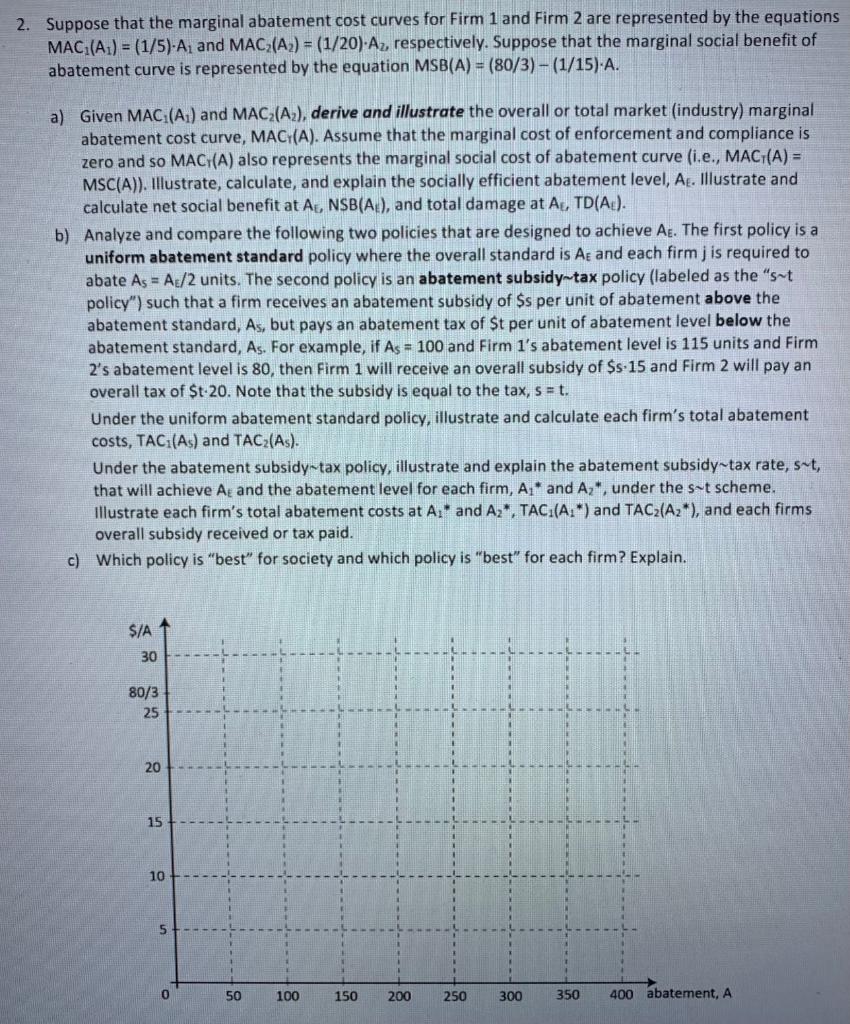

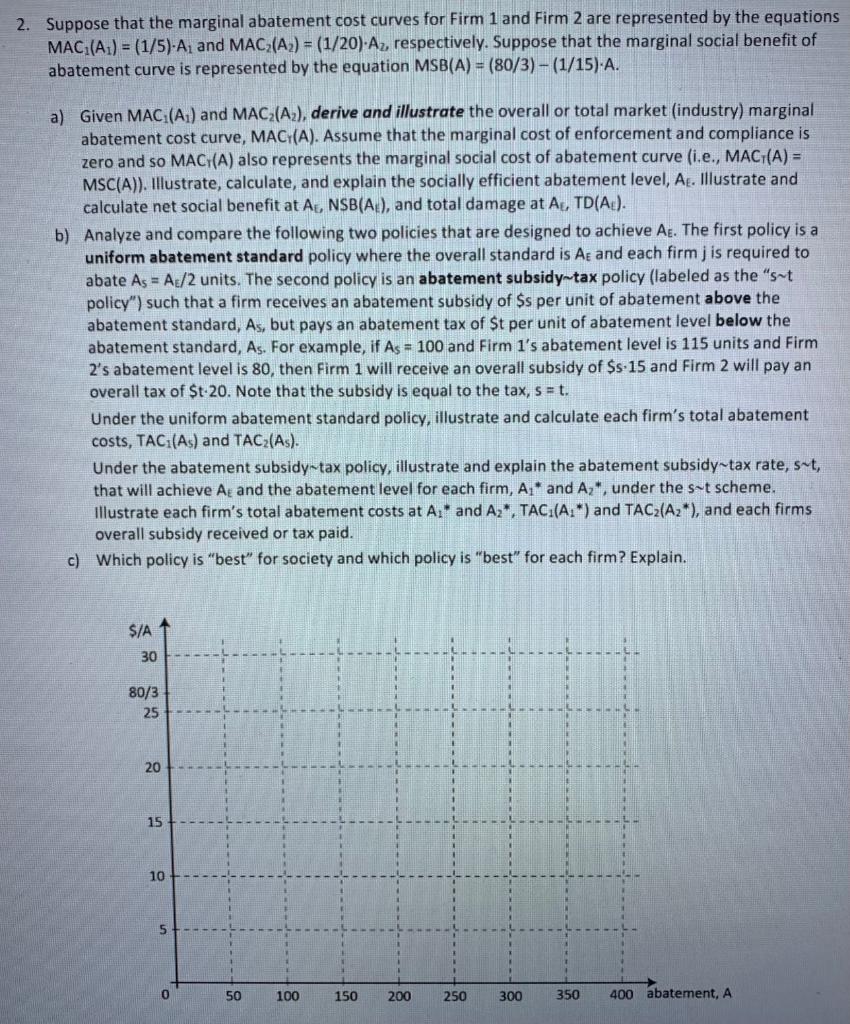

2. Suppose that the marginal abatement cost curves for Firm 1 and Firm 2 are represented by the equations MAC (A1) = (1/5).A, and MAC (A2) = (1/20) Az, respectively. Suppose that the marginal social benefit of abatement curve is represented by the equation MSB(A) = (80/3) - (1/15)-A. a) Given MAC (A1) and MAC (A2), derive and illustrate the overall or total market (industry) marginal abatement cost curve, MAC (A). Assume that the marginal cost of enforcement and compliance is zero and so MAC (A) also represents the marginal social cost of abatement curve (i.e., MAC (A) = MSC(A)). Illustrate, calculate, and explain the socially efficient abatement level, Ap. Illustrate and calculate net social benefit at As, NSB(A), and total damage at A, TD(A). b) Analyze and compare the following two policies that are designed to achieve Ag. The first policy is a uniform abatement standard policy where the overall standard is Ag and each firm j is required to abate As = A[/2 units. The second policy is an abatement subsidy-tax policy (labeled as the "set policy") such that a firm receives an abatement subsidy of $s per unit of abatement above the abatement standard, As, but pays an abatement tax of $t per unit of abatement level below the abatement standard, As. For example, if As = 100 and Firm 1's abatement level is 115 units and Firm 2's abatement level is 80, then Firm 1 will receive an overall subsidy of $s 15 and Firm 2 will pay an overall tax of $t-20. Note that the subsidy is equal to the tax, s = t. Under the uniform abatement standard policy, illustrate and calculate each firm's total abatement costs, TAC (As) and TAC (As). Under the abatement subsidy-tax policy, illustrate and explain the abatement subsidy-tax rate, sut, that will achieve Ag and the abatement level for each firm, A11 and Az", under the set scheme. Illustrate each firm's total abatement costs at A," and A2*, TAC (A.