Answered step by step

Verified Expert Solution

Question

1 Approved Answer

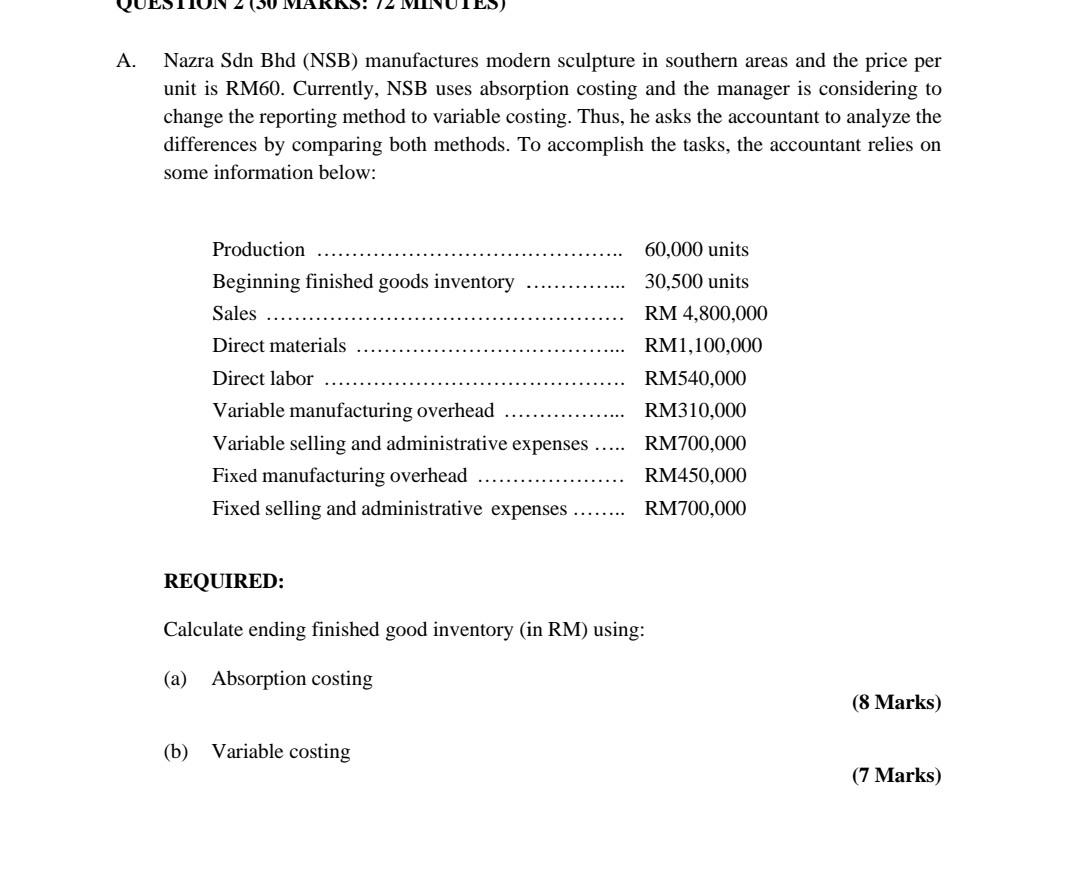

2 SU MARKS: 12 A. Nazra Sdn Bhd (NSB) manufactures modern sculpture in southern areas and the price per unit is RM60. Currently, NSB uses

