Question

2: Suppose an investor is considering an investment of 200,000 in the stock of XYZ co or ABC co. hoping to gain dividend and selling

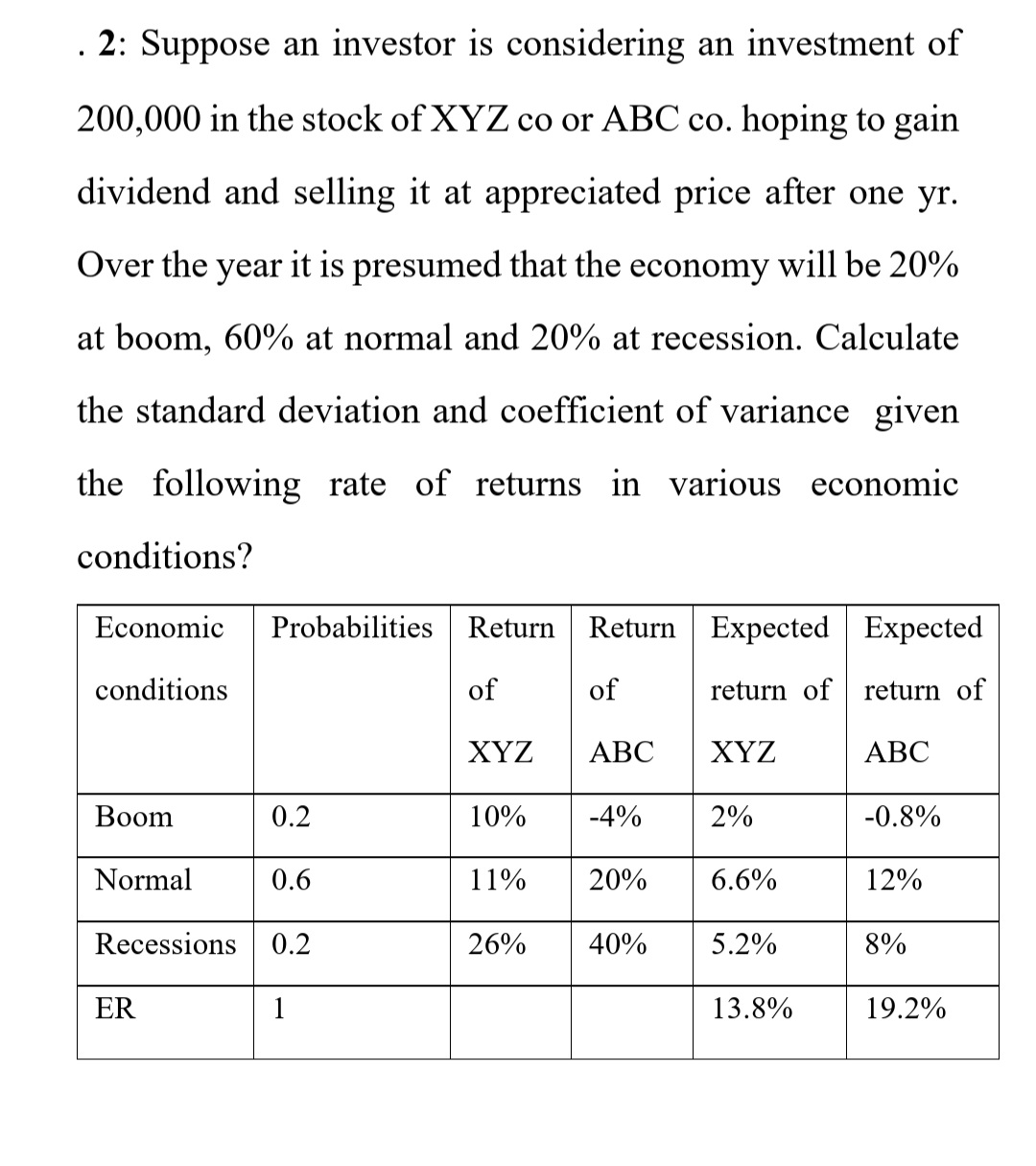

2: Suppose an investor is considering an investment of 200,000 in the stock of XYZ co or ABC co. hoping to gain dividend and selling it at appreciated price after one yr. Over the year it is presumed that the economy will be 20% at boom, 60% at normal and 20% at recession. Calculate the standard deviation and coefficient of variance given the following rate of returns in various economic conditions? {:[" Economic "],[" conditions "]:} Probabilities {:[" Return "],[" of "],[XYZ]:} {:[" Return "],[" of "],[ABC]:} {:[" Expected "],[" return of "],[XYZ]:} {:[" Expected "],[" return of "],[ABC]:} Boom 0.2 10% -4% 2% -0.8% Normal 0.6 11% 20% 6.6% 12% Recessions 0.2 26% 40% 5.2% 8% ER 1 13.8%

2: Suppose an investor is considering an investment of 200,000 in the stock of XYZ co or ABC co. hoping to gain dividend and selling it at appreciated price after one yr. Over the year it is presumed that the economy will be 20% at boom, 60% at normal and 20% at recession. Calculate the standard deviation and coefficient of variance given the following rate of returns in various economic conditionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started