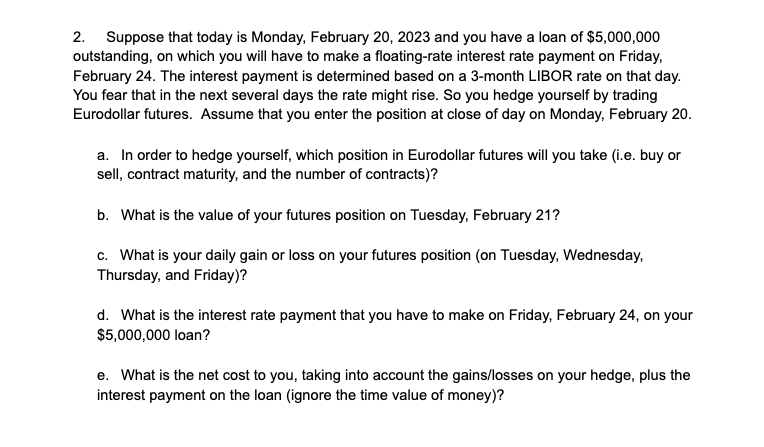

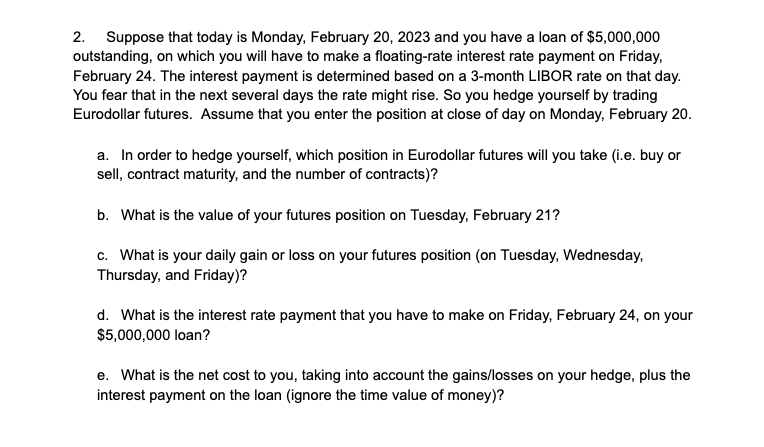

2. Suppose that today is Monday, February 20, 2023 and you have a loan of $5,000,000 outstanding, on which you will have to make a floating-rate interest rate payment on Friday, February 24. The interest payment is determined based on a 3-month LIBOR rate on that day. You fear that in the next several days the rate might rise. So you hedge yourself by trading Eurodollar futures. Assume that you enter the position at close of day on Monday, February 20. a. In order to hedge yourself, which position in Eurodollar futures will you take (i.e. buy or sell, contract maturity, and the number of contracts)? b. What is the value of your futures position on Tuesday, February 21 ? c. What is your daily gain or loss on your futures position (on Tuesday, Wednesday, Thursday, and Friday)? d. What is the interest rate payment that you have to make on Friday, February 24, on your $5,000,000 loan? e. What is the net cost to you, taking into account the gains/losses on your hedge, plus the interest payment on the loan (ignore the time value of money)? 2. Suppose that today is Monday, February 20, 2023 and you have a loan of $5,000,000 outstanding, on which you will have to make a floating-rate interest rate payment on Friday, February 24. The interest payment is determined based on a 3-month LIBOR rate on that day. You fear that in the next several days the rate might rise. So you hedge yourself by trading Eurodollar futures. Assume that you enter the position at close of day on Monday, February 20. a. In order to hedge yourself, which position in Eurodollar futures will you take (i.e. buy or sell, contract maturity, and the number of contracts)? b. What is the value of your futures position on Tuesday, February 21 ? c. What is your daily gain or loss on your futures position (on Tuesday, Wednesday, Thursday, and Friday)? d. What is the interest rate payment that you have to make on Friday, February 24, on your $5,000,000 loan? e. What is the net cost to you, taking into account the gains/losses on your hedge, plus the interest payment on the loan (ignore the time value of money)