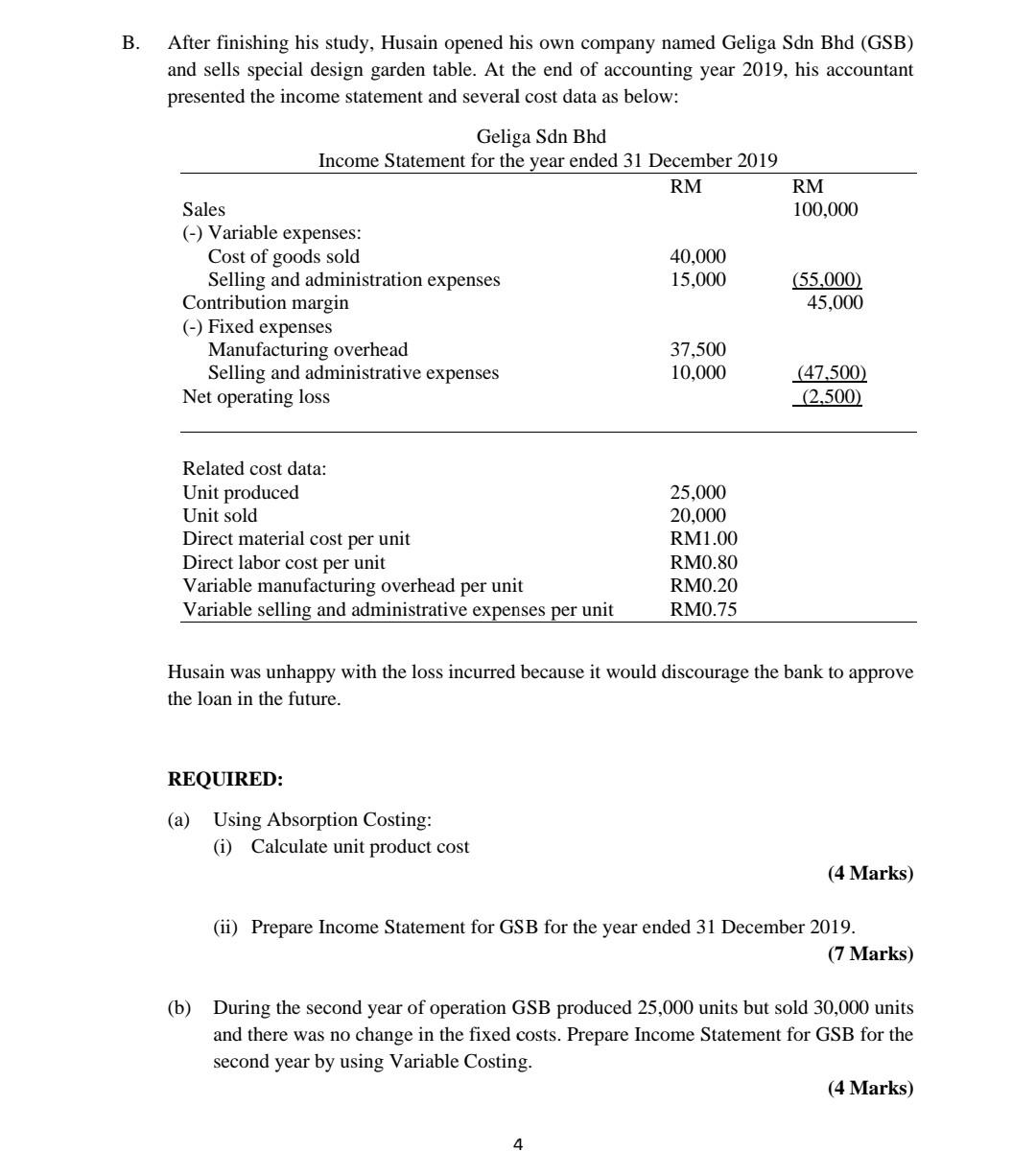

2 SU MARKS: 12 A. Nazra Sdn Bhd (NSB) manufactures modern sculpture in southern areas and the price per unit is RM60. Currently, NSB uses absorption costing and the manager is considering to change the reporting method to variable costing. Thus, he asks the accountant to analyze the differences by comparing both methods. To accomplish the tasks, the accountant relies on some information below: Production Beginning finished goods inventory Sales .... Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative expenses 60,000 units 30,500 units RM 4,800,000 RM1,100,000 RM540,000 RM310,000 RM700,000 RM450,000 RM700,000 REQUIRED: Calculate ending finished good inventory (in RM) using: (a) Absorption costing (8 Marks) (b) Variable costing (7 Marks) B. After finishing his study, Husain opened his own company named Geliga Sdn Bhd (GSB) and sells special design garden table. At the end of accounting year 2019, his accountant presented the income statement and several cost data as below: RM 100,000 Geliga Sdn Bhd Income Statement for the year ended 31 December 2019 RM Sales (-) Variable expenses: Cost of goods sold 40,000 Selling and administration expenses 15,000 Contribution margin (-) Fixed expenses Manufacturing overhead 37,500 Selling and administrative expenses 10,000 Net operating loss (55,000) 45,000 (47.500) (2.500) Related cost data: Unit produced Unit sold Direct material cost per unit Direct labor cost per unit Variable manufacturing overhead per unit Variable selling and administrative expenses per unit 25,000 20,000 RM1.00 RM0.80 RM0.20 RM0.75 Husain was unhappy with the loss incurred because it would discourage the bank to approve the loan in the future. REQUIRED: (a) Using Absorption Costing: (i) Calculate unit product cost (4 Marks) (ii) Prepare Income Statement for GSB for the year ended 31 December 2019. (7 Marks) (b) During the second year of operation GSB produced 25,000 units but sold 30,000 units and there was no change in the fixed costs. Prepare Income Statement for GSB for the second year by using Variable Costing. (4 Marks) 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started