follow the instructions and fill in the blank lines in the table below for each taxpayer. On line p. show the amount of taxable social security benefits for each taxpayer. Social Security benefits received First-Tier Formula AGI before SS b. 50% SS benefits C Tax-exempt interest d. Modified AGI Less: Base amount f. Excess modified AGI 50% of line f. Tentative taxable SS benefits CH B Single $ 7,800 $50,000 3.900 500 [25.000) S B MFJ 312,900 $48,000 6,450 400 $ (32.000) $ C MFS $11,000 $ 5,000 5.500 400 ( 64 ta S 0)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started