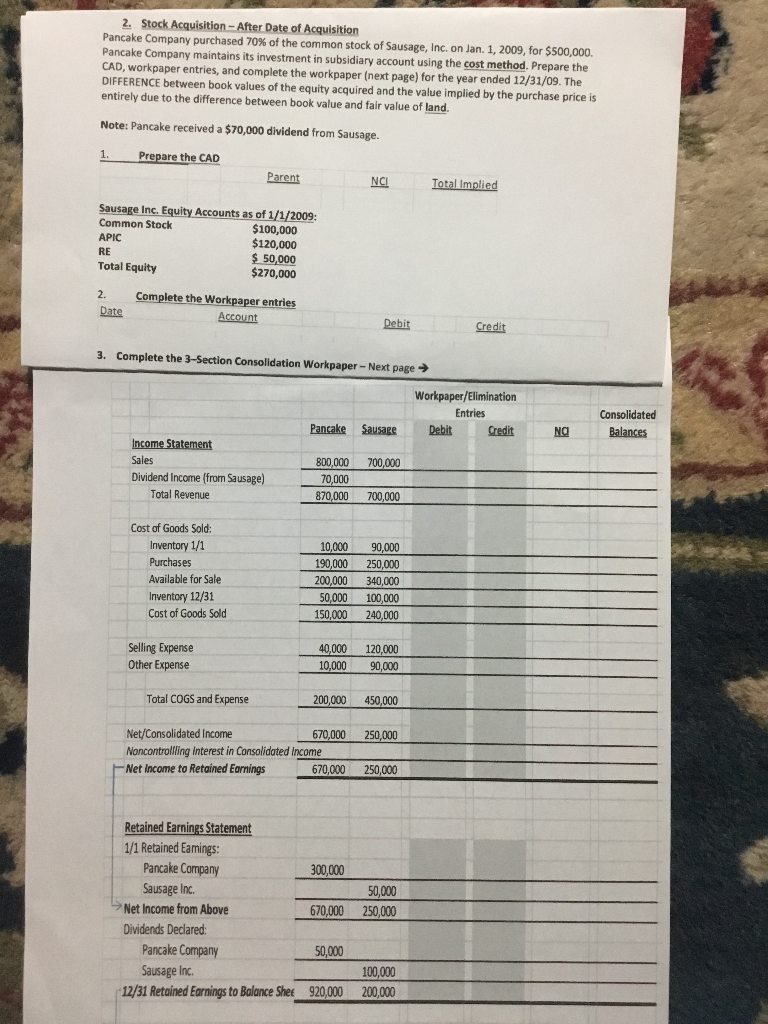

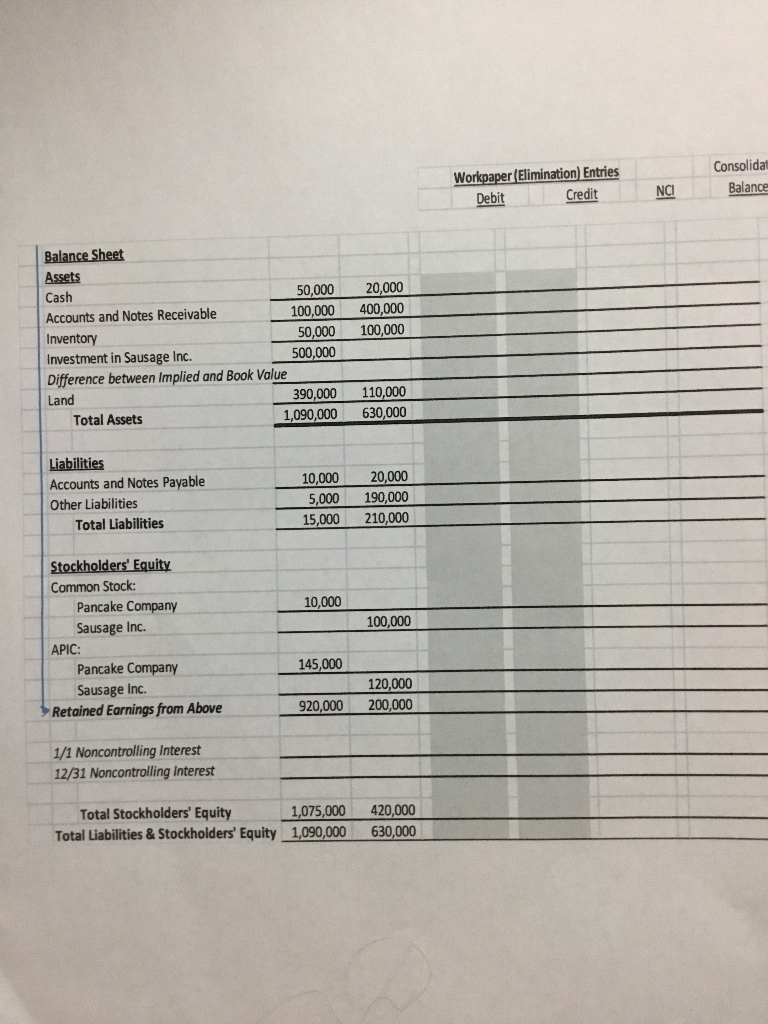

2. Stock Acquisition-After Date of Acquisition Pancake Company purchased 70% of the common stock of Sausage, inc. on Jan. 1, 2008, for SSCO,000. Pancake Company maintains its investment in subsidiary account using the cost method. Prepare the CAD, workpaper entries, and complete the workpaper (next page) for the year ended 12/31/09. The DIFFERENCE between book values of the equity acquired and the value implied by the purchase price is entirely due to the difference between book value and fair value of land Note: Pancake received a $70,000 dividend from Sausage 1. Prepare the CAD Parent Total Implied Sausage Inc. Equity Accounts as of 1/1/2009: Common Stock APIC RE Total Equity $100,000 $120,000 $50,000 $270,000 2. Date Complete the Workpaper entries Account Debit Credit 3. Complete the 3-Section Consolidation Workpaper-Next page Workpaper/Elimination Entries Consolidated Pancake Sausage Debit CreditBalances 800,000 70,00 870,000 700,000 Sales Dividend Income (from Sausage)70,000 Total Revenue Cost of Goods Sold: Inventory 1/1 Purchases Available for Sale Inventory 12/31 Cost of Goods Sold 10,000 90,000 190,000 250,000 200,000 340,000 0,000 100,000 50,000 240,000 Selling Expense Other Expense 0,000 120,000 0,000 90,000 Total COGS and Expense 200,000 450,000 Net/Consolidated Income Noncontrolling Interest in Consolidoted Income Net Income to Retained Earnings 670,000 250,000 670,000 250,000 Retained Earnings Statement 1/1 Retained Eamings 300,000 670,000 250,000 50,000 Pancake Company Sausage Inc. 50,000 Net Income from Above Dividends Declared Pancake Company Sausage Inc 100,000 12/31 Retained Earnings to Balance Shee 920,000 200,000 Consolidat Workpaper Elimination) Entries DebitCreditNBalance Balance Sheet Assets Cash Accounts and Notes Receivable Inventory Investment in Sausage Inc. Difference between Implied and Book Value Land 50,000 20,000 100,000 400,000 50,000 100,000 500,000 390,000 110,000 Total Assets 1.090,000 630,000 Accounts and Notes Payable Other Liabilities 10,000 20,000 ,000 190,000 15,000 210,000 Total Liabilities Stockholders' Equity Common Stock Pancake Company Sausage Inc. 10,000 100,000 APIC: Pancake Company Sausage Inc. 145,000 120,000 Retained Earnings from Above 920,000 200,000 1/1 Noncontrolling Interest 12/31 Noncontrolling Interest Total Stockholders' Equity 1,075,000 420,000 Total Liabilities & Stockholders Equity 1,090,000 630,000 2. Stock Acquisition-After Date of Acquisition Pancake Company purchased 70% of the common stock of Sausage, inc. on Jan. 1, 2008, for SSCO,000. Pancake Company maintains its investment in subsidiary account using the cost method. Prepare the CAD, workpaper entries, and complete the workpaper (next page) for the year ended 12/31/09. The DIFFERENCE between book values of the equity acquired and the value implied by the purchase price is entirely due to the difference between book value and fair value of land Note: Pancake received a $70,000 dividend from Sausage 1. Prepare the CAD Parent Total Implied Sausage Inc. Equity Accounts as of 1/1/2009: Common Stock APIC RE Total Equity $100,000 $120,000 $50,000 $270,000 2. Date Complete the Workpaper entries Account Debit Credit 3. Complete the 3-Section Consolidation Workpaper-Next page Workpaper/Elimination Entries Consolidated Pancake Sausage Debit CreditBalances 800,000 70,00 870,000 700,000 Sales Dividend Income (from Sausage)70,000 Total Revenue Cost of Goods Sold: Inventory 1/1 Purchases Available for Sale Inventory 12/31 Cost of Goods Sold 10,000 90,000 190,000 250,000 200,000 340,000 0,000 100,000 50,000 240,000 Selling Expense Other Expense 0,000 120,000 0,000 90,000 Total COGS and Expense 200,000 450,000 Net/Consolidated Income Noncontrolling Interest in Consolidoted Income Net Income to Retained Earnings 670,000 250,000 670,000 250,000 Retained Earnings Statement 1/1 Retained Eamings 300,000 670,000 250,000 50,000 Pancake Company Sausage Inc. 50,000 Net Income from Above Dividends Declared Pancake Company Sausage Inc 100,000 12/31 Retained Earnings to Balance Shee 920,000 200,000 Consolidat Workpaper Elimination) Entries DebitCreditNBalance Balance Sheet Assets Cash Accounts and Notes Receivable Inventory Investment in Sausage Inc. Difference between Implied and Book Value Land 50,000 20,000 100,000 400,000 50,000 100,000 500,000 390,000 110,000 Total Assets 1.090,000 630,000 Accounts and Notes Payable Other Liabilities 10,000 20,000 ,000 190,000 15,000 210,000 Total Liabilities Stockholders' Equity Common Stock Pancake Company Sausage Inc. 10,000 100,000 APIC: Pancake Company Sausage Inc. 145,000 120,000 Retained Earnings from Above 920,000 200,000 1/1 Noncontrolling Interest 12/31 Noncontrolling Interest Total Stockholders' Equity 1,075,000 420,000 Total Liabilities & Stockholders Equity 1,090,000 630,000