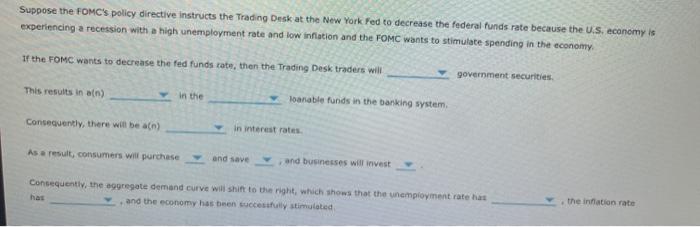

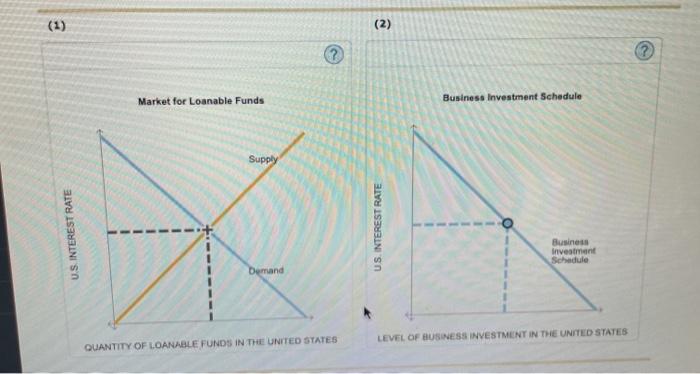

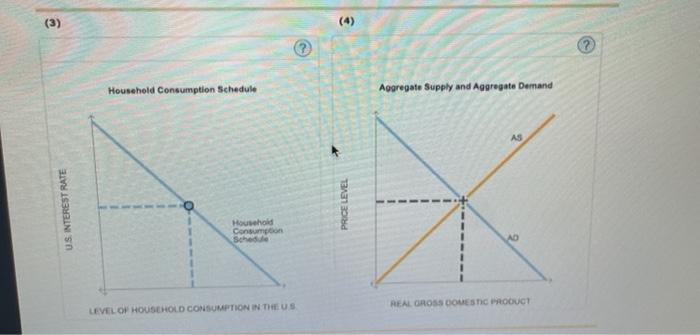

2. Stimulative monetary policy Which of the following are the result of a stimulative monetary policy? Check all that apply. A firm's cost of debt decreases. Depository Institutions experience a decrease in their supply of funds. A firm's cost of debt increases. Depository institutions experience an increase in their supply of funds. The following graphs represent (1) The Market for Loanable Funds, (2) The Business Investment Schedule, (3) The Household Consumption Schedule, and (4) The Aggregate Supply and Aggregate Demand Model within the U.S. economy The aggregate supply and aggregate demand model (4) examines the relationship between changes in national income (real gross domestic product) and changes in the price level (inflation). The aggregate demand curve shows the relationship between the price level and the total amount of money spent on those goods and services. It is downward sioping because people tend to purchase more goods and services as prices decrease, and less goods and services when prices increase. The components that make up the aggregate demand curve are consumption Spending (C). Investment (1), Government Expenditures (G), and Net Exports (NX). The aggregate supply curve shows the relationship between the price level and the total amount of output firms will produce and sell. It is upward sloping because businesses tend to produce more goods and services when prices increase, and less goods and services when prices decrease. Use the graphs to show what happens in the given scenario and to help answer the questions that follow. (Note: You will not be graded on any changes you make to the graph) Suppose the FOMC's policy directive instructs the Trading Desk at the New York Fed to decrease the federal funds rate because the U.S. economy is experiencing a recession with a high unemployment rate and low inflation and the FOMC wants to stimulate spending in the economy, if the FOMC wants to decrease the fed funds rate, then the Trading Desk traders will government securities This results in an) in the loanable funds in the banking system, Consequently, there will be an) in interest rates As a result, consumers will purchase and save and businesses will invest Consequently, the aggregate demand curve will shift to the right, which shows that the unemployment rate has has and the economy has been successfully stimulated the ination rate (1) (2) Market for Loanable Funds Business Investment Schedule Supply U.S. INTEREST RATE US. INTEREST RATE Business Investment Schedule Demand LEVEL OF BUSINESS INVESTMENT IN THE UNITED STATES QUANTITY OF LOANABLE FUNDS IN THE UNITED STATES (3) (4) Household Consumption Schedule Aggregate Supply and Aggregate Demand AS U.S. INTEREST RATE PRICE LEVEL Household Consumo REAL GROSS DOES TIC PRODUCT LEVEL OF HOUSEHOLD CONSUMPTION IN THE US