*) and TAC2(Az*), and each firms overall subsidy received or tax paid. c) Which policy is "best" for society and which policy is "best" for each firm? Explain. S/A A 30 80/3 25 20 15 10 5 0 50 100 150 200 250 300 350 400 abatement, A 2. Suppose that the marginal abatement cost curves for Firm 1 and Firm 2 are represented by the equations MAC (A1) = (1/5).A, and MAC (A2) = (1/20) Az, respectively. Suppose that the marginal social benefit of abatement curve is represented by the equation MSB(A) = (80/3) - (1/15)-A. a) Given MAC (A1) and MAC (A2), derive and illustrate the overall or total market (industry) marginal abatement cost curve, MAC (A). Assume that the marginal cost of enforcement and compliance is zero and so MAC (A) also represents the marginal social cost of abatement curve (i.e., MAC (A) = MSC(A)). Illustrate, calculate, and explain the socially efficient abatement level, Ap. Illustrate and calculate net social benefit at As, NSB(A), and total damage at A, TD(A). b) Analyze and compare the following two policies that are designed to achieve Ag. The first policy is a uniform abatement standard policy where the overall standard is Ag and each firm j is required to abate As = A[/2 units. The second policy is an abatement subsidy-tax policy (labeled as the "set policy") such that a firm receives an abatement subsidy of $s per unit of abatement above the abatement standard, As, but pays an abatement tax of $t per unit of abatement level below the abatement standard, As. For example, if As = 100 and Firm 1's abatement level is 115 units and Firm 2's abatement level is 80, then Firm 1 will receive an overall subsidy of $s 15 and Firm 2 will pay an overall tax of $t-20. Note that the subsidy is equal to the tax, s = t. Under the uniform abatement standard policy, illustrate and calculate each firm's total abatement costs, TAC (As) and TAC (As). Under the abatement subsidy-tax policy, illustrate and explain the abatement subsidy-tax rate, sut, that will achieve Ag and the abatement level for each firm, A11 and Az", under the set scheme. Illustrate each firm's total abatement costs at A," and A2*, TAC (A.*) and TAC2(Az*), and each firms overall subsidy received or tax paid. c) Which policy is "best" for society and which policy is "best" for each firm? Explain. S/A A 30 80/3 25 20 15 10 5 0 50 100 150 200 250 300 350 400 abatement, A