Answered step by step

Verified Expert Solution

Question

1 Approved Answer

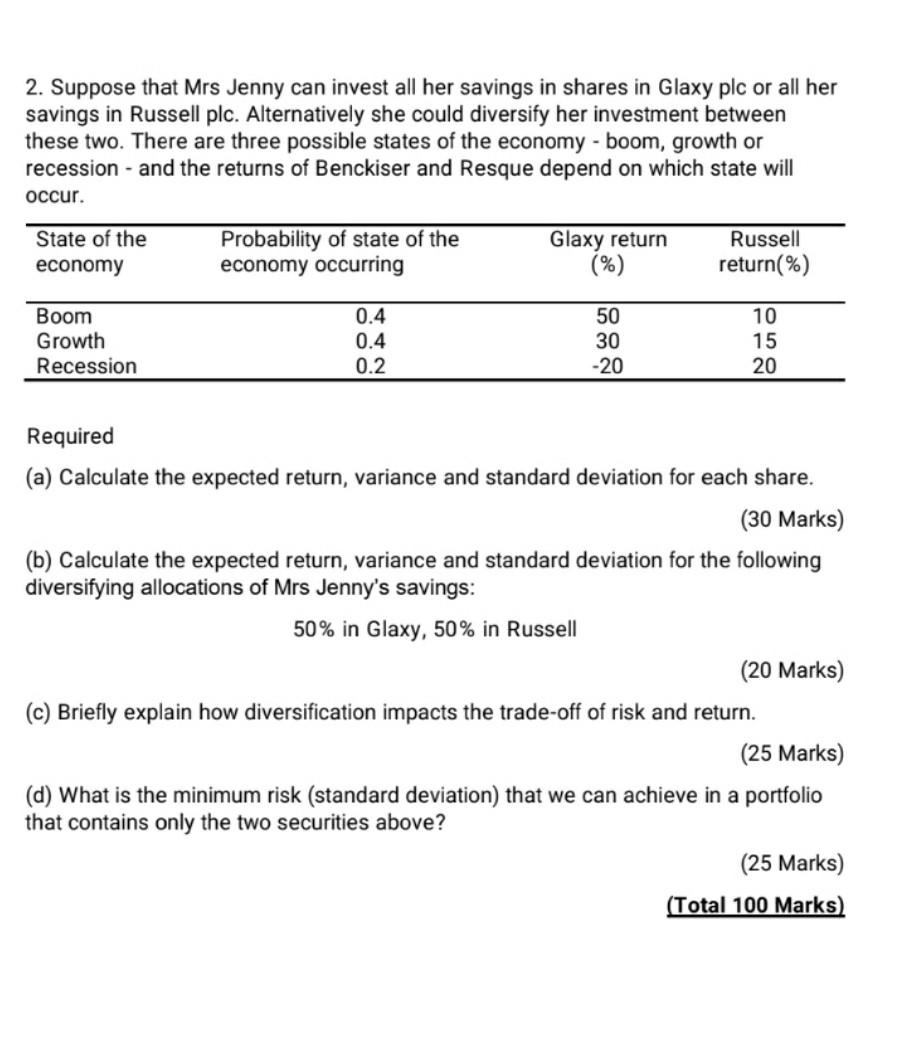

2. Suppose that Mrs Jenny can invest all her savings in shares in Glaxy plc or all her savings in Russell plc. Alternatively she could

2. Suppose that Mrs Jenny can invest all her savings in shares in Glaxy plc or all her savings in Russell plc. Alternatively she could diversify her investment between these two. There are three possible states of the economy - boom, growth or recession - and the returns of Benckiser and Resque depend on which state will occur. State of the economy Probability of state of the economy occurring Glaxy return (%) Russell return(%) Boom Growth Recession 0.4 0.4 0.2 50 30 -20 10 15 20 Required (a) Calculate the expected return, variance and standard deviation for each share. (30 Marks) (b) Calculate the expected return, variance and standard deviation for the following diversifying allocations of Mrs Jenny's savings: 50% in Glaxy, 50% in Russell (20 Marks) (c) Briefly explain how diversification impacts the trade-off of risk and return. (25 Marks) (d) What is the minimum risk (standard deviation) that we can achieve in a portfolio that contains only the two securities above? (25 Marks) (Total 100 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started