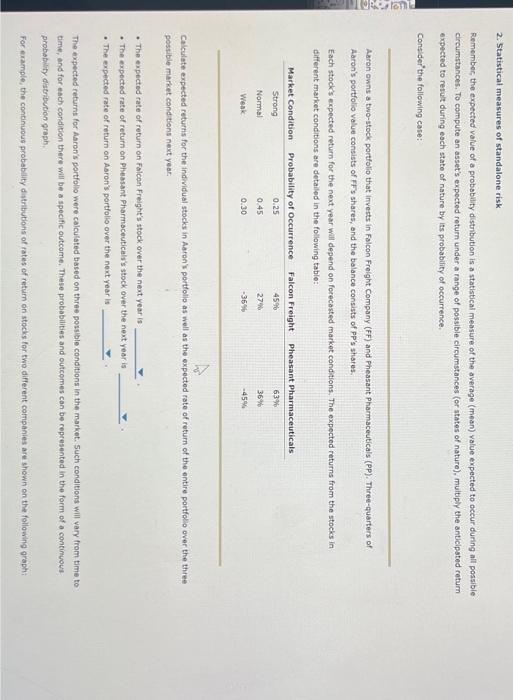

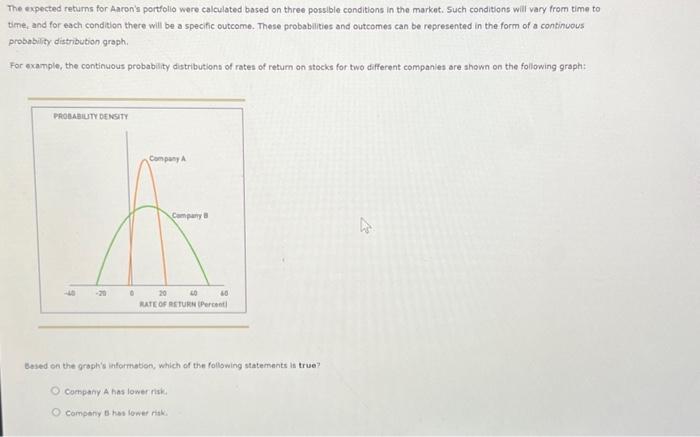

2. Statistical measures of standalone risk Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticlpated retum expected to retult during each state of nature by its probability of occurrence. Consider' the following care: Aaron ewns a two-stock portfolio that imverts in Falcon Freight Company (FF) and Pheasant Pharmaceuticals (PP). Three-quarters of Aaron's portfolio value consists of FF's shares, and the balance consists of PP's shares. Each stock's expected return for the next year will depend on forecasted market conditions, The expected returns from the stocks in different market conditions are detailed in the following table: Calculate expected returns for the individual stocks in Aaron s portfollo as well as the expected rate of return of the entire portfolio over the three possible market conditions next year: - The expected rate of return on Falcon Freight's stock over the neat year is - The expected rate of return on Pheasant Pharmoceuticals's stock over the next year is - The expected rate of return on Asron's portfolio over the next year is The expected refurns for Aaron's pertfollo were calculated based on three posslble conditions in the market. Such conditions will vary from time to time, and for esch condition there will be s specific outcome. These probabilities and outcomes can be cepresented in the form of a continuous probability distributiongraph. For example, the continupus probability distributions of rates of retuin on stocks for two different companies are shown on the following graph: The expected returns for Aaron's portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph. For example, the continuous probability distributions of rates of retum on stocks for two different companies are shewn on the following graph: Based on the graph's information, which of the following statements is true? Company A has lower risk. Company is hisi tonet itive