Answered step by step

Verified Expert Solution

Question

1 Approved Answer

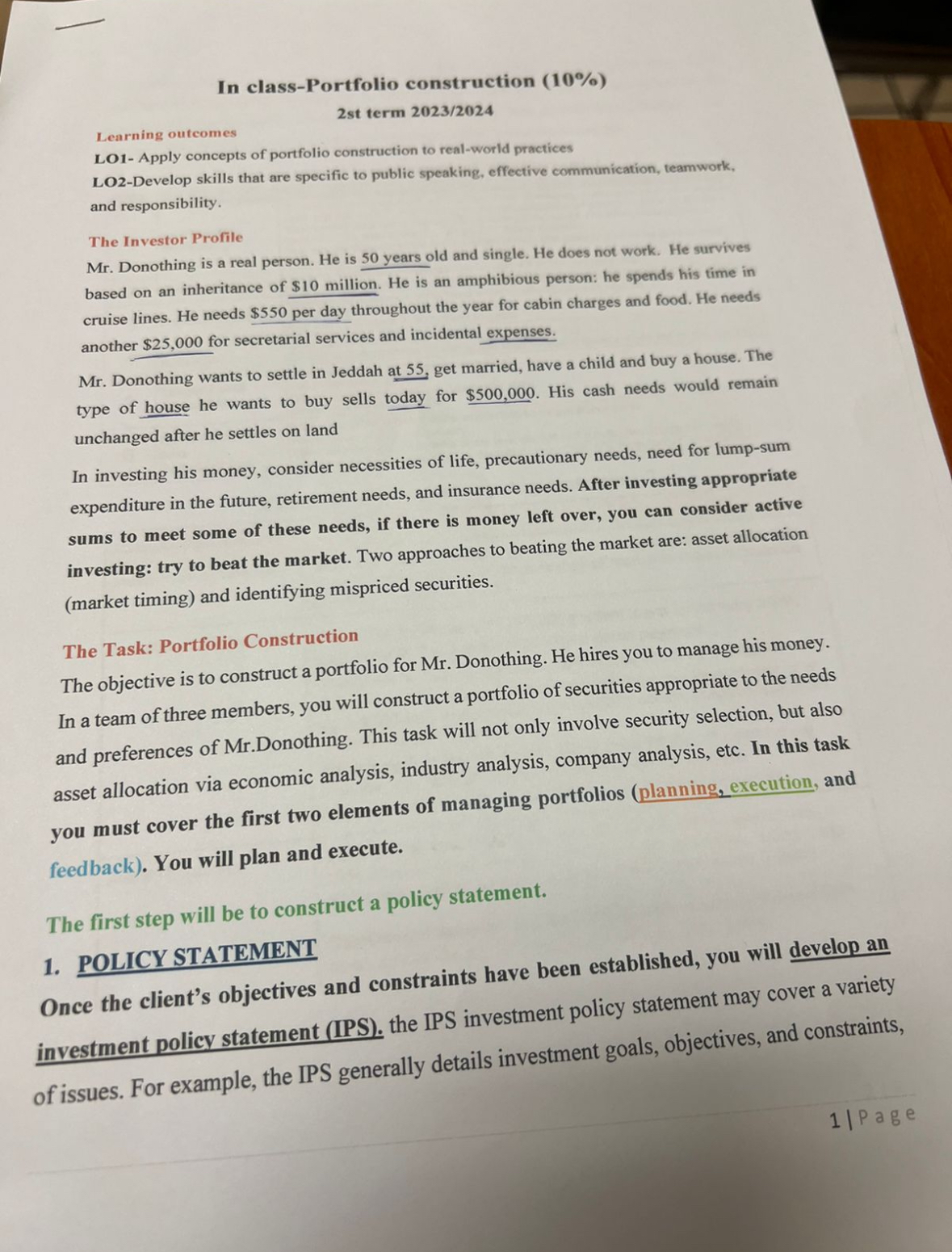

2 st term 2 0 2 3 / 2 0 2 4 Learning outcomes LO 1 - Apply concepts of portfolio construction to real -

st term

Learning outcomes

LO Apply concepts of portfolio construction to realworld practices

LODevelop skills that are specific to public speaking, effective communication, teamwork,

and responsibility.

The Investor Profile

Mr Donothing is a real person. He is years old and single. He does not work. He survives

based on an inheritance of $ million. He is an amphibious person: he spends his time in

cruise lines. He needs $ per day throughout the year for cabin charges and food. He needs

another $ for secretarial services and incidental expenses.

Mr Donothing wants to settle in Jeddah at get married, have a child and buy a house. The

type of house he wants to buy sells today for $ His cash needs would remain

unchanged after he settles on land

In investing his money, consider necessities of life, precautionary needs, need for lumpsum

expenditure in the future, retirement needs, and insurance needs. After investing appropriate

sums to meet some of these needs, if there is money left over, you can consider active

investing: try to beat the market. Two approaches to beating the market are: asset allocation

market timing and identifying mispriced securities

The Task: Portfolio Construction

The objective is to construct a portfolio for Mr Donothing. He hires you to manage his money.

In a team of three members, you will construct a portfolio of securities appropriate to the needs

and preferences of MrDonothing. This task will not only involve security selection, but also

asset allocation via economic analysis, industry analysis, company analysis, etc. In this task

you must cover the first two elements of managing portfolios planning execution, and

feedback You will plan and execute.

The first step will be to construct a policy statement.

POLICY STATEMENT

Once the client's objectives and constraints have been established, you will develop an

investment policy statement IPS the IPS investment policy statement may cover a variety

of issues. For example, the IPS generally details investment goals, objectives, and constraints,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started